As of December 2019, total credit card debt in Australia stood at about $49.5 billion - avoid getting into credit card trouble with this easy-to-follow advice:

Keep away from Amex, they are completely unscrupulous and I believe their way of doing business is unlawful and negligent. AFCA was not a great help though and I have heard many people complain as much about the process of AFCA even more so than the initial complaint with the Bank. Very disappointing as they are supposed to be an advocate for the consumer ot the Banks.

Hi @Sanja, just wondering if you have more information on this which your can share with the forum. It is always good to know the issues in detail which consumers face, especially with the credit card industry. Details also provides opportunity for comment as well as provide background to others.

I had one of those Amex Corporate cards where the employee is still on the hook if things go wrong - I think it was ‘corporate’ to the extent the company paid the fee in order to get copies of my statement.

When I went to cancel the card, for various reasons including a similar perception to you re Amex, they told me I wasn’t authorised to cancel the card … I found that rather amusing and asked them who they would come after if I tried to max it out - the answer was me of course. I don’t know the specifics of how that kind of arrangement worked at the time, but I taped the sliced card to a sheet of paper and wrote a note saying I would not be responsible for any charges after that date, signed it and registered/receipted posted it to Amex - never heard another word from them.

As for AFCA - they seem to be a membership based organisation whose primary role is to protect members by making consumers feel like they have a real ombudsman protecting them from AFCA’s members. My impression is that there exists enough fine print in their terms of engagement to essentially allow them to abdicate jurisdiction or responsibility from almost any complaint - but maybe my experience was atypical ![]()

I had a Mastercard corporate card in a previous job, and it was no different. I was responsible for any transaction using the card. If there was a dispute with a transaction, it was my responsibility and not the employer to resolve. The employers responsibility was limited to payment of the account…and not much more.

In our case we had to claim the amount and pay the account ourselves - the company could see the statement to validate we weren’t being fraudulent. We also weren’t allowed to use the card for personal purchases and the card accrued no points in our name (I guess the company got some ‘consideration’ from Amex?). To travel, we were supposed to use the card or risk not being reimbursed - I’m not a fan of travel so cancelling it was a win-win … on the occasions I had to travel I used my personal card with a pre-approval from corporate that it was OK - if it wasn’t, then I (happily) stayed home. Strange state of affairs really - I did wonder if it was all some kind of psychological test …

That sounds like a lot, somewhere in the order of $4000 for every adult. However, how much of the total is corporate/government etc, which may be much larger amounts, and how much of it is paid off each month?

IE, I assume a significantly lesser amount represents long term debt for ordinary people.

Unfortunately your experience is very typical. AFCA are a huge disappointment and I felt like they were continually favouring Amex. My complaint was about not being able to pay out my credit cards and close the account, we were closed out for months and I could not get any resolution. Ironically the complaint to AFCA which has taken over a year has cost me me more than $2000 in continual charges and fees, which is ridiculous. if an investigation and complaint is in process, all fees and charges should be suspended, and Amex did say they would do this, however, that conversation was not recorded by Amex, and AFCA state they do not need to record conversation with clients even though i had elevated it to the Disputes executive manager and asked the call to be recorded. I consider myself very financially literate but Amex and AFCA are a disgrace and doing an enormous disservice to the Australian people.

What was the reason that AMEX gave that the credit card couldn’t be cancelled and the associated account closed?

Usually to close a credit card one needs to"

- Pay or transfer the outstanding balance. Your card needs to have a $0 balance before you can cancel it.

- Transfer any reward points. Redeem them for rewards or transfer them to another program so that you still get value from the points you’ve earned using this card.

- Cancel direct debits. Avoid penalty charges and other issues by transferring or cancelling direct debits.

- Cancel card. If you cancel the card over the phone, make a record of the date, time, and name of the representative you speak with.

- Cancel your card in writing. If you need to send a cancellation request in writing, include your credit card number and account number in the letter and state your request for the card provider to close the account.

- Check for future statements. Log into your account following your request to make sure that the card has been cancelled.

- Destroy your credit card. Cut the card into pieces to make it impossible for anyone to put it back together.

- Confirmation. Your credit card provider should provide confirmation that your credit card account has been closed. If you haven’t received any notice of the account closure within 1–2 weeks, follow up with your provider.

Source: Finder

The process isn’t as straightforward as it could be, but AMEX should be following their customer wishes if there isn’t any grounds not to cancel the card and close the account.

We think these are the 10 worst credit cards in Australia. Do you agree, or are there others with poorer performance?

This is an issue I feel very strongly about as per my previous posts in the forum.

It is time that the Government legislated that the minimum monthly payment will be sufficient to pay the debt off in a few years and not many decades.

I might rephrase the title to ‘ten worst credit cards for those who carry a balance and how high interest can hurt you’.

