Flood damage. Suncorp got an estimate from John’s Lyng (JLG) that omitted significant costs. JLG refuse to do the repair. The cheapest quote I can get is double the payout.

How can their payout be based on an estimate if the provider of the estimate is not prepared to do the repair at that price?

Has anyone else been caught with an insurer insisting on a cash payout?

Welcome to the Community @Petercvs

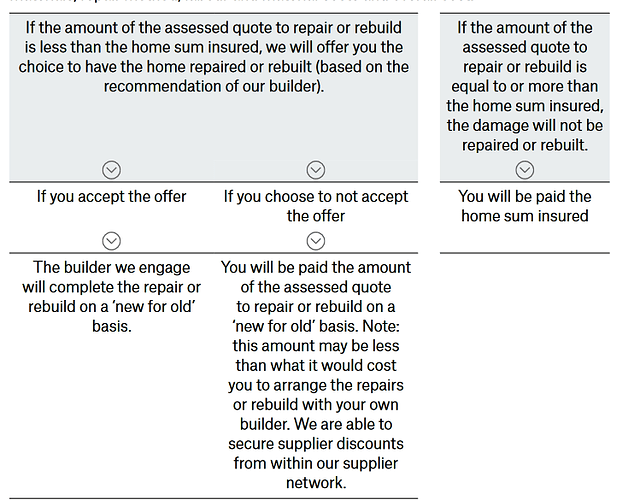

See your PDS on p90-91. Have you submitted your quote? The salient verbiage is:

When your claim for loss or damage to the home is covered and a member of our supplier

network is unable to complete the repair or rebuild, we will ask you to engage a builder to

provide a scope of works and provide a quote on the cost to repair or rebuild your home on a ‘new for old’ basis.

Once the scope of works and quote is provided to us, we will arrange for it to be assessed.This will involve reviewing the quote to determine it is appropriate and reasonable for the scope of works. This includes a consideration of the appropriateness of materials, repair method, labour and material costs and overall cost effectiveness

If the quote is appropriate and reasonable for the scope of works, we will then pay you the assessed amount.

If that is not the process you followed or that was presented to you. your next step is to lodge a formal complaint to Suncorp, and if still unsatisfactory to AFCA.

In general insurers will not pay more than it would cost them for the repair using their own lowest cost contractors, that being their benchmark.

Before the quote i requested was completed, I was paid out and told that the claim was closed and any concerns should be addressed to AFCA. The application to AFCA is in progress now.

Suncorp have the quote I obtained but refuse to change their position.

I can not do the repairs myself and my position from the start was that I wanted a repair, not a cash settlement.

I fail to see how a “quote” form a firm who can not do the repair can be a valid quote.

I want to know if others have been told they MUST take a cash settlement and complete the repair themselves.

Most of us, myself included, often miss what can be fairly important clauses in our PDS. The most obvious T&C Suncorp might stand on, not knowing your policy details, could be (on p90, ref 3rd column)

If the sum insured was sufficient to cover damages and you can substantiate errors in JLG’s quote AFCA should respond favourably as Suncorp could have violated their own process and procedure, assuming there is not more to the background.

Whether they refuse to or are unable to will make a difference, as will the difference of Suncorp asking you to get a quote or you getting your own because of your assessment of the JLG quote.

Since it is with AFCA already I doubt we can add anything except our best wishes for a good outcome and hope you will report back how it goes.

Thanks. Will keep you informed of the result.

Hi -yes, I too have been offered a cash settlement and have been told that their builders cannot complete the work. I knocked back the first Scope of work due to several significant repairs not listed. I am just in the final stages of negotiating now after waiting over 12 months for their revised Scope of work. At this stage, they have only increased the settlement by $5000 and this included further damage sustained in the second flood in February 2022. My “Suncorp Experience” has been extremely traumatic.

I have been offered a cash settlement also but decide to refuse. Can I refuse the offer and insist on the repair by the insurance company?

My property was flooded in February 2022 and no repairs have commenced. The insurer is CommInsure. After 14 months now they suggested to give us a cash payment offer. We are old retirees and are unable to take on a project like this. What happens if we refuse? Can we refuse?

Why the delay? Why the settlement now?

My guess is that they couldn’t get the work done due to lack of tradespersons or materials. If that is so you have two problems. One is, will the settlement be enough to cover all the expenses including a builder to supervise the work and secondly, can you get such a builder yourself.

