If your travel agent goes bust and takes your money with it, can you still save your holiday? Read our advice:

Are travel agents and booking services and tour operators doing the industry a disservice.

The industry operates largely on good faith. The good faith that when you are due to take your travel all will be delivered as promised. The majority of the risk is with the consumer, irrespective of the sometimes complex chain of bookings.

Travel insurance only goes so far. The current circumstances relating to COVID-19 restrictions add to the risks that are uncovered. Non refundable payments and the uncertainty travel services providers will still be in business when you are due to travel leave consumers vulnerable.

Are consumers the most vulnerable in failures of the industry and it’s inability to provide effective and acceptable protections? Consumers can’t write their own contracts. It’s the service providers contract or no travel?

The industry has not been subject to regulation for some time.

Should Choice be calling for a regulated minimum standard of contract with fair consumer protections?

@BrendanMays @JodiBird

Previously, for better or for worse.

One off global events like these are rare (once in a lifetime if one is unlucky), unpredictable and unforeseen and potentially trying to cover unknown unknowns would be very difficult. Some existing contracts have force majeure causes to cover such events…those which are unforeseen and outside the control of the travel agents or travel service provider. I expect that those travel agents which survive the current pandemic, and don’t have force majeure clauses, will insert them in future contracts.

Force majeure is not new in the contracting world, but can be relied on to protect the company which issues the contract in times when things happen which are uncontrollable.

While it would be ‘nice’ to have any travel related contract include provisions which cover such events to provide what may be seen as more balanced response for such events, such clauses may not be needed until their is another global event…whether it is say a new Krakatoa, pandemic, world war etc. It may be another lifetime before such a disruptive event inpacts on the global movement of individuals. This may never happen again to the same extent, or may be in a future generations’.

Notwithstanding major global events, one thing which may need so looking into is providing cover when a business becomes insolvent and ceases trading. I personally think that the onous should not be placed on the consumer, but should be placed on the service provider. Maybe government should look at ensuring service providers have necessary insurance to protect consumers monies/interests/payments in the time where a business ceases trading. The costs of such insurance would be significant and would be passed onto every consumer through higher service fees, but it would cover all consumers. Leaving consumers to take out special insurance to cover insolvent businesses ceasing would only benefit those who take out the insurance. …and potentially only international travellers (and not domestic), where insurance is almost universally taken out by travellers.

Does ‘Force majeure’ entitle a company to keep your money for a service it has not delivered. I believe I understand how it works in the business to business world. It’s extension to a contract for consumer and service provider? Robbery perhaps might be a more apt interpretation. Adjudication or if legally resolved, keeping 100% of your payment in a contract is far from the commercial reality of ‘force majeure’ in a B2B deal.

Compensation is typically a fraction of the total contract amount.

If we are fair dinkum about once in 100 year events it would seem to be a remote risk and a low cost? Businesses insure for other risks. 1% on annual gross income, even less if not trading due to a closure. Not that large a cost?

Applying the principles of a commercial business contract to a consumer who is simply seeking travel must seem alien to many. Bad debts and trading losses are part and parcel of business. A business chooses who to contract with. Consumers have a choice, but apparently only ever on the terms of the seller.

Try writing your own contract and offering it to a Flight Centre or Trip A Deal or … NO DEAL!

As the Choice Charter says,

Does the use of ‘force majuere’ clauses in a consumer contract ensure consumers receive a ‘fair deal’?

Deferring a travel commitment (ie accepting a credit) is only fair if both parties mutually agree to it, with a reasonable prospect the new agreement can be honoured. Otherwise a refund less immediate costs and prospective profit (3-4%) might be consistent with commercial outcomes. I’d still question the mutually agreed credit, given there is no security for advance payments. In a commercial contract the major payments are made progressively on delivery, and not in advance.

As consumers are we our own worst enemies by agreeing to pay in full in advance? In particular against a possibly false promise of cheaper travel.

