I would like to point out that I went to Westpac bank and apparently ALL Banks NOW, will not accept digital ID as proof of identification. I can spend $30,000 on a credit card with 2 clicks, but a bank will not accept Digital ID. This needs to change. I couldn’t even do it on the phone with a customer service representative after going through all the ID checks. I had to go to a branch. Both have discretion as I explained to them that all my documents are stuck in Sydney due to COVID all I have is Digital access to a Drivers’s Licence, tax records and Medicare Card. If Governments accept this form of ID, surely Banks should? This is appalling when the banks are encouraging us to do stuff more online.

Some banks allow some identification to be done online, but there generally there still needs to be direct contact to prove you are who you say you are. Direct contact may be visiting a branch with ID to verify the applicant is the person in the ID.

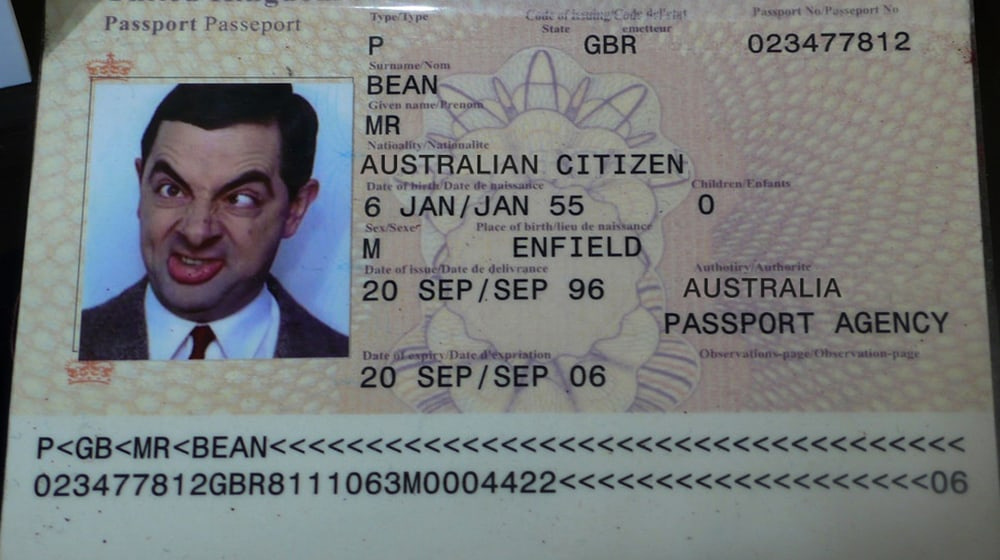

With identity theft, it would be easy for someone to have access to suitable electronic forms of ID to set up a bank account online for criminal purposes. Having face to face verification reduces risk of someone else setting up an account in your name using your IDs.

While inconvenient, I would rather face to face verification of hard copy documents (passport, drivers licence etc) rather than relying solely on digital forms of ID if there was a risk of identity theft.

Westpac allows online identification checks for online applications…

but it doesn’t say whether you need to present these face to face in a branch. Last time (about 3 years ago), setting up a new finance account, I could do all id checks online…but afterwards needed to go it a branch or post office with hardcopies to have the IDs used online verified. These were photocopied and endorsed. This was to check I was the same person making the application as on the IDs. It is worth noting electronic IDs can’t be photocopied (and endorsed) as a proof of ID record retained by the financial institution should they be audited. Audits could be done by the regulator to ensure they are meeting legislative and anti-money laundering requirements.

I went into the branch after not being able to complete a transaction over the phone. All my ID is digital as the hard copies are in storage. My passport, drivers licence and Medicare card was unacceptable proof of my identity as they are digital not hard copies. Clearly unacceptable to my mind.

As indicated above, while digital forms of ID are available, a financial institution needs to keep records of ID used to set up an account and confirm issued photo IDs match the applicant. I suspect while there is a risk of identify theft, legislation won’t be changed. Maybe if identity theft is eradicated, using only electronic forms of ID will be possible.

It is worth noting police, immigration etc can use electronic IDs for verification as they have access to electronic scanned images which can be used for verification when there is face to face contact. I am not sure I would want a bank or any other business having access to all my personal information or records, including scanned photos. I would be concerned if they had such access as this is all the tools one would need for identify theft.

