Suggesting people who have policy’s look into pausing/ freezing premiums at this time. Extras are generally not available, and elective surgery’s have been stopped. Financial hardship, is what you need to mention. It’s not necessary to show documents. Mine allows a pause of up to 2 years. Only thing some might consider is ambulance cover, but premiums over the course of three months would be the equivalent to a call out.

Thanks for the tip. Worth exploring.

Indeed the suspension of the fee increase is welcome. However, given that you wont be able to use the cover for what is predicted to be a significant period of time, some further fee relief would be welcome. I dont see why all the wait periods then have to be redeployed when you re establish. They’ve always got their hand out

I believe there is a gross injustice in that Extras Covers holders are effectively subsidising the “benefits” of hospital cover patients under COVID-19. For many people, dental and optical are the main reasons for holding Extras Cover, but they now struggle to claim on those benefits. The health funds should cease this discriminatory behaviour and CHOICE should take this matter up with them.

Thing is though, you should still be able to use your extras cover before the end of the calendar year. There might be a rush on dental checks and new glasses sometime in the 3rd or 4th quarter of the year - but you will likely still use your annual entitlements. Heck, I will still be using my optical benefits on contact lenses ordered online, and if it wasn’t for the fact that my prescription was expiring very soon, I’d probably order my glasses too. I will

be booking in for my dental checkup as soon as I’m able.

Actual financial hardship aside, if you will still claim, you still gotta pay. I could see some merit in insurers allowing a roll-over of some limit entitlememtz if the restrictions are still in place in November, but without an actual financial hardship (which they already make allowances for) it wouldn’t make any financial sense for them to do a blanket cut on their fees.

I’d query though, if optical and dental are the primary reasons people are having extras cover, they might be better off putting the equivalent amount away into a savings account to pay for their annual checkup and new glasses.

I might not be seeing something, but unless you’re using your entitlements to the max every year, is extras cover worth it?

BUPA

Is todays release mostly a token offering?

Note the ‘expanded cover’ for treatment of Covid-19 related conditions in hospital. The majority of members have cover, and the remainder are covered by Medicare for hospital admission and treatment. Where any member is treated may come down to where emergency decide, given the take over of bed space in private hospitals by the Govt. Is this likely to cost BUPA any more than the PR?

I just received this from Bupa.

"A healthier you is just 28 minutes away with Sam Wood · View online

Relief when you need it most: our COVID-19 hardship

options are here to help

Dear XXXX, keeping healthy is as important as ever being in isolation, so we’ve teamed up with Sam Wood to give you 3-months access to the 28 by Sam Wood online fitness and nutrition program , at no cost to you. It’s just another way we’re supporting both your physical and mental wellbeing.

Everyday for the next three months you’ll receive:

- Easy to follow at-home workouts (beginner and low impact options available). No equipment required!

- Daily meal plans to suit you

- Mindfulness and motivational content to help you stay focused

- Support via a private online community

- Daily updates from Sam Wood

Let’s stay healthy at home together.

Check out Sam’s Healthy Blog for fitness tips

How to boost your metabolism for weight loss

Read more How to make your breakfast healthier

Read more Read this if you’re feeling disconnected

Let’s do this!

Relief when you need it most: our COVID-19 hardship

options are here to help

Eligible Customers will receive free 3 months access to 28 By Sam Wood program (the Offer) from Bupa HI Pty Ltd (Bupa) and Australian Life Tech Pty Ltd (28 By Sam Wood). To be an Eligible Customer you must reside in Australia, be over the age of 18 and be any person who, at the time of taking out this Offer (a) is covered by any private health insurance product from Bupa HI Pty Ltd; (b) who currently holds any General Insurance product distributed by Bupa HI Pty Ltd; or at any time on or after 4 November 2019 © purchased any services from a Bupa Dental clinic and can show a valid proof of purchase for those goods or (d) purchased any goods from Bupa Optical online, any Bupa Hearing or Bupa Optical store and can show a valid proof of purchase for those goods. The Offer is not available to Australian Defence Force members who would otherwise meet any of the above eligibility criteria. The Offer expires 14 June 2020. 28 by Sam Wood will share your personal information, (including, where applicable, the health information and details of purchase set out in any proof-of-purchase provided by you to 28 by Sam Wood) with Bupa for the sole purpose of validating eligibility. View full terms and conditions of this offer here bupa.28bysamwood.com.