The idea of insurance for business is in relation to any business going insolvent at any time, taking consumers money with them. If this was applied across every sector, including travel industry, the insurance costs would be significant particularly for smaller businesses where risks of financial collapse is greater. Such cost would be passed on to every consumer. It could also encourage some businesses to take on or make riskier activities/decisions knowing their consumer/customers are protected.

Insuring for the next global event may be minor, insuring for any business collapse at any time is a significantly higher risk to the insurer. The insurance would also need to cover non-Australian business collapse where they received monies from Australian travel agents (such as Thomas Cook) for a booking). Those booking directly with foreign travel agents would be excluded as these agents wouldn’t be captured by Australian regulations.

I’m not suggesting any one solution. As you suggest there are many different scenarios. No business should be trading insolvent, and no business should be using advance payments made in full to fund today’s business and gambling on delivering your future booking.

Is there a genuine need to change how consumers contract for travel?

Assuming there is a wider community agreement, how better consumer protection can be provided is open for discussion.

The alternative view point is that despite recent history and the current impacts from COVID-19 on travel, all consumers have been treated fairly by the T&C’s attached to their travel bookings. No need to look any further?

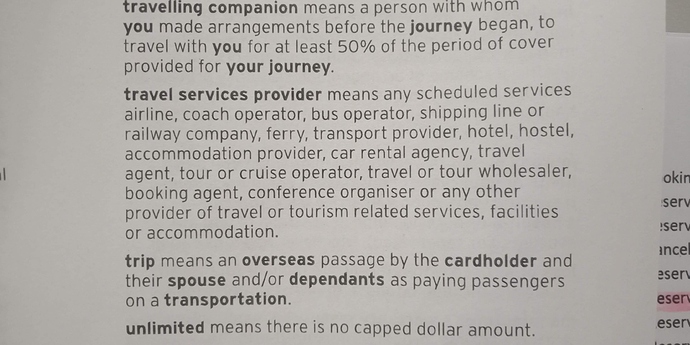

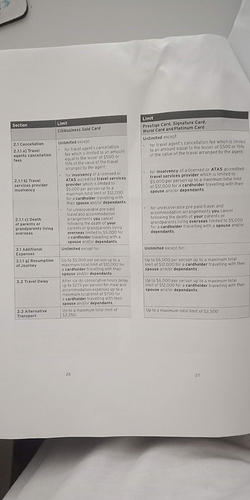

I checked my complimentary travel insurance policy and found - Under the table of benefits for my credit card travel insurance is-

2.1.1 (B) TRAVEL SERVICE PROVIDER INSOLVENCY

for insolvency of a licensed or ATAS or accredited travel service provider which is limited to $5000 per person up to a maximum total of $12000 for a card holder

travelling with their spouse and/ or dependents.

Welcome to the Community @RFW

Unless I am corrected that is not nor does it include the travel agent. My understanding is that in context a provider is (eg) a tour company, accommodation, or transportation company in the package a travel agent sells. @JodiBird, can you confirm or correct?

That policy may well help for some providers that collapsed, and well worth knowing about that clause or looking for similar. Would you share the card or account that complimentary policy is provided with?

Yes in insurance documents, their definition of insurance provider usually excludes travel agents. Though @RFW’s credit card T&Cs specifically refer to ATAS accredited providers, so that would include travel agents. @RFW could you let us know which card you have?

Allianz complimentary travel insurance via Citibank

Copy of their definition of travel service provider attached.

I checked my Westpac equivalent and found a lengthy list, the germane part being:

We do not insure you for any event that is caused by or arises from:

…

…

- the inability of the tour operator, wholesaler, transport provider, travel agent or any other service provider to complete arrangements or complete any part of a tour.

It is also an Allianz provided policy. Your policy is pure gold (no pun intended) in comparison! Yet all may not (or may) be what it seems when your policy also states it excludes (p36 if I am looking at the same document)

5. any interference with your travel plans by any government, government regulation or prohibition or intervention or official authority;

and p52

d] if caused by any service provider misappropriating your funds or failing to arrange or provide services for which you have paid;

If your provider ceased business because of ‘5’ or took your money and went into administration it seems a claim could arguably be refused.

An interesting topical issue for sure!