From a document on Foreigners working in Australia and this in particular to foreign Super plans:

"127.Given the caps on contribution limits for Australians since 1 July 2007 and the removal of concessions for foreign nationals, the pendulum has swung back in favour of foreign pension funds. The absence of limits (within reason) and effective tax rates as low as 30% now mean funding of foreign pensions has a certain attraction to mobile expatriates, albeit home country tax rules do need to be taken into account. For US citizens and Green Card holders, careful analysis of unused tax credits are an important factor.

128.In light of the complexity of the foreign superannuation rules, please consult your PwC advisor before making any decision in relation to foreign superannuation. When dealing with foreign pension funds, wills and the naming of beneficiaries and trustees, it is of paramount importance to address both home and host country tax rules."

On Trusts

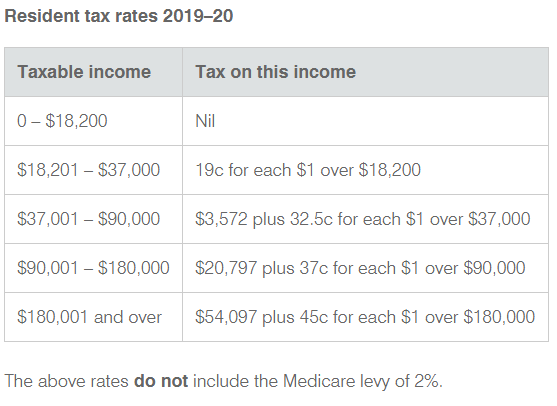

The marginal tax rate for a income below $16,000 would start at 0% only if they are adults (minors are taxed differently unless they work for the income). So it would depend on those who are in the Discretionary Trust and how the income is disbursed (paper wise) to those beneficiaries…remembering no actual income needs to be received by them it is just a paper figure, he could have Mother, Father, Wife, Sons, Daughters, Brothers, Sisters, the in-laws etc listed and disbursed to on paper.

Those wealthy enough spend huge amounts to reduce tax debts to nearly nil, do I think he gets that advice…I do and I think he likely takes the advice as well. That advice also becomes a deduction. Some gifting here and there even while being spent altruistically also may be used to reduce marginal tax rates on beneficiaries such that the deduction is worth more to reduce the tax not paid than was spent on the gift. I am also mindful he may have a foreign Trust and how this is treated for income tax may be even harder for the ATO to unravel. I think in the end he will pay little to even perhaps nil Tax here. His US taxation may be different but again would depend on how his tax affairs have been moulded by his tax advisors.

He may also split his Australian Super (if he has any) with his spouse thus reducing Tax payable particularly if the spouse has no income that attracts Super contributions thus a further $300,000 non concessional plus $25,000 Concessional payment.

Add in some negative gearing, franked credits, the benefits to paying as little tax as can be are achievable. What a “normal” salary/wage earner can do is vastly limited to what the very rich can achieve.