I am not aware of an official digital passport. Is that something new? For confirmation, you are referring to official government sourced digital documents rather than scans or photos of same, correct?

I am aware NSW has rolled out digital drivers licenses and stated as having the same legal status as the plastic driver licence in NSW and is accepted more broadly interstate, so one might reasonably expect walking into a bank with one on their phone would be acceptable.

Likewise one can get a digital Medicare card but I do not see anything about it being able to be used for ID although many online applications will accept the Medicare card number.

A ‘beauty’ of the digital and online systems such as they are, are not infallible. An example is my VIC drivers license failed a check for MyGovID even though no details have changed in 19 years and all information was verified correct with Vicroads. It was happy to accept my passport and Medicare card details. The formal statement about the driver license check failure was ‘maybe it was a communications error or the Vicroads computer was busy and did not reply in time’ even though a few attempts were made (but not enough to lock myself out).

From experience one may never need to ‘front up’ to the institution to physically present online ID that has been validated, although a few years ago one always had to submit certified copies or visit a branch with the documents in hand. Perhaps times have changed?

Agree, but wonder how it’ll work out with so many bank branches closing down all around the place ![]()

It looks like times have changes, most banks are upfront about need to verify documents in person:

Other will also accept suitably endorsed hard copies posted to them…

As the NAB for says:

We are required to collect (and verify) client identification (ID) from you.

This is not possible with a digital ID on a smart device as outlined above.

It seems the verification system may be well behind the times, noting laws rarely keep up with technology.

edit:

For the sake of argument, a digital ID could be presented and printed if the facility was made available.

There is also the rise of online only banks that have zero or one branch.

We used the identification verification process available through the local Australia Post. The financial institution allowed this to occur and issued a form with a reference number to be used for such purposes (it was an option when doing the online application).

There is no digital passport but it was always a dream of Julie Bishop’s when she FA Minister. I had a photo of it on my phone.

I can understand why a photo of any document would be rejected since virtually anything can be made on a PC these days. PC? Showing my age - maybe ‘device’ is a better term ![]()

OTOH government sourced digital documents have methods for verification available.

They do, but this assumes the person using the digital ID online is the same as the person on the digital ID. They have ways to cross check such as using government issued document references etc or visiting a government office for face to face verification.

Looks like having different faces means a face can’t be stolen…or maybe not…

That is a slight shift to the OP that included

suggesting whatever he had was not accepted. If it was a scan or photo it is understandable it would be declined to be accepted. If it was a government issued digital document it is there and the holder is there just as with a paper document.

Interesting. I have successfully used by digital drivers licence (in the gov’ts Service NSW app; same app that does your COVID QR checkins) at places like my strata, but they didn’t know what to do and so took a photocopy of my phone with the app open

No Phil, it was my Medicare card and my online NSW Drivers Licence, plus Australia Post Digital ID which includes Passport that says verified.

My argument is Gov. accepts digital ID why not Banks?

Government makes the legislation.

The only country I am aware of with a digital e-ID which is universally accepted is Estonia…

It is linked to their residency card which then links to other forms of ID. The residency card is a master ID used to link others. We don’t have an Australian residency card system. A few years ago, every citizen was issued with their own digital key and the one I saw plugged into a USB. For any transaction with financial institutions, government and other online transactions one needed a valid key. Technology possibly has moved on, but Estonia is reported as leading the way.

This poses challenges for privacy etc, which Estonians seem to accept due to their location and external threats.

Your iPhone or Android should be your digital passport. The Manager could have called my phone to see if it was me.

The manager would know you have the phone, but calling a mobile doesn’t prove you are the legal owner of the phone or any information it may hold. Many mobiles are hacked or inappropriately obtained to be used to build a identities at another’s expense. This is the reality of the world we live.

I sympathise that there could/should be better and more convenient ways to prove who one is, but, making it convenient may also make it easier for targeting by those with criminal minds…unless it can be proven that mobile phones/smart devices are more secure on multiple levels than traditional methods. Moving to fully digital must be accepted by the community as a whole and everyone accept the consequences moving in that direction.

The banks have been in the hotseat on a number of fronts in the past and they are unlikely to step outside the mandatory requirements with verifying identify. Unfortunately it won’t be a fight one will win without changes to legislation and community expectations.