One of my cards is a Westpac with a high interest rate. I have never paid even $0.01 in interest although pay them an annual fee. The included travel insurance has more than covered the fees as a practical matter. One year I even needed to claim on an overseas medical bill and it was processed without any dramas.

The card points for spend are not impressive but more than cover the fees even as they are routinely diluted to be worth ever less. There are also random offers I can take advantage of through the year, $5 in my pocket here and $5 there. If I carried a balance it would be a different equation, much to my detriment.

Which is best or worst is going to be personal to individual circumstances, needs, and financial regimen.

The high interest rates associated with most cards has been highlighted internationally for many years. Governments have been disinclined to pay more than lip service and window dressing balm since ‘banking profits are important’ and this is a biggie.

So long as that horizon was not too short, it seems so reasonable and thus unexpected any government would take it up.

… for interest rate. I’ve had one of the cards in this list for a decade or more, for very specific reasons, used it regularly and never paid a cent of interest in that time. The reason I have it relates to features of the account (no foreign transaction/conversion fees and a demonstrably ‘much better than paypal’ conversion rate, which is not saying much, but … 28 degrees)

My son travels only every few years and keeps a version of the 28 degrees for the occasion. No fees, no use between travels. It works well for him. My Westpac sucks for international use, so I buy tickets with it to validate the insurances and use my ING Visa (also no foreign fees when one plays their easy-to-play game) for international purchases.

The 28 is a good card for the right user…

My credit card is a leftover from my days of having a Viridian Line of Credit mortgage with what was Colonial which was then bought by the Commonwealth. I was totally stupid about the line of credit and never paid it off monthly. I could have, at the time, I just didnt. This is a lesson in DO NOT HAVE A CREDIT CARD. By the time I got to Commbank which was several years later, interest rates had increased but at least I was under the limit. I dispensed with Line of credit and got myself onto a variable rate mortgage (and no regrets, best thing I ever did) which also paid out most of the CC. At that point I should have just continued to pay it off and then cancel it. But I didnt. I sat on it. And then, I just had to have that new iMac. and then there was something else, yadayada. Commbank introduced a new lower rate card (10% at the time). I’m still on that, even now, but its not 10% anymore, though they could afford to have left it there. I make payments of $200 most fortnights, and use it liberally for things needed (rather than things wanted). Talk about learning lessons too late. I will be using it again, for the new upright stove and fridge, and probably for the mobility scooter I will need within the next couple of years.

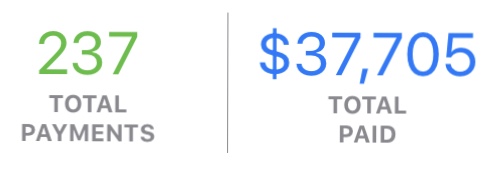

I never go over the limit and I never miss a payment. My bill watching app keeps tabs on every payment I have made, sine I began using the app. But until the latest version it has never displayed the total paid on anything. And here’s the lesson. The card has cost me over $37,000 since 2011. But would I have saved all that? KNowing me, the answer is no chance… still, its a scary thing, seeing it thrown up on the screen like that… and then you realise just how much of a financial fool you’ve been.

My estate will have to pay it out in the end, just as well I have no dependents except the cat.

We have one for exactly the same reason. The only negative is fees associated with cash advances…last time travelling we found our Visa Debit card slighty better (by a very small amount) compared to 28 Degrees. We use 28 for purchases and Visa Debit for cash when travelling.

We do exactly the same ( unless we are travelling in Japan where my partner has a bank account ).

I have noted that Latitude (28 Degrees Global Platinum Mastercard) seem very reactive to anything that looks like it could be a suspicious transaction, eg I have received a phone call within minutes of making purchases in Japan and the USA, checking to see that they were genuine.

Before departure, I always notify of when we are travelling and what countries we will be visiting. Touch wood, haven’t had any issues to date.

That is usually a requirement for the card to be enabled for use in those respective countries. Don’t give notice and the card should be locked on the first attempted use. For regular international travellers (eg people out of the country every few weeks or months to the same locales) the security systems learn not to be hair triggered; for the casual traveller the process usually works to protect the card and holder.

A problem arises when you do not have the phone and the security system trips, and they cannot quickly contact you. They usually lock the card pending one’s contacting them. Sans phone, one of my issuers sends an email with some details of the sus charge and all I need to do is click on OK or Not OK to proceed; some do it by apps but that also depends on the phone. Roaming sometimes matters, and for apps data plans matter. Some apps depend on the phone number for extra security so if a local (foreign) SIM is in place all bets are off.

They have ping’d an SMS at me a few times over the last couple of years to verify a transaction is legitimate. I figure they cop (most of) the hit for fraud so it’s reasonable for them to employ measures to reduce it.