Hi in regards to superannuation i remember hearing a chap who said superannuation should be changed because of the way business is more concerned about stock market and you just mentioned about making capital instead of giving everyone a good return. I don’t really trust putting my money into any of these funds knowing could be worse off in years to come. What’s your opinion on superannuation.

Superannuation in the long term view has a vastly better Member return than putting money into pretty much anything else except perhaps property. Even property properly managed in a Self Managed Superannuation Fund (SMSF) has benefits than to having outright normal ownership. Tax treatment of withdrawal of benefits being one. Superannuation has brought many benefits to those who had never had it in the past. It is more about who you invest with that determines the best outcome, and not investing because a Super fund accumulates capital assets is not a good idea at all. You want the fund to accumulate assets as it grows as that is what is turned to cash to pay out those who wish to withdraw from a fund…no assets equals no money.

For most people it is a nobrainer because of the tax benefits.

The only caveat is for Australian tax residents who are US citizens, but that is another topic. For the vast majority a good super fund account is as good as it gets.

I researched one retirement village in particular and found that I would have to pay $1055 per month fees and then at the end of 11 years I would have to pay a exit fee of 30% based on the sale price and not on the buy in price which then I would get less than I paid for the villa this included any improvements made to the Villa by the resident. In that case I would not have enough ;money (if I was still alive) to go into full care. We are having the same problem with a friend who is departing an over 55 complex but by the time they take out the exit fee she will not have enough money to go into full care. Even though the cost of the Villa to enter into it would have given her enough at the original sale price. Another Retirement Village was going to charge $300,000 entry fee, and 85% of her pension plus $50 per day. How can anyone pay $50 per day when they take 85% of the pension. Are there any other ways to get into full care.

It is worth talking to a trusted qualified and certified professional financial planner.

There are also advisors/planners who specialise in aged care. They will do all the work for you for a fee. Get a clear quote of their ongoing costs if this appeals as an option. It did not for us. We helped our mum to move to near us to better enable us to assist her to manage directly her needs.

We went around the loop just over a year prior. We spoke to several specialist advisors, as well as one who was independent of the sector. The best advice in our instance came from the non retirement industry specific professional.

I’m unable to offer any specific advice, I’m not a financial advisor.

The system can steer individuals to the wrong outcome, or conclusion, especially with the requirement for a Residential Accommodation Deposit (RAD). Firstly it is not essential or mandatory to make any deposit. Zero, nil nothing to put in. One could put the cash from the villa into the bank and draw down on it to pay for the daily accommodation payment instead (DAP). Or in the instance you have indicated, pay a part deposit for the RAD, which reduces the cost of the daily accommodation payment. It’s a complex decision that can affect pension entitlements.

If on entry into aged care one does not have sufficient funds to meet the deposit requested (RAD) one option available is to draw down from the deposit to meet the short fall due for the DAP. Other living expenses can also be met by drawing against the RAD deposit. This should have been explained to you. If it was not, the person offering the advice may not be that reliable. The system is designed to provide a level of support and care, while ensuring you fund as much of your care as you have means to do so, IMO.

Ultimately all options can lead to your loved one in aged care spending your inheritance. If all their funds are exhausted, the burden to support them transfers to the government Aged Care Services paying the cost directly to the aged care service provider.

A good advisor/planner should lay out all the options, not just one, and what happens with income, pension and expenditure over 1,2, 5, 10, 15 years etc. They usually provide an initial consult for free, in our experience and will take some of that time to explain how services are costed.

It’s worth taking your time to see several and make sure the best option is selected at the time. There may also be an interim option for respite if your family member has an ACAT assessment, that indicates they are unable to live independently.

There should be no person who ends up not having their needs met.

The Govt has outlined processes in place to ensure Aged Care:

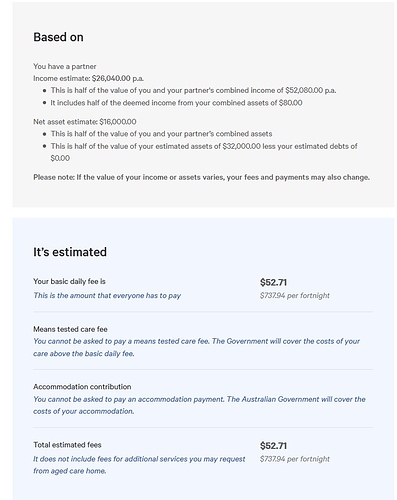

Using the Fee Estimator will help guide a person to assess the impacts of their Assets and Income on their fees. When considering the asset in the Retirement Home this should be the amount realised after fees and costs are removed (not what a person paid to enter the Home). When using the estimator please ensure you select the correct assessment ie Home Care Package or Aged Care Home from the tab, currently it should link to the Aged Care Home one.

If a person for other reasons cannot afford the fees they can be considered for Hardship provisions.

I did a what if on the estimator as a non home owner with a reasonable income (just a bit above Max rate pension) and reasonable asset (not huge but others can test themselves for their real world circumstances):

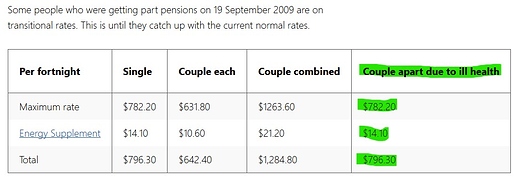

The Illness separated rate of Pension is the Green highlighted figures

The difference leaves about $60 per fortnight for other expenses and this does not include any rent assistance that a person may be eligible for. The Basic rate of Aged Home Care is $52.71 per day, if you fit below the Income and Asset test lower threshold this will be the only component you need to pay.

