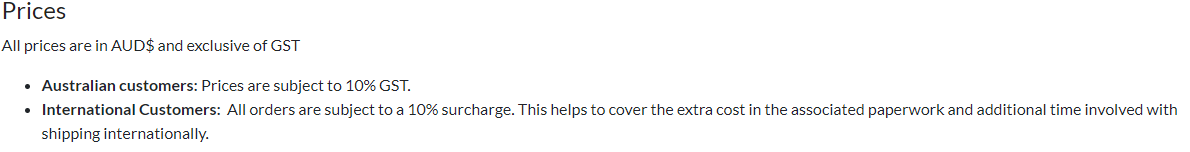

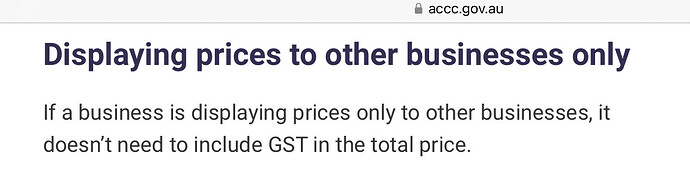

It isn’t an exemption but how a business can present pricing based on the majority of its customer base.

A reasonable person would assume a business caters for the majority of its customers. If it is wholesale business, it is a business that sells mostly to other businesses as outlined above. Such businesses could reasonable expected to present pricing in accordance with the ACCC displayed pricing where it doesn’t need to include GST in the displayed price. Displayed pricing could be expected to be ex-GST. Owning a business ourselves we often see exist pricing from businesses which customer base is mainly other businesses.

A reasonable person would also expect a retail business which sells to domestic customers/wider public, would have total pricing on display to include GST.

Where a business is a wholesaler and clearly states this, like Simply Candle Supplies, it could be expected that displayed prices are exist like that allowed for by the ACCC. If a consumer seeks a price from a wholesaler, they need to check whether prices quoted are exist or inclusive of GST. Both which are acceptable by the ACCC.

Where it isn’t clear a business is a wholesaler, like Australian Seed, a consumer could believe the business is a retailer where displayed total price includes GST. It isn’t clear/obvious Australian Seed is a wholesaler, but they do state that the pricing their website is ex-GST. And also states ‘Wholesale pricing available for retailers and garden centres wishing to stock our products.’ which tends to indicate retail not wholesale prices are displayed. This therefore suggests prices should be inclusive of GST.

The Australian Seed website also indicates they export seeds where GST wouldn’t apply. I can’t comment on this particular business to why exist prices are displayed, but they could make it clearer if they were a wholesaler or retailer, and if a retailer, that where total prices are displayed Australian customers are subject to GST (if pricing is ex-GST as currently displayed) or likewise foreign buyers if they decided to change their total price to he inclusive of GST.

Looking at the Australia Seed website it is likely they cater for business (nurseries, rehab, mining etc) and foreign buyers. This is a deduced from information on the website but could be made clearer if this in fact the case.

The internet has allowed retail consumers to access wholesale pricing, especially where a wholesaler displays it pricing on their website to anyone who visits. Some wholesaler take a different approach where pricing is only given to those who hold accounts and are bona fide business customers.

The original post was it is unlawful for (all) businesses to display prices ex-GST. It has been shown that this isn’t correct, and only applies to retail businesses and not wholesalers.