Please do not reply to this email. Replies go to an unmonitored mailbox. This email was sent by Bupa HI Pty Ltd ABN 81 000 057 590 - 33 Exhibition Street, Melbourne, VIC, 3000, Australia (Bupa).

Unsubscribe · Privacy & Security"

How incredibily generous when there is currently very little they are paying out for.

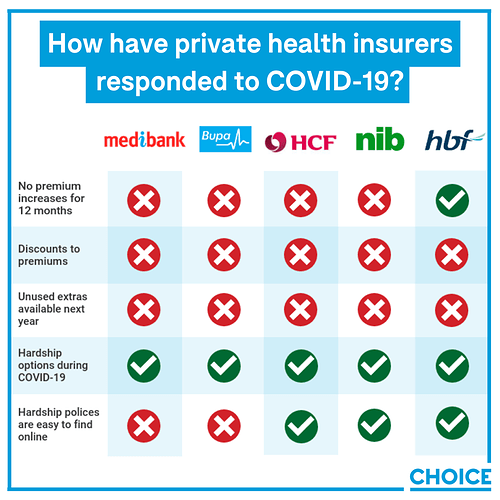

We rate how private health funds have treated policyholders during the COVID crisis:

I need insurance too but unfortunately I haven’t got one yet and I have not make it as my priority. It is really important to consider getting an insurance while you are young and at the prime of your physical strength. Hopefully. I’ll be able to get one with investment opportunities alongside.

We’ve put together a scorecard on private health insurers response to COVID-19, read our analysis.

Pretty terrible scorecard overall and none really offered value for money in regards to what members lost. Not that this should be surprising because it seems that only profits matter and health insurance is just a means to get there without really having to care. As the article describes $1 Billion pocketed with almost no provision of services to members. And Puffery rears it’s oh so ugly head again with the Advertising extolling the virtues (maybe that might be vultures) of these companies…Even if there are no virtues in reality to extol.

EDIT: Signed the Call to Action at the bottom of the article.

They should add Social Media buttons to send the word out on the Campaign page, similar to what is on the analysis article page…tweeted from the article page.

A succinct description of a capitalistic economy. Our governmental choices are amoral libertarian or amoral capitalistic at the end of the day.

One would hope to have a clear difference but what wins elections has become fairly clear. Both options do similar things just to different degrees and with smirks or smiles, depending.

A timely reminder to shop around … the ‘big guys’ sometimes are ‘big’ on things you don’t want ![]()

For example:

COVID-19 Member Support Program

Defence Health has introduced the COVID-19 Support Program to help members during this pandemic.

Support in these exceptional circumstances includes:

- Suspending the 1 April 2020 premium increase until further notice for all members. You do not need to take any action; this has been automatically applied to your policy.

- Covering all eligible members with a Defence Health Hospital policy who may require COVID-19 related treatment. To determine if you are eligible, please contact member services on 1800 335 425.

- Extending Extras claiming criteria to include ‘telehealth’ consultations for members requiring ongoing or newly referred dietetics consultations, psychology, speech pathology, occupational therapy, physiotherapy or exercise physiology sessions over video or phone (conditions apply).

- Temporary changes to our financial hardship suspension rules, allowing eligible members who joined Defence Health less than 12 months ago but on or before 1 March 2020 to suspend their policy for a minimum 3 months and up to 6 months.

- Extending the option of financial hardship suspension to Extras-only and Young Adult Support Plan policy holders.

- Allowing those who’ve returned from suspension within last 12 months to suspend their policy again for a further 3 to 6 months during the pandemic.

- Members who have already paid their excess in the current financial year, and had another planned hospital admission between 1 March and 30 June 2020 that has now been moved due to COVID-19 into the next financial year, will not be charged an excess in the next financial year for the delayed admission(s). Members in this situation need to call us to ensure no excess charge is applied (1800 335 425). Please note, the excess will still apply to any other admissions that were not delayed as a result of COVID-19.

- Maintaining Reservists’ current ADF package or Reservist discount until further notice, with no requirement to provide a declaration of service (recognising days served may be reduced due to pandemic).

- Extending ex-serving members transition discounts by 6 months.

