A true strictly wholesale company would only sell, preferably in bulk, to retailers, not to end buyers.

So it should be made clear up-front, whether the headline price is GST inclusive or exclusive.

They don’t, and they sell to end buyers, they are in breach of the GST pricing.

Where does the information on the ACCC website state this is the case?

Wholesaler can sell single items to bulk items. An example being a wholesale supplier for tradies. A tradie doesn’t want to buy scores of a item when they only need one or a few.

One of the businesses given as examples above states they are a wholesaler, the other is ambiguous.

This has been covered in previous posts in this topic.

If a business is only selling to other businesses, then the advertised price does not need to include GST. If also selling to end users acting as a retailer, then the advertised price has to include GST.

Explained on the ACCC site if you would care to look.

The seed site also in this topic at least has two options, one path for retail, and another for businesses.

This candle business is effectively engaging in illegal ‘drip’ pricing by adding on GST only after one has got to the point of checkout. There are some costs like shipping that can only be determined once a shipping address and method becomes known. That is acceptable.

You are misrepresenting what the ACCC states, it states:

It isn’t about only selling to other businesses. It is about displaying prices to other businesses, the audience for the prices. Being a wholesaler is about principally selling to another business. Thus ex-GST prices can be displayed. If a private consumer decides to try to buy from a wholesaler, the wholesaler can accept or refuse the sale. There is no legal obligation to only sell to businesses if one is a wholesaler. Our own experience is many only sell to other businesses, while some chose to also sell on occasion to private consumers. We use wholesalers which require ABNs to make purchases, others don’t place such restrictions when making a purchase and could be used by private consumers to buy purchases.

This legal service for small businesses.attempts to clarify the issue of B2B. Bold added.

You can advertise to another business that the price of the good that you’re selling them is $300 plus GST.

However, you should be aware that the primary issue with B2B prices is that they are commonly found on websites or public forums that the wider audience has access to. Therefore, if this is the case with your good or service, it may be recognised as a business-to-consumer interaction instead of a B2B interaction. As a result, you will be required to include GST in the full price of the good or service being advertised.

Asking the ACCC/Fair trading for their written opinion would put this to rest?

The ACCC website is clear on their views. It appears it is the consumer which is easily confused. Since consumers are easily confused, the government could amend relevant provisions to ensure any price shown to a consumer is inclusive of GST, whether it is retail, wholesale (business) or an overseas business allow Australians to view prices and are subject to GST (which includes most products bought from an overseas seller) . This would remove any possibility that a consumer is confused.

The government might also need to introduce provisions allowing business to refuse sales to retail consumers where they chose, to ensure consumers aren’t confused to what a wholesale or a business set to to principally sell to other businesses…and claiming some sort of unfairness or discrimination.

Businesses would need a transition to the new arrangements as well, so costs of additional red tape can be absorbed over a longer timeframe to reduce a one off financial hit.

Edit: Considering the advice of the ACCC in relation to business to business transactions, the legal advice seems to contradicts the information on the ACCC website. If one takes the legal advice as it stands, it would not be possible for any business to display ex-GST pricing (which is allowed for by the ACCC, which incidentally is also the regulator and administrator of the relevant legislation). There can’t be any guarantees that any ex-GST pricing may not be seen or accessed by the wider audience/consumers. This includes in industry catalogues, websites or other marketing materials. The legal advice therefore suggests that only inc-GST prices could ever be displayed. This makes the information provided by the ACCC (the regulator) nonsensical which is not its intended purpose. The last sentence on the website may give an indication of the purpose of their advice.

Apologies but whether the ACCC is as clear as necessary is not evident. I have never seen any pricing sans GST that did not state ex/GST even on web sites that also indicated ‘no retail customers need contact us’, assuming there has been one.

Pushing the letters of poorly drafted codes and expectations as inviolate requirement allowing a lax interpretation is not necessarily The Right Answer.

‘Red tape’ often protects the community for a reason. If businesses did not need oversight there might not be ‘red tape’.

