Exactly, and again, because headline energy costs have increased more than average inflation, therefore you’d think there is scope for the groceries to have increased less.

Again yes, but the question being asked is – are current prices a fair reflection of supply restriction and/or input cost increases, or are some retailers taking advantage of price confusion and customer ignorance to increase prices beyond what is justified i.e. are they making superprofits?

In particular, transport costs were responsible for a good proportion of 2021/2 price increases, but in the last few months transport costs have eased considerably, yet there has been no visible reduction in prices.

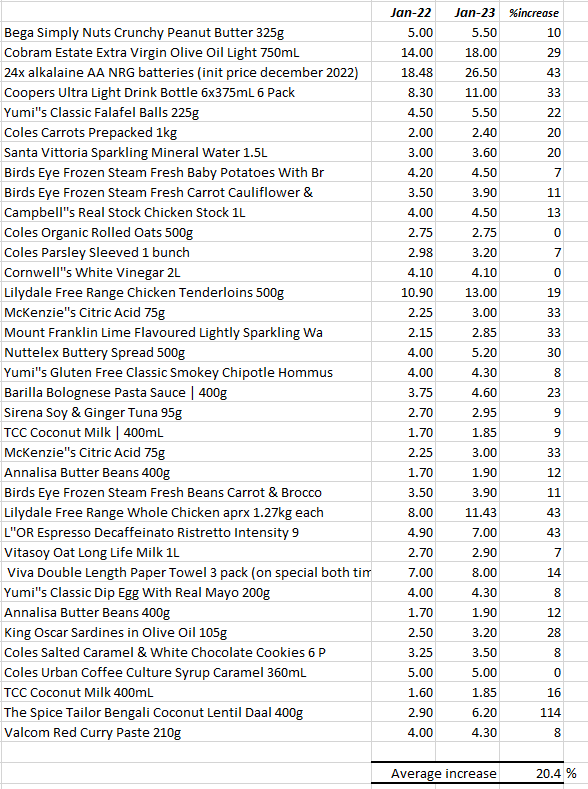

It is hard to comprehend any supply side issues justifying a 43% increase in AA battery prices, and in fact no other retailers or battery brands have increased much or at all. Furthermore other pack sizes of the same NRG batteries have increased much less, so I would suggest this is a conscious change by Coles’ pricers. Flavoured mineral water (33% price increase) has few input costs other than transport, packaging and wages, and it is improbable that all those costs have increased by 33%, especially given above-mentioned recent transport cost reductions.

Perhaps increases in world coffee bean prices can explain a hefty rise in the price of my favourite pods (I know…)? But no, coffee beans were considerably more expensive in Jan 2022 (and had been for 5 months) than they are now and for the last three months. Maybe manufacturing delays are longer than three months, so prices will drop soon. We will see.

Other than special products like coffee with highly variable input costs, it is hard to see why any of the items on my list should have increased by more than inflation’s 7%. If inflation is x%, then average (local) input costs will rise by x% and resulting prices the same. In fact input cost changes over the year would support a lowering of prices - this excellent site Commodities - Live Quote Price Trading Data gives historical commodity prices and of those I checked almost all were trading currently for the same or less than a year ago. Rubber, cotton, urea, propane, steel are substantially lower, and plastics, bitumen, aluminium, corn, canola, beef, poultry, ethanol, platinum are about the same. Salmon, and lithium are higher.

It is true that most commodities peaked severely during Covid but in the last quarter most have fallen to pre-covid levels give or take. If these falls are yet to work through the system, again we should expect lower prices soon.

I don’t buy the supply and demand argument here - afaik nothing in my list above (or their major inputs) is currently in short supply. Some electronics (and weapons and ammunition  ) are definitely short, but alkaline batteries, coffee, mineral water, butter beans, canola and palm oil (for margarine, up 30% at Coles) … er, no.

) are definitely short, but alkaline batteries, coffee, mineral water, butter beans, canola and palm oil (for margarine, up 30% at Coles) … er, no.

I still believe there is a good argument for an informed investigation into recent inexplicably large grocery price rises (including discovering how much of these increases are thanks to manufacturers, wholesalers or retailers). It’s always easy to say ‘the market sets prices’ but as we all know, markets are a long way from perfect and suppliers are canny at taking advantage of the imperfections.