The HSBC education loan @mark_m linked is pretty special. Some lenders are more up front about what a comparison rate is, and some others not so much. To credit, HSBC states it is only applicable for one specific loan amount and term. It is thus a furphy for anything except ‘the specified loan’ but there is an establishment fee, a monthly servicing fee, and an early termination fee. I noticed some lenders in some countries also include penalties for repaying ‘too much’ on a monthly basis! The devil is in the T&C.

Who does the ‘comparison rate’ suit because it only applies to a specific standard loan and term regardless of what any individual consumer would borrow.

Do or can financial institutions game it by tailoring their loan products’ sweet spots to the standard loans and ‘revealing all’ is left to the application phase when money changes hands to progress further?

Is it misleading as regards the true costs of one’s own loan? Perhaps I misunderstand, but I struggle to understand what relevance it has. For a mortgage –

A loan might be for say $500,000 or more for other than 25 year terms. While noting most are variable rate and fixed rates are shorter term and have periodic renegotiation/renewals wouldn’t a consumer be better served with the real costs of ‘their loan’ for the current term and rates?

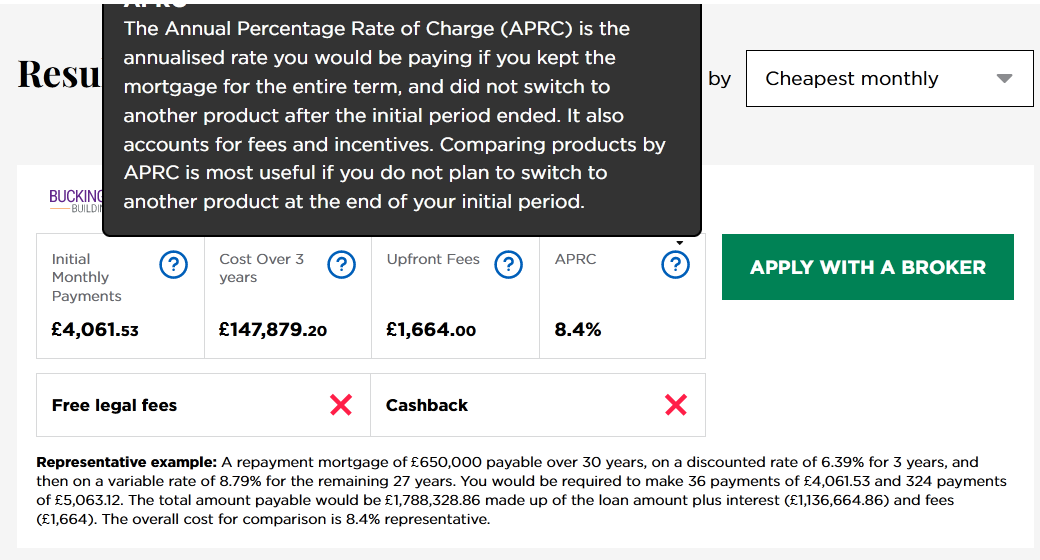

A true annual percentage rate for your loan including all fees and interest seems the only true comparison. In these days of computer accounting is it too much red tape to require lenders to do an APR? I accept with offset accounts and so on it might not be straight forward and an APR might not be fully accurate either, but seems it should be better guidance for loan-shopping comparisons than anything based on ‘not my loan’.

@BrendanMays, is the ‘comparison rate’ as an advertising metric off radar? Is it a non-issue in the greater community (no pun intended)? Without the APR every borrower would need to do their own numbers or trust their lenders to be honest and up front during the sales process. Or do they rely on costs for ‘not my loan’ until contracts are filled in?