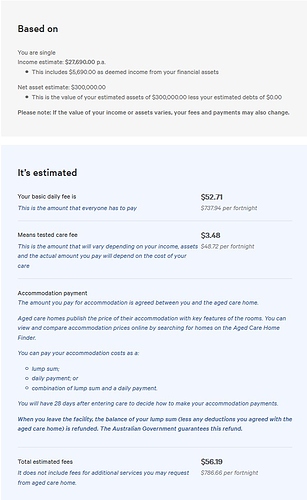

If a Single person on pension and with assets of $300,000 (assuming value of Retirement Home after sale)

In the above scenario there will be an accommodation cost and this will reduce the asset value if paid from that sum. This may further reduce the cost to the Basic only rate. Every circumstance is individual but this is just to give some idea. Testing of an individual’s own real life figures will give a better estimate in each case.

Im interested in feedback about major retirement villages such as Halcyon and Gemlife.

On the surface they look terrific and a wonderful option. Cash in the family home and buy a new modern brick and tiled free standing home in a luxury complex with loads of lifestyle options built in. Enables you to buy the boat, travel and remain independent.

I know people in these villages now and they are thrilled and loving the environment - but I worry about the future.

The basis is that you own the building but lease the land in perpetuity. There have been many horror stories in the past about relocatable home parks throwing elderly tenants out after years of occupancy with basically nothing.

I worry about the fact I won’t own the land.

I also noted that the Stockland group acquired Halycon in 2021 and they are a reputable organisation - however when land becomes scare and its value sores in years to come - what do i do when they find a better use and return for their investment.

Would love any feedback that can be offered with first hand experience. Id hate to write off this as an option if the security is better than I thought.

Welcome to the Community @InterestedOnlooker

I moved your query into this existing topic that has a number of posts germane to deciding about retirement villages.

Master leaseholds and individual leaseholds are for explicit terms, and at the end of that term there are no guarantees.

People buy into retirement villages for lifestyle choice, not because they are financially attractive. It appears you may have considered the economics and are most concerned with long term security. I would thus look at their deed/contract to see what it states about the leasehold.

Another aspect is your possible concern about passing on an inheritance; retirement village ‘investments’ are at the end of the day lifestyle choices and could have significant financial ramifications beyond just the leashold aspect.

Others will probably add their opinions and experiences. Although it seems not many Community members live in retirement villages some have rellies who do.

Thanks for the assistance PhilT - new to the format and obviously failed in my initial search.

For sure retirement facilities charge a fortune and commonly new ones are around where its like your own home. I was, speaking to a resident of a new complex and it was, a, self care unit block amd sje, said that her and tje husband had the, cheaper unit and was, still expensive for smaller unit. She , was, saying tjay the kids get part of the sale if the, parents were to die. I tell you what we never had, these expensive designs before it was, kist stay at home ora, nursing home but htey have taken ot a step further doesn’t mean everyone can afford it. I agree with you how could you afford woth all the ongoing costs of a, retirement facility.

Hi all, my husband and I are looking to purchase into an Ingenia over 50’s lifestyle resort. As per usual it is suggested we seek legal advice. I got a quote from one firm between $750 and $1500 for advice which seemed excessive to me. I think I have a pretty good understanding of the contract, there is no stamp duty, no exit fees, I am aware site fees can increase each year, we keep all capital gains and I know we don’t own the land. So my question is do people who have bought into these villages think it is worth seeking legal advice please? Thanks!

Welcome to the Community @Izzy,

I recommend you peruse this older topic from the beginning, including the links to related topics and Choice articles.The Community is unable to provide legal advice but we can flag many of the potential issues, as has been done previously. You might be atop everything but IMO if only for your piece of mind consulting someone with expertise in retirement village contracts would be valuable since you at least have doubt.

An important thing to keep in mind is even lawyers hire lawyers for their legal needs. The cost of legal fees would likely be noise in the context of costs to live in a retirement village.

What ever you decide, consider also the amount of money you will have tied up or committed over the coming years. It is likely to be approaching $1M. Understanding the differences and being confident is important. Consider a small oversight in assessing the contract could amount to $10’s - $100’s of thousands of unexpected costs along the way.

There are two types of advice one might consider.

Legal advice will explain the contract terms and conditions. Whether they are financially fair note - Lawyers cannot offer financial advice.

Professional financial advice should be considered if one needs to better understand in full the future costs. This could include an assessment against one’s personal circumstances.

We accessed the second when considering the alternatives for our mum when she was unable to return home after a medical episode. It guided us to make a decision that was not the first option offered. Financially she was far better off for having done so.

The recommendation to seek financial advice on the contract is as much a protection for the provider of the retirement facilities as it might be for the customer. If things in the future are not to one’s expectations, if it’s in the contract that is how it is. If it’s not in the contract, then that is also how it is.

We’ve several of the extended family who have had the type of retirement living you are looking into. When the properties were no longer required, vacating, remedying and sorting out the residual has been an experience none wish to repeat. Note they are run as profit making enterprises. There are capital risks. They may suit some of us and meet our financial needs. Eyes wide open!