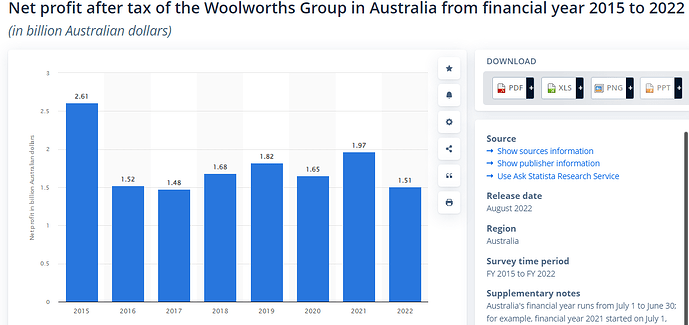

Looking at Net Profits After Tax (NPAT) which was the 2021-22 to 2022-23 number causing the hysteria with some sections of the media…

For Woolworths, this increase in net profit is for one year only. The Woolworths 2022-23 net profit is $1.62B, which is within the range of profits which have occurred in the past 9 years:

(source statista.com and confirmed on the Woolworths Group Investor website)

It is also less than the profit which had occurred for 5 of the past 9 years. Also less than the average for the past 9 years being $1.76B.

Likewise Coles, its net profit for the past 5 years has been $1,435M (2018-19), $978M (2019-20) $1,005M (2020-21), $1,048M (2021-22) and for the current year $1,098M (Source Coles 5 year summary report). The 2022-23 is not dissimilar to Woolworths where it is within the range of past profits (over past 5 years) and also less than the yearly average of $1112M.

The profits announced by Woolworths and Coles aren’t historically high and less than that which has occurred in recent years. The argument of profiteering does not stack up. If it did, there would be a substantial increase above long term trend in profit, above recent yearly averages and also similar to or significantly more than the consumer price (or food inflation) rates measured by the ABS in the past 12 months. None of these have occurred.

While I agree with Choice on most things, this is unfortunately a time that I can not agree with Choice for the awarded shonky. Choice can cherry pick data to try and argue why it has awarded the Shonky, but, this is not supported by the public financial reporting of Woolworths or Coles. A simple review of published financial data (which most knowledgeable investors do when making decisions about investing) would have shown it was a furphy.