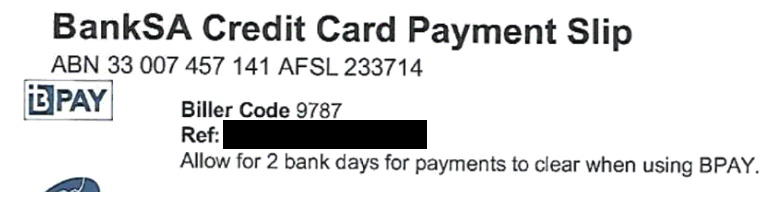

How often do you see a biller make a statement to the effect that payment takes some time? a couple of days to process, time for the money to be received, etc etc.

This might be true for some forms of payment, but not with BPAY if you pay on a banking day within banking hours. The problem is, many billers either don’t understand the written agreement they have signed with BPay, or they don’t care - and neither it seems does BPay, even though they advertise settlement criteria on their website.

From https://www.bpay.com.au/Help-Centre/Personal-User/BPAY-Services-FAQs.aspx :

How long will it take for my payment to go through?

BPAY payments are acknowledged as paid the biller on the day the payment is made, as long as it is a Banking Business Day^ and the payment is made before the cut-off time set by your financial institution (usually the end of the financial institution’s business day) — contact your financial institution institution if you need to know more.

If you miss the cut-off time, your payment will be acknowledged by the biller and on the next Banking Business Day.

^Banking Business Day means a day on which banks in Sydney or Melbourne are able to effect settlement through the Reserve Bank of Australia.

Most financial institutions BPAY are involved with have a co-branded BPAY Biller Operations Manual which says in part under a section named similar to “Your general obligations” that “you must” … “(treat Payments as being made on the Settlement Date) for the purposes of obligations owed to you by your Payers, treat Payments to you as being made on the Settlement Date;” and further defines _"Payer Direction means a direction from a Payer to their Payer Institution to effect a Payment to you as a biller through BPAY Payments, by debiting (for example, a payment) or crediting (for example, an Error Correction) an account or facility held by the Payer with that Payer Institution. Payer Institution means a financial institution participating in the BPAY Scheme with whom a Payer has an account facility from which payments can be made and who receives a Payer Direction from that Payer. Payment means a payment made, or to be made, by or on behalf of a Payer to you as a biller through BPAY Payments. Payment Cut-off Time means, with respect to a Payer and its Payer Institution, the time on a Banking Business Day set from time to time by that Payer Institution as the time by which that Payer Institution must receive a Payer Direction for it to be included in a Payment Instruction processed by it or sent to the CIP on that day." and “Settlement Date means the day a Payer gives a Payer Direction to its Payer Institution. However, if the Payer gives the Payer Direction after its applicable Payment Cut Off Time on a Banking Business Day, or on a non Banking Business Day, the Settlement Date is the next Banking Business Day.”

Seems fairly clear - if you pay on a normal banking day in normal banking hours then the biller will consider your payment date to be that same day. Not the next day. Not three days hence. That. Same. Day.

They often don’t - and BPAY seem unwilling or unable to hold them to account, even though it amounts to false advertising on the part of BPAY to say your payment will be handled in such a way, have agreements in place to ‘ensure’ this happens, yet fail to enforce them.

BPAY aren’t alone in their indifference to this - the big billers (once you find someone who knows they have an agreement in place), the ACCC and the Commonwealth Ombudsman (because some of the big billers are Federal Government Departments) all maintain similar indifference. The only possible hopeful is ASIC, but if you’ve ever tried to fill in an ASIC complaint form you’ll know it’s a non-trivial exercise.

I’ve not heard of anyone actually being levied late charges/etc as a result of mishandling of BPAY payments, but there are other potential flow on effects of being seen to pay bills late. Of course, you could just pay the bill a day or three early, but that’s hardly the point - why should the customer be responsible in accounting for the billers mishandling of the payment?

If you take this up with billers, you’ll get all sorts of excuses. Particularly the ones around processing delay/etc - and to be fair it does place an onus on the biller not to issue overdue notices until they have received BPAY notifications covering the settlement dates of relevant invoices, but that is part of their agreement and again not the customers responsibility.

I hope that helps someone. Check your invoices/statements and see when your billers claim you settled the last account - you might be surprised. If they missed the mark, help them out by letting them know they are processing BPAY incorrectly ![]()