I couldn’t agree with you more on these per ticket charges. They are a bloody ripoff as well. These are a part of corrupt practice that you find elsewhere. Examples are, credit card surcharges, unconscionable bank fees on ordinary consumers as well as businesses in the form of interchange fees, credit card companies surcharging businesses excessively, all of which then flows to all of us as surcharges on the retail price whenever you use a credit card or even a debit card.

Lastly there are good old utility companies and their deliberate use of confusing power bills, that contain fees of one sort or another, as well as very difficult to understand contracts that lock you in for a period of time. All of this is cleverly designed to confuse and stress us all. We find the pace of modern life quickening with each passing year. These companies make full use of this to immorally advance their own pecuniary interests through complex contracts, billing practices and the imposition of one charge or another.

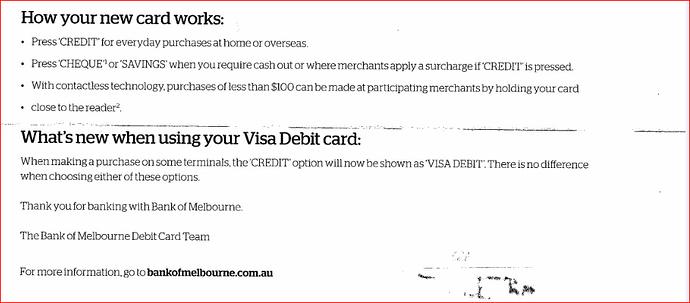

The ALDI supermarket chain surcharges any Debit card that is linked to Visa or MasterCard. They do this because they can get away with it. It is the same old story; all due to a lack of a proper regulatory framework that is designed to protect the public from this behaviour.

As a preliminary to the following comments about EFTPOS cards, I want to stress that I am not employed by EFTPOS Australia, UBank or the NAB. Other banks may have a ‘stand alone’ EFTPOS card with no links to Visa or MasterCard. I simply do not know although I am sure that they will in future. It is unavoidable in my following advice that I keep referring to the NAB because to my knowledge they are currently the only major bank with an EFTPOS card with a smart chip, that is also not linked to credit card companies such as Visa & MasterCard.

I have a tiny bit of good news for all, with a heads-up to anyone interested in avoiding the surcharge of 0.5% at ALDI.

Australian EFTPOS cards are evolving and have computer chips in them. Eventually you will be able to use them online. I don’t know when that will happen. The NAB has released an EFTPOS card with a chip in them about a year ago that does not have the usual credit card logos on the front of them.

If you have an NAB EFTPOS card that has a computer chip in it but does not have a Visa or MasterCard logo on it, you can avoid the surcharge of 0.5% at all ALDI stores in Australia.

It is essential that your Debit or EFTPOS card DOES NOT HAVE A VISA OR MASTERCARD LOGO ON IT, because if you do you will not escape ALDI’s surcharge.

This is how you can avoid the surcharge:-

Firstly, NEVER USE ALDI’s payWave facility with the aforementioned NAB EFTPOS card. IF YOU DO YOU WILL BE SURCHARGED.

I love the efficiency of contactless payments but in this case I completely avoid it.

-

Swipe the card and place the EFTPOS card into the reader with the card’s chip going into the machine first.

-

Choose if you want any cash out from your account or not.

-

I do not remember exactly when you are asked for your PIN number, so enter your four-digit PIN number whenever you are asked for it.

-

Select ‘SAVINGS’ or ‘CHEQUE’ however, NEVER SELECT ‘CREDIT’.

-

The good news is that you will only be charged the exact amount in dollars and cents. No horrible, annoying and immoral surcharges of 0.5% will be lumped at the end of your bill.

-

Check your paper receipt to confirm the veracity of what I am telling you. You will be pleasantly surprised as I was when I first used this EFTPOS card in this manner. I have been using this EFTPOS card for several months without a problem.

If you are a regular shopper at ALDI and want to use this sort of card, it is a good idea to set up a regular deposit from another account through the internet, even if it is from another bank account. It could be a monthly or fortnightly deposit with an amount of money that suits your needs.

The NAB do not support an Auto Top-Up facility for this account however if you have an ‘Ultra’ account with UBank you can set this up for free. This will save you having to go to an ATM or do any banking to keep the EFTPOS card flush with funds.

The NAB EFTPOS card is free and can be obtained from any suburban branch. There is no annual fee or any monthly account keeping fees for the card as well. If my memory serves me well, you can set the EFTPOS card up so that you cannot go into deficit by going below a zero balance and thereby incurring bank fees and charges. If you set the card up in this manner and do not have sufficient funds to pay for your goods, you will not be able to take any goods out of a shop as a purchase has not been transacted.

Will keep this in mind for Shonky submissions

Will keep this in mind for Shonky submissions