Hi,

I am going to travel to Finland & Norway. I can’t find any travel card that offer NOK currency.

Is anyone have this experience that can share with me pls?

Thanks

Mel

Travel cards are usually not the best strategy although they suit some travellers.

Why not open an account at ING (if one ‘plays their game’), Macquarie (no games!), or another bank that offers fee free international charges and money withdrawals from ATMs (although the foreign bank might charge a small fee)?

Some Choice articles are

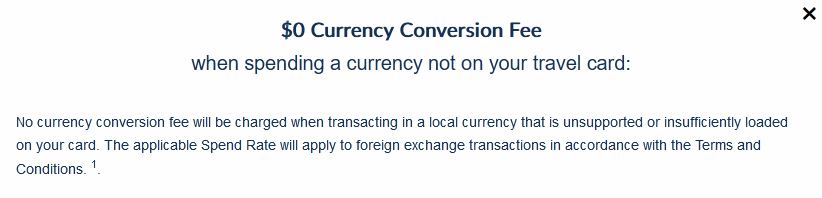

As for a travel card that might work for you if that is what you prefer, the Travelex card does not offer the NOK but does state

It is possible others have a similar’program’?

Also be careful because some prepaid foreign currency travel cards have monthly fees, poor exchange rates, and other fees such as non-use that can drain them quickly.

Hi, I did look into ING option. While I am away, I am not sure if I can purchase more than 5 times as the tour group including every meal…

I also find frustrated has to remember to use it and transfer $1000 each month.

I am going away at the end of Mar. The free transaction only apply after the first month to full fill 5 time transactions. I may be too late to qualify.

I also don’t know where can I get NOK cash before I go!

Thanks

Check Macquarie - no games and both the savings and transaction accounts earn decent interest.

Buying NOK cash with AUD cash is usually the most expensive way. When I go international my first stop out of the airplane is an ATM to get local currency using my fee free debit card although in some countries the airport ATMs give a worse xrate than one ‘down the street’. I have been to airports that do not have ATMs but have an ‘official’ currency exchanger that gave a decent xrate.

Since the NOK is not a major currency you might find it less stressful and just as or more economic to plan buying some in Norway?

It seems Macq bank credit card charge annual fee $99-69.

If you are unlikely to make more than a few purchases, I would suggest looking at using your bank issued debit card (Visa/ Mastercard). While the fees and charges may not be the lowest available, you may find that convenience will be high (saves the time and effort to try and find as well as opening a new account).

If you do use your bank issued debit card, make sure you tell your bank of your travels so that they don’t think overseas unauthorised transactions are occurring from your own use.

Avoid using cash if you can so you aren’t left with amounts of left over currency which isn’t exchangeable.

Thanks for your good idea. I might also look into it. Debit card is more convenience. It is more likely a easy option.

Officially,

The Ministry of Trade, Industry and Fisheries has given Innovation Norway the responsibility for the development and maintenance of the official travel guide to Norway.

The vision of visitnorway.com is to make it easy to choose Norway as a travel destination and to promote a more sustainable form of travel.

The website contains thousands of travel industry business listings from all over Norway provided by third parties such as local tourism offices and destination marketing organisations. Please note that the website contains links to commercial partners.

Norway appears to be well connected and serviced with ATM’s and for electronic payments. The advice on tipping is also worth making a note of.

That was my intent re recommending Macquarie…

I never trust tipping advice excepting by watching what locals do. Much of the media seems bent on making tipping universal. American tourists, especially, usually tip because they do at home and often do not realise workers in many countries are paid reasonable wages or an equivalent (service) charge is included on the bill, and workers income is not at the whim of the customer like it is in the US. Even in the US tipping is ‘not mandatory’ although near universal and growing to new and wondrous situations, and be prepared to be insulted if you don’t in restaurants where staff can be on $2.13/hr!.

In some cultures offering a tip is an insult and if one offers a tip they feel incumbent to offer something in return. In others it is just not done and embarrassing to them.

Back to tipping in Norway, another take

Thanks about the tips. choice community is so helpful.

I use Wise travel card. Easy to access, easy to load, lowest conversion rate, can add most currencies. You can also transmit money through it.

I have always used a regular bank ATM fee free card at the airport in Helsinki. Easy

Buying NOK outside Norway is basically impossible. I have and use the ING every day saver (I think it’s called) which I believe the first month after activation can be used as if you had complied with the conditions. That worked really well for me. I have a backup latitude 28 deg platinum global Mastercard credit card too, which is good also as long as you remember to pay in full the balance each month. We rarely take or use cash and I don’t think I touched any cash while in Norway last august.

First hand experience of recent travel is helpful.

Our preference has been to rely on changing currency on arrival, or being confident of accessing an ATM. The risk varies depending on the destination, the time of arrival, flight delays etc, where the options can be very limited, or none at all. Travellers to Norway appear to be well considered.

Perhaps not in everyone’s thoughts, for some cash for incidentals etc. Australia Post include NOK in their available currencies. Customers are able to order up to AU$5000 2-3 days in advance of collection.

Agreed! We rely on our Aussie Mastercard for most things but also take some cash in the local currency before leaving, if available, just in case. Euros are easy to get but for other currencies, you may have to go to the bank’s head office to get any.

If needing more cash once in the country, just go to a bank. You might take a hit on the rate but so what, you have the security of a bank and that’s worth a lot when away from home. Africa in another story. You often get a way better rate from back-street money changers than from banks but go there only in the company of a trusted local.

As are some Latin American and Asian countries. A notable exception to using ATMs and cards is in some countries with unstable currencies the best xrates can sometimes be had with cash at travel agencies that are happy to buy certain foreign currencies (esp USD and EUROs) to onsell to their travelling clients.

Doing one’s homework pre-travel as @mwycho has been can be invaluable.

You haven’t specified if you are trying to get physical currency (probably not needed) or just a debit/credit card to use in Finland/Norway.

In general, travel cards (where you convert currency in advance) are a rip off and you’d be better off just paying the ~3% fee from your normal card at the time of the purchase.

Even better if you bank with someone who doesn’t charge currency conversion or international transaction fees. For example, the coles rewards mastercard, HSBC global account (also 2% cash back for contactless transactions in AU), Citibank plus (may not still be available to open new accounts). Be careful of cards that claim to have no fees but use a conversion rate that includes a fee of 3-5%.

For Visa and Mastercards so long as the card is documented to use the Visa/MC exchange rates (as is the norm) there is no difference in xrates between cards issued with or without bank fees.

It will be revealed in the card PDS.

There are some strange idiosyncrasies to do with official exchange rates in some countries. Local knowledge is aways helpful. In Ghana, I was using US dollars to pay for hotel accommodation, then I discovered I could stay there for nearly half the price if I converted the UD dollars to the local currency and paid with that. Go figure.