Welcome to the community @Meitoh.

As a first time poster there’s no need to post a question more than once. Others have raised similar questions in an existing topic to which your duplicate post has been moved. Keeping like posts in a common topic is one way the community shares similar questions and suggestions.

There is already feedback to your post.

We are old retirees and could not take on the repair project ourselves. The delay is due to the original builder kept on discovering new things to repair and have 2 engineers doing further inspection. Now they claim they could not do the job because they could not estimate the extra cost.

What I want to know is that are we entitled to refuse any offer and insist on CommInsure to do the repair?

Depending on your policy, and most are alike, no you cannot.

Consider if you push them and they agree to fix it they may not have tradies available for a long time, or perhaps not in your area.

All that can usually be done is negotiations regarding what needs repair and the reasonable cost. The insurance companies usually use their own cost IF they could do the repair, that is going to be less than an individual can contract for.

The two documents which are relevant are:

with claim examples here:

The PDS states:

Building, Contents and Portable Contents claims

If we pay your claim we will, in consultation with you:

• repair your damaged property where it is practicable and economical to do so;

• replace your lost or damaged property where it is not practicable and/or economical to repair it; or

• pay you the value that fairly represents your loss, in the form of cash or a pre-paid store card*, up to the relevant sum insured stated on your current Certificate of Insurance.The amount we will pay will be reduced by any applicable excess and/or outstanding premium. If we pay a claim for both building and contents, you will only need to pay the higher of your building or contents excesses. If your claim also includes items insured under Portable Contents Cover, the Portable Contents Cover excess will also be payable.

If discount arrangements we have in place with suppliers result in us replacing or repairing any part of your building, contents or portable contents for less than the sum insured or its retail value, we will not refund any premium or pay the difference.

If we pay you in cash or store credit vouchers, we will not use any discount arrangements that may be available to us, to reduce the amount we pay you.

The PDS indicates that decision in relation to cash settlements will be made in consultation with the policyholder. The PDS also indicates that repairs to a damaged property will occur where it is practicable and economical to do so. It appears that CommInsure may have determined that it is no longer practicable or economical to repair your property/house which would point towards a cash settlement or a total rebuild. If a property is no longer practicable or economical to repair, it possibly could be argued that then it would fall into a situation of a total loss and the cash settlement should be the insured amount on the policy less any liabilities (mortgage, excesses etc) - see claim example 4 in the second document.

Is the cash settlement for a total loss? If the amount is for a total loss, then it may be assumed that information has come to light that the property is unrepairable and possibly should be demolished and rebuilt. If it is total loss, possibly see if CommInsure is willing to do a rebuild as part of the negotiation process due to your own circumstances. I would be pointing to the above wording that they are required to consult with you in relation to resolving any claims made under their CommInsure Home Insurance PDS.

Also Comminsure H&C: January 2019 big hail storm broke many roof tiles and skylight, SES covered skylight but had run out of tarps and suggested insurer arrange a few to cover entire roof.

Comminsure sent out first of many incompetent responders who came with one 2x2 piece of plastic and broke more tiles, after 10 days of my reporting back to CommInsure about continued roof leaks and need for total roof cover, nothing more was done to protect the roof despite my pleas explaining because roof is leaking now mould is growing on ceilings.

CommInsure send team to remove mouldy and damp ceiling plaster and soggy ceiling insulation. This team managed to break: irreplaceable light fitting, toilet seat cover, soap dish tile, and more.

I asked for a payout so I didn’t have to depend on Comminsure’s apparent careless team/s.

An assessment was done by my builder on the damage done early February , and payout made - all very efficiently- however, the CommInsure mould team continues to find and remove more insulation and ceiling than what was included in the payout.

I requested a revision of payout, and suggested that as their team removing ceiling etc were giving CommInsure daily updates and photos of what they were doing, CommInsure had evidence from what was included in payout and the extra work now required to replace insulation, ceiling plaster, painting etc

CommInsure continued to request from me evidence of extra and costs.

Four years later extra costs still Not Resolved.

The reason the builder (appointed by CommInsure) claims they could not do the job is that they could not estimate the cost of replacing a joist underneath the house. This has been going on for some months. So I asked CommInsure to find another builder. Then they told could not find any builder to do the repair under warranty! They suggested a cash settlement also. This property is definitely repairable as a scope of work was signed by all parites in Aug 2022. When they started to demolish the floor they discovered a joist should be replaced and they could not estimate the cost of replacing it. This really sounds crazy.

