Today the ACTU funded inquiry into price gouging has been released. Professor Fels (a former ACCC Chairman) led the inquiry. In January 2024, Professor Fels wrote to the Federal Treasurer to request that the ACCC conduct an inquiry into the price gouging allegations. This request may have added fuel to the Government asking the ACCC to conduct their inquiry that is now occurring.

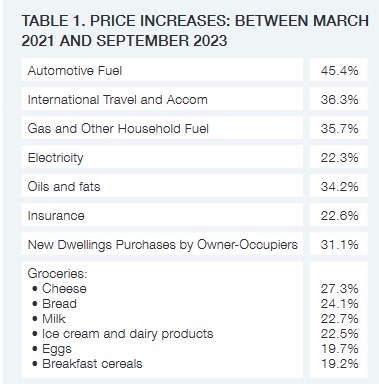

In the ACTU report at Table 1 is the following breakdown of cost increases for a number of areas and products

The ACTU report can be found at the following address

Recommendations from the ACTU inquiry

"SUMMARY OF RECOMMENDATIONS

RECOMMENDATIONS RELATING TO PRICES

Recommendation 1.1: The Australian Government should use its power to require the ACCC to conduct

more price and market investigations.

Recommendation 1.2: The Australian Government should have power to require the ACCC to undertake

market studies as well as price studies.

Recommendation 1.3: The ACCC should have power of its own to initiate price and market studies.

Recommendation 1.4: The GST pricing legislation of 2000-2003 provisions regarding the naming of

businesses and industries that overcharge should be reinstated.

Recommendation 1.5: Section 46 of the Australian Competition and Consumer Act should be amended to

make it an offence to charge excessive prices in terms similar to the European Union provisions.

Recommendation 1.6: The Government could establish a Commission on Competition and Prices to review

Government and other restrictions on competition and high prices caused by a lack of competition.

RECOMMENDATIONS RELATING TO MERGERS AND DIVESTITURE

Recommendation 2.1: The Australian government should establish a pre-merger notification system along

similar lines to most OECD countries.

Recommendation 2.2: That in merger matters the onus should be on applicants to satisfy the ACCC and on

appeal the Australian Competition Tribunal that the merger is not anticompetitive and is in the public interest.

Recommendation 2.3: The merger test should be augmented to continue to prohibit mergers which

substantially lessen competition but there should be an additional provision prohibiting mergers that give rise

to substantial market power (a more structural and immediate test) and/or which entrench, create, or add to

market power.

Recommendation 2.4: A divestiture power should be introduced into the competition law.

RECOMMENDATIONS RELATING TO COMPETITION

Recommendation 3.1: The Australian Consumer and Competition Act needs to be shortened.

Recommendation 3.2: If the secondary boycott law is retained in the Competition Law there should be a

provision that secondary boycotts are only unlawful if they substantially lessen competition.

Recommendation 3.3: Australia should ban non-compete clauses in employment contracts affecting both

employees during and post-employment.

Recommendation 3.4: The current National Competition Review should examine policies and laws that

prevent Governments from needlessly restricting competition.

Recommendation 3.5: The ACCC receives further funding for strong enforcement of the cartel law. It should

also apply the criminal sanctions available for unlawful price fixing and other cartel agreements.

Recommendation 3.5: Treasury should conduct a public consultation to determine the need for improvement

in the drafting of the criminal elements of the cartel law in view of recent difficulties in the bank cartel case.

RECOMMENDATIONS RELATING TO SPECIFIC INDUSTRIES

AVIATION

Recommendation 4.1: Airport prices should be regulated in the same way as other utility prices.

Recommendation 4.2: The Australian Government should use the opportunity of its current aviation review

to remove international and domestic restrictions on competition. Any remaining restrictions should be

reviewed by the Treasury led Competition Policy Review.

EARLY CHILDHOOD EDUCATION AND CARE

Recommendation 4.3: The ACCC should be empowered to investigate pricing decisions made by for-profit

providers to ensure gaming is not occurring.

Recommendation 4.4: Prices in relation to disability care and support and aged care should be kept under

continuous review by the ACCC.