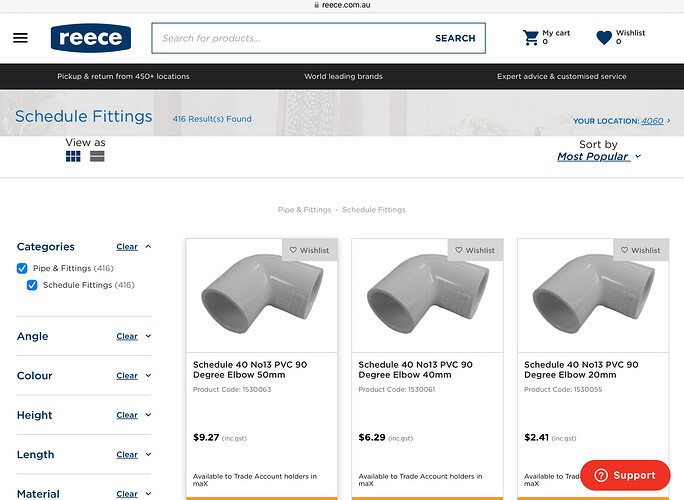

This is how a responsible wholesale business addresses the issues raised.

I’ve linked to the trade portion of the business selling plumbing supplies. I’ve used Brisbane - Qld facing pricing (selection of postcode required before pricing is displayed). Why? Because the majority of the sales of these types of products will be for regulated trade work. They are not intended for retail supply. They can only be legally installed for same by a licensed plumber. It’s self evident which interpretation of the ACCC advice Reece has followed.

A polite suggestion is there may be many smaller businesses who have chosen to ignore the ACCC advice on the requirements of the ACL to include gst in the displayed pricing. Speculatively because the risks of the ACCC taking them to court are low. It looks like it is up to individual consumers to complain in each instance to their state/territory fair trade offices where there appears to be a failure by a business to comply.

Choice routinely raises consumer concerns when there are weaknesses in our consumer protections. Consumers and the ACCC expect the pricing of products displayed to everyday consumers to be inclusive of gst. In the examples originally provided (by @Donkey) there’s evidence of a failure to provide those consumer protections. Where the fault lies is something for the regulator to resolve. It’s been well worth the discussion.

If a business is selling to other businesses and to consumers then it MUST include GST in the price.

Business to Business Transactions

The rule doesn’t apply only when the price representation is made exclusively by your business to another business, as this doesn’t involve advertising to consumers.

Example

You can advertise to another business that the price of the good that you’re selling them is $300 plus GST.

However, you should be aware that the primary issue with B2B prices is that they are commonly found on websites or public forums that the wider audience has access to. Therefore, if this is the case with your good or service, it may be recognised as a business-to-consumer interaction instead of a B2B interaction. As a result, you will be required to include GST in the full price of the good or service being advertised.

So I would say that anything on the internet that a non business person can have access to and purchase from (whether or not they also sell to other businesses) must include GST in the price.

That is correct as I have outlined above. Wholesalers traditionally didn’t do any retail sales, but only onsold onto other businesses. Some wholesalers continue to onsell to other businesses, but may chose to sell to a consumer when approached. Others chose not to and either refuse a sale or refer a consumer onto a retail seller. We have experienced all three over the years.

The current display of pricing allows businesses to show ex-GST pricing when products are being onsold to other businesses. Fortunately or unfortunately with the internet, it allows consumers to approach wholesalers directly when in the past it has been very difficult to do so. The internet allows customers to access wholesale pricing - some consumers possibly think it is unfair if they can’t buy at these prices - especially when everyone wants a product as cheaply as possible.

The ACCC advice possibly was more relevant immediate after the GST was introduced a couple of decades ago when many businesses provided pricing plus sales tax. Accountants before and after also look at cost base and GST as two separate line items and this favours use of ex-GST pricing. Within many businesses (and even governments) use ex-GST for budgeting purposes as GST is more a tax that goes through the operations rather than an operating cost. Hence why ex-GST pricing occurs.

I can see advantages of changing business to business pricing to ensure it is consistent across the board, but also recognise that for many businesses the change would come at some cost and inconvenience.

The other consideration is how big the problem is…it is likely to be very small and any confusion from a customer could occur if it is assumed that a wholesaler must also retail their products. I expect the number of ex-GST displayed price businesses that allow side retail sales would be small, but may be increasing as connection with consumers could increase through internet access and possibly in hard economic times sales might be lower (the later is however ‘robbing Peter to pay Paul’.

If consumers recognised wholesalers are businesses to business sellers, then the issue becomes even smaller. If a consumer expects wholesalers to also sell retail, then this becomes an issue with displaying ex-GST pricing.

Would it be the case consumers wish to buy products and are less concerned with them having an onus to differentiate wholesalers from retailers, especially when a search will return the product page, not the top web site? The common solution is that prices have been regularly shown ex/GST and inc/GST, and when not stated consumers understand it [should be] inc/GST.

