Has anyone determined whether having Time of use or Demand is the more cost effective way to get electricity in the home? Last year they talked me into using Demand on the grounds that my usage was generally low and so I wouldn’t have a high Demand peak 30 minute period within the month that would raise my electricity charges.

However, St Patrick’s day was hot this year so I had the oven on cooking lunch for guests along with the aircon for that one day so my bill cost was well up for the month.

Talking to my provider yesterday it seems that Demand is more to do with living in a city where there’s high demand overall. However the agent said he lives in Melbourne and they don’t have Demand as an option. How does that work?

I’ve tried looking thru that government energymadeeasy.gov.au site where they allow comparison of every feature (billing, disconnection etc) except actual charges so is pretty useless.

It’s all very confusing seems to be deliberately obtuse.

Demand charges are generally applied to commercial customers, whereby the peak 30 min (typical, maybe varies between providers?) sets the monthly charge. It can be rather large! In exchange (not necessarily a fair one IMHO), a lower price per kWh is offered. There is a push to have it applied more widely to households.

A battery, with or without PV can be used to keep the peaks low, and therefore the demand charge, and it need not be a large one if it is to cover short-lived peaks in demand. PV panels with no battery can also reduce the peaks, but only if any actual peak usage rate occurs when there is sufficient output from the system to minimise the peaks. Obviously PV panels wont help if the peak is at night or during overcast weather.

Whether or not it is worthwhile for a particular household would require analysis of their usage patterns, so logging of the usage is needed for a decent analysis.

Lots of If’s and but’s.

Our Brisbane residential urban property is on a demand tariff. We have 12 months of experience. One needs to know and understand your electricity reliably for every half hour interval over a long period of time to be able to decide with any certainty. I found the ‘Energy Made Easy’ website is not able to compare a Demand based plan. It is something one needs to do by pencil and paper or better a spreadsheet if you have the ability.

My suggestions for anyone considering a demand tariff based plan.

- Be sure that the supply tariff quoted when added to all other daily connection, metering and any solar feed in is significantly less than the cheapest fixed tariff or ToU plan you would be happy to be on.

- Be confident of the day and highest peak 30 minute demand recorded within the peak times each month for the past 12 months or longer.

- Note that the reading for the one day with the highest recorded peak demand will be doubled (QLD). Assume the same elsewhere before the higher peak tariff is applied. The peak consumption is assumed to be the same as that one highest day for every other day in the month. Hence the cost of the highest monthly peak day is multiplied by the number of days in the month. Ouch!!

- Know the maximum power the loads in your house can use and may increase your peak demand. Note it only needs one to turn all the aircons on full at 5pm in a hot locked up house to send the peak demand skyrocketing. The retailer assumes that is what one did every day for the month. There is no saving in the demand charge for not using them for the rest of the month.

- Invest in a remote live power reading solution for your meter box. Being able to see how much power your home is using in real time is the best way to learn about usage and to identify when you are about to set a higher peak than you can afford.

Why does it work for us?

I’m not sure that it is any worse or better at present. The best offers keep changing every few months, are not fixed and the rates do go up. It’s a moving target.

- We have a capable solar PV with east and west facing panels maximising afternoon generation.

- The property has a good aspect and an insulated roof space. This minimises energy use for heating/cooling. We ensure any cooling or heating when needed is on well before the afternoon peak period commences and the rooms comfortable enough to turn the AC down.

- The hotwater, stove top and oven are all on gas. We cook substantially without using electricity.

Last summer the peak demand charges for each of the 3 months added $3.18, $4.02, $1.80. All consumption was charged a tariff of 19c/kWh and solar feed in credited 10c/kWh. For winter just finished the monthly peak demand cost was less than $4.00 for each month.

@gordon has already commented if one has a solar PV and battery even a small battery may be sufficient to take advantage of cheaper power available through a demand tariff based plan. Although when I approached several different retailers in SE QLD (Energex network) I found a lack of good information, and poor knowledge across their sales teams. A further consideration has been despite having a smart meter at our other home not in the city, Energex appear to have blocked the retailer from making a Demand tariff available. Most unexpected given policies to move customers progressively onto tariffs based on charging customers higher rates when using electricity during peak times.