I have read the policy several times since Dec and nothing appears to apply to our situation. I wrote to the Insurance Council yesterday and hope that they will response soon. We definitely could not accept any cash settlement as we are too old (75 and 85) to take on this project. Hope I will get some responses soon. Thanks for your suggestions.

It sounds like either the CommInsure builder may not be interested in continuing the repair for some reason.

The cost to replace a joist should be relatively straight forward if the scope of work can be easily determined. As you have indicated they have demolished/stripped flooring, it should be easier to determine the scope of works.

Another question, was the joist damaged by flood water or had pre-existing damage (e.g. termites, dry rot, sagging etc) and needs to be replaced to allow flood repairs to occur?

If the joist damage was pre-existing it would fall outside the insurance claim and it may be seen as your responsibility to rectify before other repairs are completed. If this is the case, see if you can negotiate with the builder separately to the insurer to do the work - or engage a subcontractor to do the work for them. Hopefully this is possible as it is unlikely that another builder will do a joist repair while another separate builder is doing other related work in the same place.

This could also be the reason why a cash offer has belatedly been tabled.

Hopefully the Insurance Council is able to resolve the stalemate and can see a pathway to move forward with to have your home repaired.

My reading between the lines suggests it may be a problem with your policy limit. Comminsure may have determined the repair could not be done within it so has ‘left the building’ possibly basing their offer to you being the balance of what was spent to date against the policy amount, or possibly being the policy insured amount, that has nothing directly to do with costs of repair.

If the underlying issue is being under-insured it is a pervasive problem where many renew their policies year after year but do not account for current costs and thus are left less than whole or in untenable situations if their pockets are not deep enough.

Please add your experience with the insurance council when you get a response but be prepared to receive unhappy news because a person’s age and situation is not accounted for in the world of ‘insurance law’, yet there is always hope until the last shoe drops in the process.

There was a scope of work drafted by the builder in Aug 2022 and approved by CommInsure. I signed the contract at the same time. I also got the building insurance. When they started to strip the floor board, the carpenter discovered the Joist is not up to current standard.

In 2011 this property was flooded but insured by Suncorp. The builder responsible changed the joist because it is too damp after the flood. It was adjusted to 2011 standard then. The current builder told me that they could not give me the quote therefore unable to do the job.

There is nothing I can do at the moment but wait for the decision from CommInsure as they are waiting for another builder’s opinion and decision. The only thing that worries me is that by law I have to accept the cash payout. We are old retirees (75 and 85) and do not know anything about construction or building. We definitely could not take on this project no matter how much they offer us.

Thanks for your discussion. I have started to write up this case for the Insurance Council and possible AFID.

Thanks

I don’t think that is being suggested, I would assume that you hire a builder who takes responsibility for the whole project and who may or may not hold a hammer personally. If you don’t feel up to selecting a builder then perhaps a relative or close friend might lend a hand.

I wonder if there is more to this than you might be aware. It appears that everything was okay until the joist was exposed and engineering assessment carried out. This seems to indicate the revealing of the joist somehow changed things.

Do you know why the current builder won’t give a quote and what the engineering assessment has showed?

This would be useful information and may impact on what happens moving forward.

For example, if the current builder doesn’t have expertise to complete the works, then this is straightforward as CommInsure could commission one that does.

If the 2011 building work was substandard and because of this the joist needs to be replaced to meet current building codes/for safety, then this may be problematic as it may not be covered by the existing insurance claim (note the PDS states 'Wear and tear, poor workmanship and insufficient maintenance, and any resulting damage, are not covered under this policy (please refer to the General Exclusions)).

This is where knowing why the joist needs replacement and why the current builder is unwilling to carry out the work important to determine who is responsible and what needs to be done to move forward. If you don’t have them, it may be worth asking CommInsure for copies of the engineering assessments, especially since you indicated two have been done in an earlier post. Also requesting in writing why the current builder or CommInsure is unwilling to proceed with the repair would also be useful to you and any complaint you make to the Insurance Council/ACFA. Such information may fill in some of the gaps to allow you to better understand where you are at and where you might stand. Until such information is known, you will be speculating about what is happening.