I know I am already paying interest on interest because the account is not being cleared each month in full.

The point I am making is that when I checked the card balance on 24/12, the interest had already been charged to it, yet the statement is reflecting it was charged on 26/12-not correct.

Since none of your posts show anything about account balance, it is not possible to understand your claim of interest being charged before it appears on the statement.

I think it unlikely. Banking systems are very accurate when it comes to money.

Now as to the argument from authority, I too worked for a decade for one of the big banks. In IT supporting banking systems.

Because it seems my word is not good enough, here are some screenshots to clarify-including my balance and transactions.

I cannot ‘prove’ the date of my screenshot on 24/12, other than to refer to my original post when I first made the statement date query. My phone does not provide the current date on the top banner.

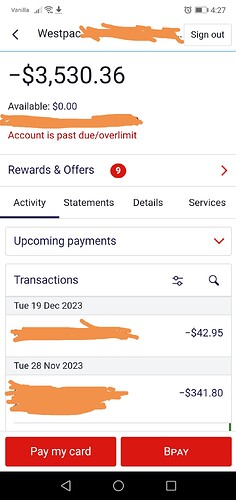

This first screenshot was taken 24/12, and shows the last couple of transactions, and the balance showing at that date. Note no ‘interest’ showing as a listed transaction.

Westpac does not provide running balances on credit cards on their ordinary website internet banking. I do not use the app, so I cannot comment on how it would appear there.

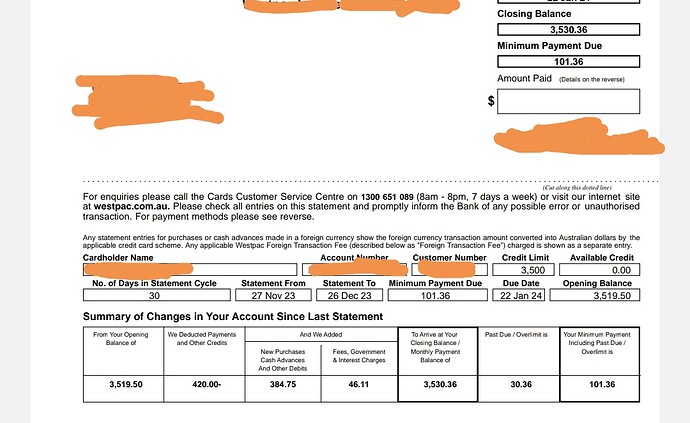

This is a screenshot of the statement dated 26/12 first page, showing all header details, including opening balance, closing balance, and interest charged.

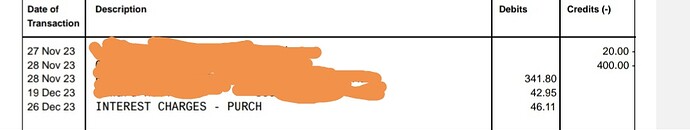

This is a screenshot of the transactions on the statement 26/12, showing the individual amounts, so you can also compare to my original screenshot of 24/12.

Do the math-the interest amount of $46.11 WAS showing in the balance on 24/12, but is showing on the statement as having been posted to my account on 26/12.

As I said before:

It isn’t a matter of your word or veracity it is a question of interpretation of the data.

I see a statement dated 26 December with some amount of interest on it. I have no way of saying if that is accurate by inspection because I do not know exactly how the calculation was done. Showing us more detail has not improved the situation.

The date that a document becomes available does not necessarily alter the content.

To say that it is necessarily wrong because of when it was generated is not established. The only way to know for sure is to do the sums by the correct method - which has not been done.

How about we leave this as no progress is evident.

Westpac needs to be truthful in their reporting of data-regardless of how they calculated it.

If they processed the interest to my account on 24/12, then that’s what the statement should reflect. Regardless that it was a Sunday (which used to be deemed a public holiday). 26/12 is also deemed a public holiday, but it didn’t stop them issuing a statement on that day.

It might have nothing to do with the observation that began this topic, but 25 Dec was a holiday.

Did you contact Westpac to ask what the ‘deal’ was? IME Westpac has lots of ‘customer managers’ managing us not our accounts or their services, but a few of their agents have been quite helpful over time.

An explanation from the responsible party should be more enlightening than any amount of two and fro of speculation.

I see your point now. The calculated interest has indeed been applied to the account and shows up in the balance, but does not show up as a transaction until applied on the last day of the billing cycle.

But this is a variation of what I posted previously.

Balance = previous amount from last billing period - payments made + new purchases + accrued interest

Seems that since no new purchases could be made given the account has no credit left, Westpac have precalculated the interest to the end of the period on the 26th. And applied that earlier. In this case the balance matches so they seem to have assumed correctly.

But if you had made a payment on the 24th, say, to create some credit space, then the interest calculation would not be correct as it is based on the daily balance and accumulated over a month, however many days that may be.

My grumble has been that CommBank would regularly advise that the next statement would be available for viewing on ##th of the month, but, no, that was the statement date, and it would be available to view or download for another 2 days.

Surprise this month: they actually acknowledged that there is a delay before seeing the statement! (Can’t find the actual words now.)

However, this month’s statement advised of changes to the terms for the credit card - all adverse to me, so I have some research to do!