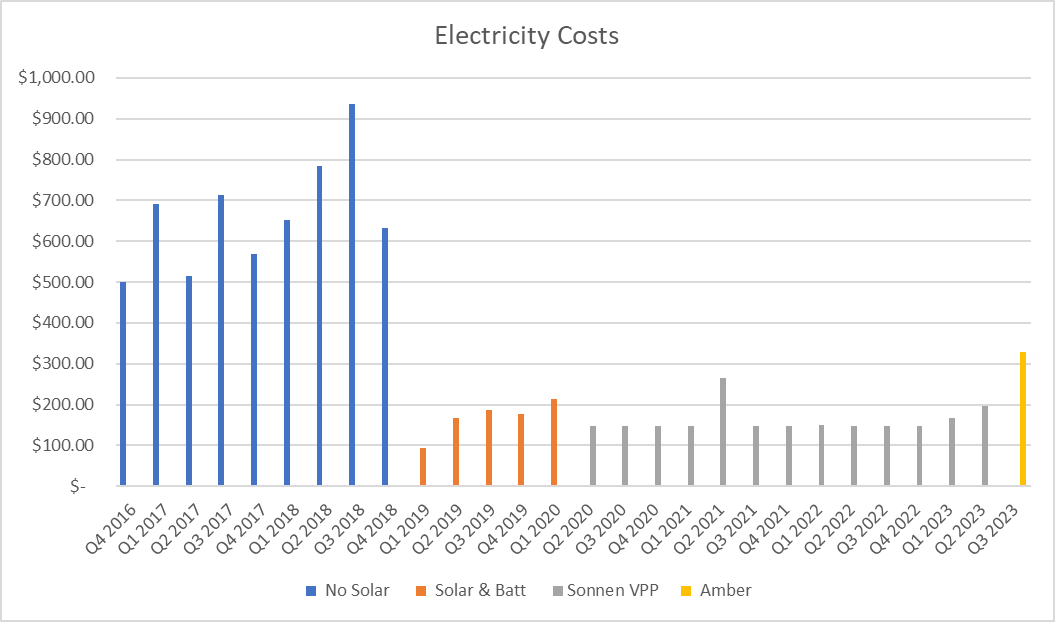

I had PV and battery installed back in 2018. $20k investment.

Long story short, after installing the system I was on a regular plan for about 12 months then moved to a VPP and now I’m exposed to wholesale market via amber electric.