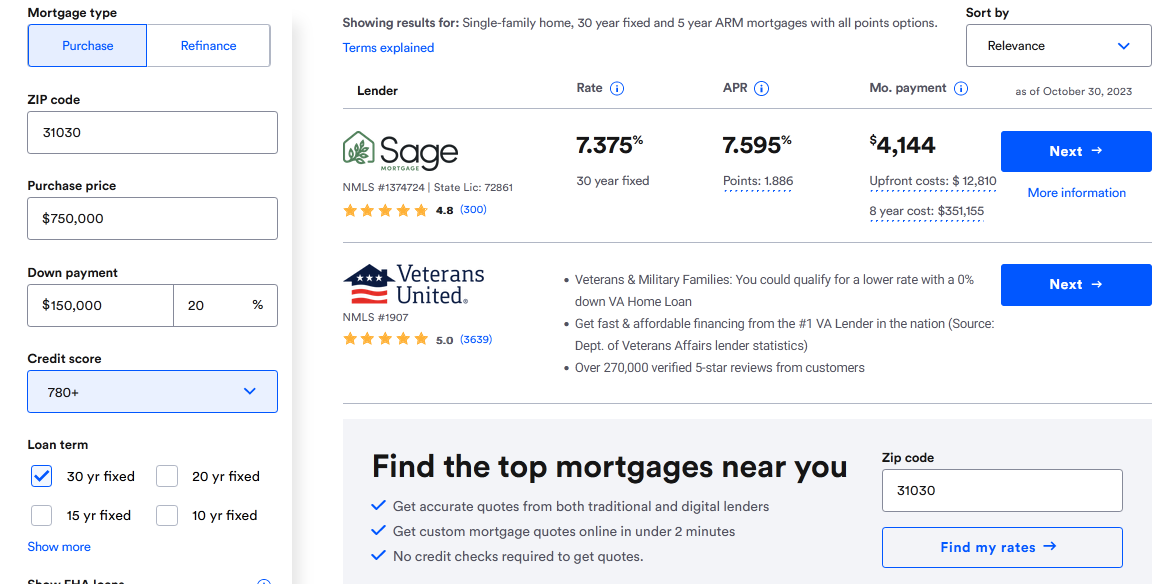

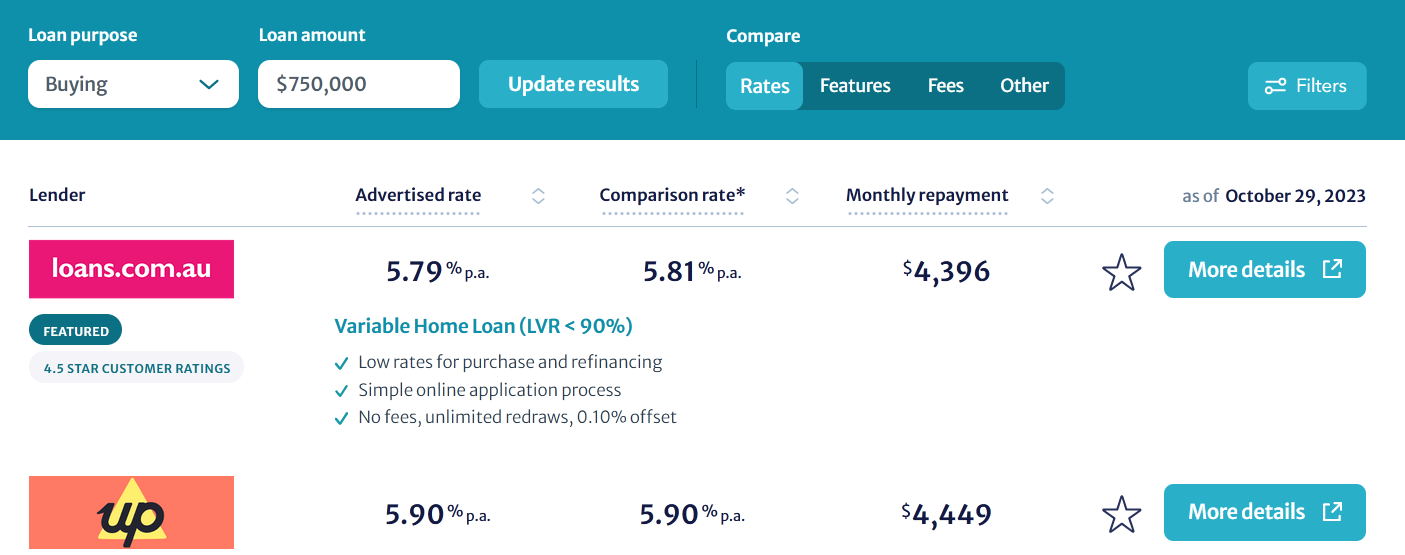

I ran some numbers through a UK, USA, and Australian mortgage site and this synopsis is presented based on the loan amount and repayment period for my proposed loan with 3 years fixed and then variable.

From the USA (note credit score (easily obtained in real time) and term are included!). The USA still normalises on fixed rate mortgages over the entire term.

But from Australia no matter what amount is plugged in the ‘comparisons’ are the same.

Do I miss the relevance of the comparison rate or is our system designed to be opaque on the real comparative costs while shopping for a loan?