This has been an issue everywhere a VAT has been imposed, particularly where there are multiple rates. In Australia, the requirement has always been that if advertising a price to consumers the headline ticket price must include the GST, because represents the real cost to the consumer.

In the case of business to business sales the requirements were based on the assumption that almost all businesses would register for GST. Where this is the case the underlying cost to the business is normally the GST exclusive amount, because the GST could generally be claimed back as an input credit. So a “headline” price that was GST exclusive was considered reasonable (You may recall that the GST was sold by government as not being a “tax on business”).

However, even when selling business to business the GST amount was required to be advertised alongside the GST exclusive headline price. Drip pricing where GST was not disclosed upfront and then added on later was not pukka even in a business to business transaction. Businesses need to be mindful of their cash flows as well as their underlying expenses.

The requirements as outlined at the time are spelled out in this ACCC media release.

For this reason the only safe course is to advertise the GST inclusive amount and a statement about whether the price includes GST. Even in a business to business sale the seller cannot determine whether an input credit is available to the purchaser; for example goods may be taken from stock and diverted to private use. Businesses at the time were very concerned that they should not have to determine or guess the entitlement to an input credit of the purchaser.

Cheers skip

When my husband and I were in business we always included GST. We accepted a quote for an alarm system. After it was Installed we were given an invoice which was 10% more than the quoted price. The quote didn’t include GST. I paid the quoted price, never heard back from them.

Another wrinkle is the

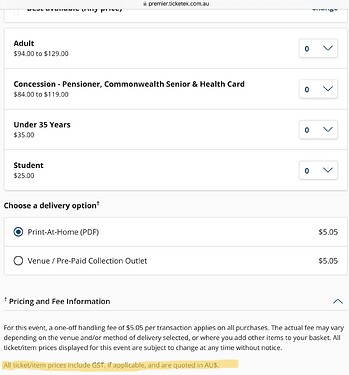

https://morningtonpeninsulawine.com.au/winter-wine-weekend#

Where pricing is $120+ticketing fee+GST. IMO a bit over the top and they are trying to make it look less so. Not unlike some businesses.

It never ceases to amaze what people spend their time doing, or not doing. Shows that we haven’t really come far as a whole.

Some of us choose to go as nature intended barefoot through the park, life and the shopping centre. I used to run in the evenings around the streets and beach for fitness and pleasure. Barefoot! I found it comfortable and the tactile sensation reassuring. It was my time and my choice.

Ok, I’ll wear shoes, but the puffer jacket is a step too far. ![]()

Noted some other notable events advertised for Vic this winter include gst. Even if us oldies need to pay more.

I purchased a large amount of desserts online a couple of years ago from a store that added GST to my order after I got to the payment screen.

I ordered the food and then sent the store an email outlining the law. They quickly refunded me the GST and then updated their website to include GST in their pricing. The owner claimed she didn’t know about the requirement to include GST!

Agree. I have found this too lately. Even some sites adding their own extra costs right at the last-minute! Really disappointing!

For retail sellers, the only additional costs which should be reasonably expected are:

-

postage/freight as this will be calculated based on the order size, type of delivery (courier, overnight, snail mail etc) and delivery location.

-

Credit/debit card processing/surcharge fees can also be reasonable if they are consistent with obligations outlined by the ACCC.

For the above additional charges which may be reasonable, businesses must be upfront and clearly disclose to consumers at the start of a purchasing process the types of fees that will apply and when.

If a business is including other costs, fees or charges, this would be considered drip pricing and something which is not allowed.

Not contradicting anything else that has been written but bear in mind that a business is not required to be registered for GST if its total sales are under the threshold. If the business is not registered for GST then it is illegal to include GST, and GST and tax shouldn’t even be mentioned. In that case they must not issue “Tax Invoices” but instead can issue vanilla “Invoices”. (Any business that is registered for GST should be mentioning its ABN.)

So if you come across some tin-pot web site that sells only to the public, it still might be legitimate for it not to include GST in any advertised prices.

Also, some goods are exempt from GST (even where the business is registered for GST).

Obviously the business can’t then add 10% GST at the checkout.

Yep. Day 1 bug from the government. All businesses should have been required to quote and advertise

- if registered for GST, the GST inclusive price and a statement that the price is GST inclusive

- if not registered for GST, the price and a statement that the supplier is not registered for GST

but it’s 20+ years down the track now, so probably not a lot of interest in fixing it now.