Just logged into my Westpac internet banking. Checked my credit card balance, as I always have it riding close to the limit, with allowances made for fees and charges at statement time.

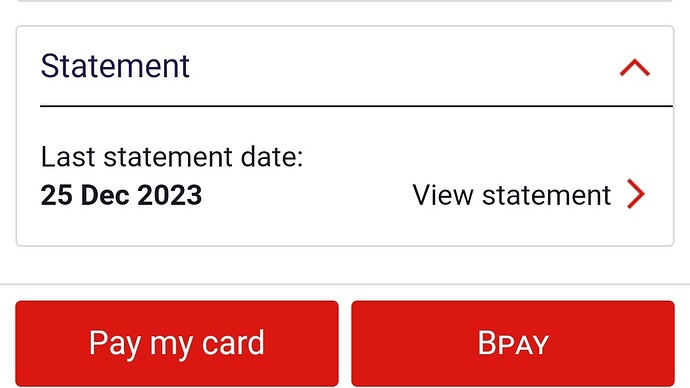

It seems Westpac have already ‘issued’ a statement, although it’s not in the list able to be viewed, with issue date of 25 December! Never seen this before, including during an 18 year employment with them.

Westpac working in the future.

I wonder since tomorrow is Christmas and it appears the statement date is the 25th of the month, they have set things up early. But, why didn’t they bring forward the statement date to today or push it out a few days. Maybe they didn’t as they could be concerned about complaints if they did either way.

I would guess that the 25th is the normal scheduled date. But as the statement is not viewable yet, it hasn’t been produced yet. So not post-dated really.

Now batch processing usually runs on schedules. Business day and weekend schedules could well be different. Mondays could be different since some extra processing needed to do things that were not done on the weekend. As this year the Monday is a public holiday so like a weekend, there may have been a change to the pre-xmas weekend schedule.

Maybe only noticed by you as the 25th is a credit card date applicable to you, not everyone.

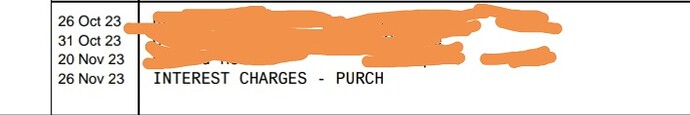

Oh, but they’ve added on their fees already too, as they do at the end of the statement cycle.

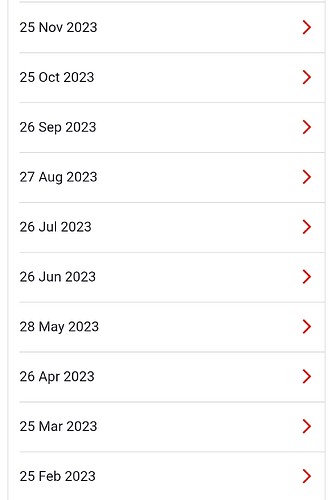

And although the 25th might be the statement date, here are the previous dates, where they can clearly push it out.

Yes, but what is the actual statement dates on the credit card statements themselves?

It looks to me that the statement has not been generated yet but for some reason the system has a placeholder for it. If come the 26th it is available and correct all will be well. In the meantine why panic?

Because their end of cycle fees are already added to the account, even through that date hasn’t yet been met. Not very correct in my view.

Well I don’t understand your issue.

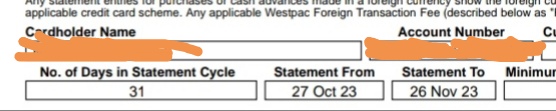

End of monthly cycle date, which varies according to the days in the month, occurs and then on that date, interest is charged.

Which is exactly what I would expect to see. The interest is calculated based on the number of days in the month, and charged to your bill to be dealt with by the due date.

Banks do calculations very carefully on a daily basis.

Well, I guess I won’t know anything with certainty until I do see December’s statement.

If the end of statement fees have been generated until 25 or 26 Dec, but have been charged to my account already-and I only know for certain at the very least today, (because I can tell by the balance-the actual entry is not showing up), then I am paying either one or two days interest on interest.

The interest on interest will amount to about 11 cents per day per $10,000 owing. Depending on the amount you owe and how you value your time, it might not be worth worrying about.

Storyline of a Richard Pryor movie??

So is the statement available now? Is it correct?

Not in my mind.

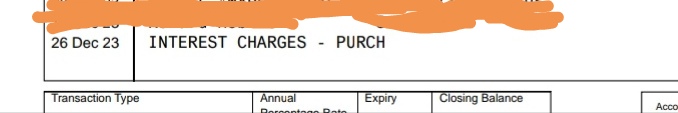

I know those interest charges were added to my account by 24th, yet statement and account shows them as being debited on 26th.

The amount concerned for me is small, but consider the cumulative effect of however many customers, some with substantial debts…

Just looking at various dates is not going to tell if the result is correct you unless you know exactly how the calculation was done.

You could find out how it is done and repeat the sums to make sure or ask the bank for an explanation of perceived discrepancies. I am unsure which would be more tedious.

No, the accumulated interest calculated daily over the monthly billing cycle was charged to your account on the 26th. It is right there on the statement.

Where are you getting the 24th from?

Edit: maybe you are looking at available credit via online banking when you checked on the 24th. It would be logical for the bank to know how much interest your account has accumulated so far in the monthly cycle, and reduce the available credit to avoid going over the credit limit when the final interest charge applied.

So available credit = credit limit - current balance - accrued interest not yet charged.

The banks provide details of how interest is calculated on credit cards. This from NAB is particularly detailed.

Interest, payments and statements | Credit card - NAB.

Given that the debit date for interest has not been backdated you are not being charged any extra interest 9or interest on interest). That would only be the case if for example interest was calculated to December 26 but debited to you account on an earlier date.

It is likely that you had 31 days of interest debited with an effective date of December 26 and you next statement will have 30 days of interest debited on January 25th.

As it stands the interest on interest (included on the January statement) will be calculated on the December interest debit for a period of 30 days. Had you statement issued on December 25, the debit would only be for 30 days interest (one day less) but the interest on the interest would be calculated for a period of 31 days (one day more).

Well if you maintain a running outstanding balance on a credit card, you are always paying interest on interest. The interest from the previous cycle becomes part of the ongoing balance for the next. And at very high interest rates compared to other borrowing.

: maybe you are looking at available credit via online banking when you checked on the 24th.

Ummm, nope, I worked for Westpac for over 18 years, so I know how to read a credit card statement.

My credit card has a very moderate limit, and at the moment I have no choice but to ride it very close to said limit, so I know exactly how much needs to be available and when, for the couple of automatic payments to come out.

If you look at my original posts, which were made on 24th, the interest had already been charged to my account (I have a screen dump of the couple of transactions, with no interest entry showing, but the balance DOES reflect that the interest had already been charged.