I aim to avoid fees when simply paying regular bills.

My internet provider charges a monthly $2 non-direct debit fee. My payment method of choice is B-Pay.

The provider advised that there is a $2.50 B-Pay fee as this is what B-Pay charges them and they need to recoup this from customers. Would this be correct?

When I asked what method of payment was available to avoid any fee the response was credit card as I would only be paying the merchant fee and this was a lesser amount.

Not very responsible for a large company to make a recommendation to customers to use credit to pay regular bills.

Hi @lobrien12,

The RBA has provided some information showing credit cards are typically the highest cost for merchants to process (after cheques). The average cost for BPAY is 0.73 cents, or another way to look at it is 0.21 percent per transaction value. However, there’s no way to know exactly what your ISP pays as it will be part of their merchant agreement with their bank.

Ok, so what do we do about? The first thing you could try is to call back their customer service department and demand they wave the fees. Hopefully your custom is valuable enough to them that they see the sense in this, but if not, you can always shop around and weigh up the costs. Also, I’m sure you’re already aware of this and it’s probably beside the point, but if you get a debit card with a Visa/Mastercard logo, you’ll be able to access the fee-free payment option without getting traditional credit card (and all the trappings that they can bring).

Hope this helps!

This annoys me as well. I have tried ringing Optus to ask why they charge this fee on their home & internet services, because when you pay by BPay they don’t charge it on their mobile services. All I got was a “because we do” type of answer, and an hour of wasted time! They did offer to remove it from one bill, as a once off - not permanently, and not for everyone. Not very satisfactory.

Given the RBA changes last year to fees& surcharges, I wonder if it’s even legal now for them to charge more than it costs them to use BPay (less than $1).

The sneaky sarcastic part of me is thinking that in order to get my money’s worth, I should pay my Optus bill in three or more installments LOL.

Welcome to the Community @wickedgame,

You will find an increasing number of businesses, especially utilities, doing that.

I am adding your post to this older topic as it covers a few other variations of what consumers are having to deal with. An allied topic is rental agents requiring rent payment through expensive third parties.

If I pay Telstra by my credit card is something like .75% additional charge. However if I pay Telstra by PayPal with my credit card, no additional charge and still get my reward points. Same as my local council. If I pay the rates at the council by credit card they charge 1%. If I pay at Australia Post Office or Australia Post Office Bill Pay website costs me no extra. I refused to pay payment handling charges.

I would think that charge is due to Australia Post charging Telstra, who in turn pass it on to you.

You want to query why AP charges a fee to handle a cash payment.

Welcome @Monica_D to the Community.

Payment by CC invariably involves a fee. Why? Because CC companies charge a fee to businesses to use their services.

For some time now, businesses have been able to pass some or all of those fees on to you, the payer.

I use Bpay for almost all bill paying, and that is fee free.

Hi @wickedgame, welcome to the community.

Tesltra outlines fees and charges associated with various payment methods here:

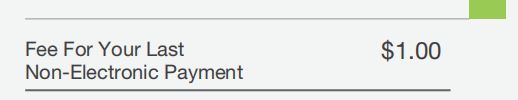

Telstra indicate that in person at an Australia Post or Telstra store, they apply a fee of $1.00 + debit or credit card payment processing fee (if applicable). Australia Post bill payment services aren’t free and they would either charge a fixed fee or percentage commission for bill payment services. Telstra, which it is entitled to do, has decided to levy these charges back to their customers.

If you wish not to pay fees when paying a Telstra bill, look at other options which don’t incur fees or charges as outlined on the above Telstra webpage.

Don’t get reward points on BPay like you do on the credit card. I manage around $250 to $400 a year in fuel cards from reward points. Consequently only BPay when I would receive a charge for using my credit card.

Slightly OT but an alternative for paying utility bills for ING Orange customers is setting up an ING direct debit with the utility. Utilities generally do not have fees for direct debit payments and ING will rebate 1% of the utility bill.

This is what the government did wrong. The government should have required the underlying costs of the payment method to be passed along for all individual payment methods - so that one set of customers is not subsidising another set of customers (which is what is happening here) - and so that there is full transparency. (The government’s complaint at the time was more about the lack of transparency, if I recall correctly.)

But keep doing what you are doing for as long as it works.

The bottom line is that no payment method is zero cost to the provider - and so somewhere along the line the retailer pays that cost. It’s just a question of how much of that the end consumer sees.

I guess it is a balance between the benefit of paying for things using a CC with reward points, and the downside that mostly there will be a fee for using a CC to pay for things.

Possibly also an annual fee for a CC to factor in.

There is seldom a fee for paying with the CC. Generally it is avoidable by paying with PayPal or Australia Post Bill Pay with your credit card.

The credit card fee for the benifits and insurance cover it gives you are not an issue. Anything you buy on the credit card for twelve months from date of purchase is covered for theft, loss and breakage. The credit card fee of $100 is easily covered three times and more by the reward points.

Haven’t used cash for must be twenty years.

Typo? There is often a fee for paying by CC as evidenced by numerous posts about paying bills, eating out, and many usually smaller merchants.

Benefits are card specific. Some have many and others virtually none excepting fraud protection and the ability to get a charge back when it goes wrong.

Card fees vary widely from $0 to $000’s for cards that ‘recognise movers and shakers’ with the Amex Centurion leading the pack. It depends on how much is charged on the card. I use my card for virtually everything but it remains roughly a zero sum excepting for the rarely used benefits; the most valuable has been complimentary travel insurance.

None at all? Not even gold coins to the good folks soliciting for the RSL, Salvos, […, local organisations]?

I’m a new comer to using cards for every day purchases compared to you @Monica_D only started during Covid-19 restrictions on cash and now find it a lot more practical.

I use a debit card with not a great amount of money in it just to be safe in case it’s lost or stolen. During Covid there’s only been one occasion when there was a charge for using the card, but just lately I walked out of Aldi’s because they charge for payments with a card, unless it’s debited from a savings account and a pin number is used, which I don’t like to do, and I feel that’s not-on for a store which claims to be the cheapest (it’s just a matter of principle with me, probably doesn’t bother others).

As far as charities are concerned I give on line, there’s hardly any groups out on the street to donate to where I live but sacred heart and salvos and cbm email and post donations requests regularly.

Oh dear!!!

As explained in my case there is only ONE business and ONE council that impose fees for paying a bill. Both of which I avoid using PayPal or Australia Post Bill Pay. I wasn’t commenting on others.

I was talking about MY card fees, not making generalisations. Suggest you comprehend what people write.

The only place I use cash is donation boxes for camping sites or $1 or $2 coins in showers. Have a box with $5 notes $2 and $1 coins in my vehicle for that purpose. I don’t carry cash on my person. NO, I don’t give gold coins to the RSL or Salvos or anybody else.

I’m thinking of moving back in the other direction. I want to keep the option of using cash (“use it or lose it”) and push back against the surveillance state.

I totally understand your point about COVID. It influenced my behaviour too but - touch wood - the worst of the pandemic is over.

Cash is king ![]()

Good on you! Fortunately this is still a free country ![]()

Thank you Monica for sharing how you make using cc work for you; you’re not advocating that everyone should do as you do but you make some useful observations and good points, in my opinion. Hope you’ll keep on contributing to the forum, looking forward to seeing you soon ![]()

![]()