Read our COVID-19 Member Support Flyer.

Disclosure: Been a member for many years, no other connection …

From an article in YourLifeChoices (https://www.yourlifechoices.com.au/health/your-health/private-health-fails-covid-test) a rebuttal of CHOICE by Dr Rachel David:

"Private Healthcare Australia chief executive Dr Rachel David attacked the CHOICE research as “inaccurate and irresponsible”.

“In recent years, CHOICE has changed its approach to research and campaigned vigorously against private health in Australia,” Dr David explained.

“Its latest missive criticising health funds on their response to the pandemic is inaccurate and irresponsible.

“Health funds were among the first organisations to respond to the crisis by supporting their members financially and with access to healthcare in the first week of national lockdown.

“CHOICE has made no reference to how many people have been assisted or by how much. This is in spite of the fact over 100 000 people have claimed hardship assistance and members can continue to do so.”

Dr David said that health funds have said they will not profit from COVID-19 restrictions.

“Health funds made some savings over the six-week period in which elective surgeries were cancelled and some allied health providers were closed,” Dr David admitted. “Over half a billion dollars of these savings have already been returned to members.

“Health funds are now using the remaining savings to fund the backlog of elective surgery. The Australian Prudential Regulation Authority (APRA) has made it clear that health funds must retain enough capital to fund this backlog of elective surgeries and the additional healthcare needs of private patients.”

According to Private Healthcare Australia, more than $500 million in savings has been returned to members through postponing the 1 April premium increase, financial hardship provisions and funding of telehealth services for psychology and physiotherapy.

“Some funds have also provided members with cash backs, rollover of services to the next calendar year and cancelled the 1 October premium increase,” Dr David explained. “If the independent regulator’s claims data, due to be released in a few months’ time, shows more savings need to be returned to members, health funds will do so.

“Premiums rise because funds are paying for more healthcare. The COVID-19 situation has not stopped health inflation rising at levels far above general inflation.

“Health funds don’t want to increase premiums by a single dollar, but it is necessary to ensure health funds remain financially viable, meet statutory prudential requirements and, most importantly, continue to be in a position to provide members with access to quality and timely healthcare.”

I know who I prefer to believe and that’s CHOICE but wanted CHOICE to see what has been said against them and allow CHOICE to set that record straight.

A person in that position must surely have no bias and nothing but good in her heart rather than focusing on maximising bonuses and dividends, and maybe even more government gifts to her industry.

The phrases quoted looked careful and selected by said Dr - it got my skepticism meter registering immediately … what does it mean to be “among the first to respond”? what constitutes a “response”? 100k people claimed assistance but how many received it and how much? Won’t profit from C19 restrictions? what does that mean? Dollars have been returned to members? is that over and above what is returned normally? (ignoring whether one is a “member” or just a “customer” of a commercial profit focussed corporation)… “some funds have also provided members with cash backs etc” - which? how much? “Health funds don’t want to increase premiums …” - glad to see, for the ‘for profit’ funds, that shareholder return isn’t a concern, it’s peoples health …

Dr? PhD in marketing I’d suggest …

Macquarie University Graduate School of Business is her featured education on LinkedIn.

Private health funds ceased being all that creditable when they became listed public enterprises. Except perhaps to investors, as shareholders.

Eminently qualified to do so, but no PhD.

More concisely a MBBS, Adelaide Uni, 1991, so a trained medical Doctor.

MBA 2002 Macquarie Uni - Graduate School of Business.

It’s a fair call the chosen career path is not one of hands on care of patients. 4+ years after graduation is sufficient time to complete related work experience.

Commencing shortly there after:

- 1996-2000 Senior Advisor Medical - Office of the Federal Minister for Health and Aged Care.

- Director of Corporate Affairs -Wyeth Australia,

- Director Public Affairs - CSL,

- Expert Adviser Healthcare and Infrastructure - McKinsey and Co,

- Director of Government Affairs, Policy and Strategic Market Access - Johnson and Johnson Family of Companies,

- 2015 - CEO - Private Healthcare Australia.

A very successful career. Experience and well chosen high profile opportunities demonstrate how success can lead to a CEO’s role in a significant organisation. It’s that early role as a Senior advisor just 5years post graduation that appears the most strategic.