BANKING AND FINANCIAL SERVICES

Recommendation 4.5: The ACCC should be provided with a standing Ministerial Direction to monitor prices

and competitiveness in the retail banking sector.

Recommendation 4.6: The ACCC should be issued with a Ministerial Direction to undertake a further inquiry

into pricing practices in foreign exchange markets to develop mechanisms for a fairer transmission of cost

information to consumers as well as to provide specific assistance to prevent exploitation of those with low

English language proficiency.

ENERGY

Recommendation 4.7: There should be a review of the design and operation of the wholesale market as

to whether it requires refinements or a fundamental change in the form of a ‘capacity market’ as in North

America and in Western Australia. This review should be chaired by an independent expert with input and

resources from the AER, AEMO, and ASIC. The level of electricity generation concentration should be kept

under review, and there should be close scrutiny of the impact on competition, positive or negative, that could

occur in the transition to a re-designed energy market.

Recommendation 4.8: ASIC should be provided with a Ministerial Direction to investigate the energy

derivatives market to ensure that participants in both the National Electricity Market and the markets for

derivatives are not misusing their position in either to gain an unfair advantage or influence the price of energy

to meet derivatives conditions.

Recommendation 4.9: Network prices should continue to require close regulatory scrutiny with the long-term

interests of consumers put first.

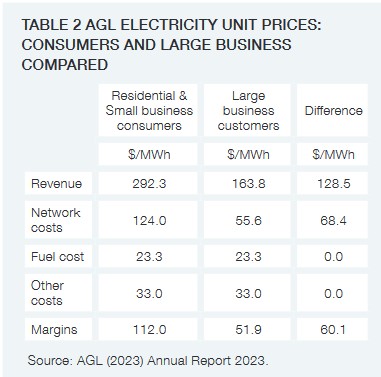

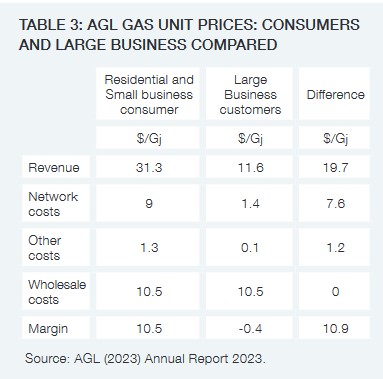

Recommendation 4.10: There should be a regulatory review of the high degree of price discrimination in the

retail electricity and gas markets.

Recommendation 4.11: State Governments and regulators should continue to introduce initiatives to

improve retail outcomes brought about by current market imperfections.

FOOD AND GROCERIES

Recommendation 4.12: It is recommended that there should be a comprehensive ACCC inquiry into

competition and prices in the retail food and grocery industry.

Recommendation 4.13: The Food and Grocery Code Review should be fully mandatory.

Recommendation 4.14: The Food and Grocery Code Review should investigate creating a price register for

farmers to assist them in understanding market prices across primary industries.

SHIPPING COSTS IMPACTING FNQ AND NT

Recommendation 4.15: The ACCC should once again have an ability to challenge and overturn

unreasonable prices charged by Sea Swift to ensure the service is not exploiting its market position.

ELECTRIC VEHICLES

Recommendation 4.16: Regulations in the Road Vehicle Safety Act 2018 which block parallel imports of

electric vehicles be immediately lifted.

Recommendation 4.17: Regulations under the Road Vehicle Safety Act 2018 which block parallel imports of

cars into Australia should also be repealed in coming months.

OUT OF POCKET CHARGES BY MEDICAL SPECIALISTS

Recommendation 4.18: The National Competition policy review should conduct or commission a

contemporary study of specialist fees backed by an analysis of restrictions on competition and of the role of

information imbalances between patients and specialists.

Recommendation 4.19: The ACCC or the Productivity Commission or another appropriate body should,

separately, review specialist fees and the policy steps that could be taken to make them more transparent or

to reduce them.

PHARMACEUTICALS

Recommendation 4.20: A mandatory reporting scheme should be implemented in relation to originator

and generic agreements to improve the detectability of pay for delay agreements similar to the reporting

arrangements in the United States."