While you may not think so (I also agree which has been mentioned in the community), this is the measure which caused hysteria within the media, political system and even by Choice by awarding the Shonky:

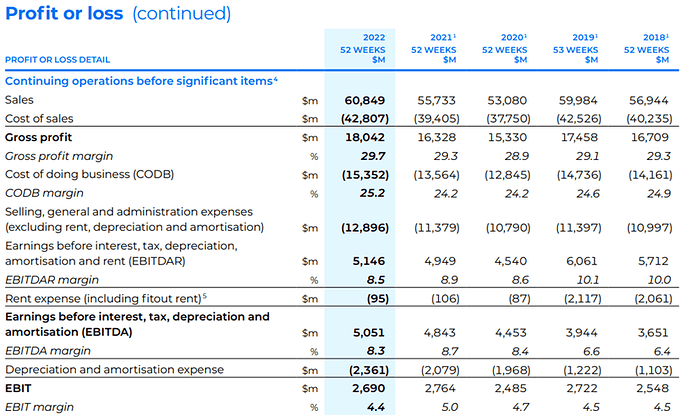

Woolies arguably was the worst of the pair, with the group announcing a $1.62 billion profit in August, in a year when Australians are truly doing it tough. Over at Coles, the group posted a slightly more modest $1.1 billion profit. Anecdotally, many shoppers feel as though they’re paying more for less…Coles and Woolworths have both recorded over a billion dollars in profits this year and most people feel like they’re being fleeced,

This is why NPAT was the subject of discussion. This metric was used as it serves a political purpose and allows critics to ignore those businesses which higher ratios for most of the other metrics (such as Aldi). If say Gross Profit or EDIT was used, Aldi is a worse offender than Coles/Woolworths. As Aldi total profit in $ is modest compared to Coles/Woolworths, the focus has been on NPAT because it suits the political agenda.

Different metrics in financial reporting have different roles for determining the financial status of a business. Using one, without understanding others or focusing on one without looking at the background or influences the metrics is highly misleading.

Also, comparing what happens in foreign markets is also misleading. Australian supermarkets operate in a environment where a lot of factors which affect metrics which are different. Examples being wages, energy costs (heating and cooling in particular), product origins, subsidies, competition and the list goes on.

Anyone who has been fortunate to travel to other countries has seen that some OECD countries shelf food prices are generally significantly higher than Australia (such UK and western Europe for example), with others again some categories higher (such as US, eastern Europe) and some generally lower (such as Asia). Australia doesn’t have the highest shelf pricing. Our own travels possibly suggest that a country like Switzerland or UK are expensive to that which exists here. It is worth noting that UK supermarkets prices are generally higher than Australia, they also operate with a lower EBIT/NPAT percentages.

Australian and foreign shelf prices and business financials are very dependent on the local operating environment. Selectively using one metric or comparing with other foreign markets without qualification is disingenuous.