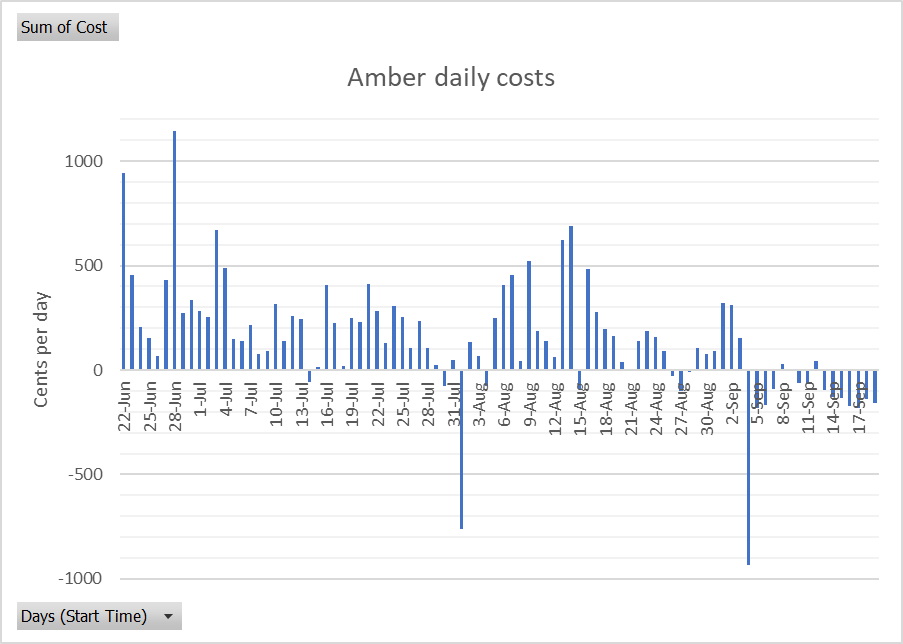

Each step has reduced the costs to the point where now they are paying me each day. Last 20 days I’ve average -$0.78 per day (that’s profit) for a normal household with 4 people (still have gas cooktop and hot water though). But at least my electricity is free.

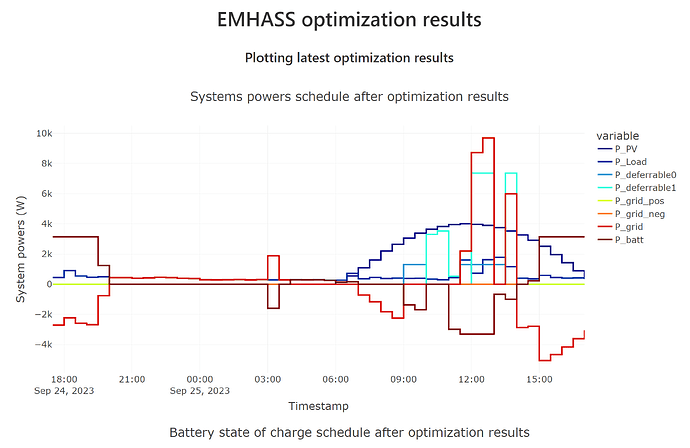

Took a bit of technical work. I implemented a thing called EMHASS to manage the energy arbitration within amber’s wholesame market. but if I keep it up I’ll have paid the $20k back very quickly.

I’ve gone from a $3000 bill for 2018 to $600 in 2022 and with this EMHASS system finely tuned now I hope to be making a small profit at least in the warmer months. And that also inclluding moving from gas heating to reverse cycle aircon and I’m now charging my EV at home every day in the last 20 days. I’ve had an EV for 4 years but used to charge it at shopping centres all the time.

These are the daily costs and now profits from electricity using amber and EMHASS. A bit of a jump in costs to start with until I managed to find the EMHASS system and finally get it working properly.

Welcome to the community @RRC

Informative for many. The opportunities and tariff options (plans) differ across the NEM. That can lead to confusion for those following these posts. Any chance of sharing which state and distributor/region your home is serviced by?

The posted graphics provide insight for those who keep a close eye on their own consumption and bills. Is this the EMHASS system you referred to?

Are you able to suggest to others interested a suitable link to Amber and what it delivers?

I’m in NSW on Ausgrid with Ausgrid’s two-way trial tariff.

The charts are just Excel presentation of historical data.

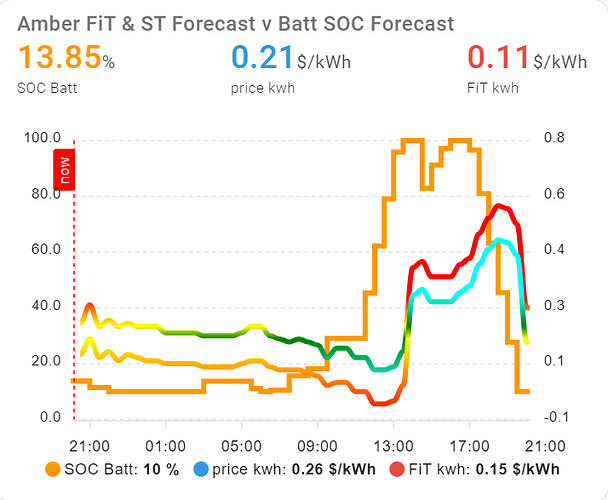

EMHASS itself does present graphical data. For example this is the next 24 hour plan calculated by EMHASS. I’ve got it recalculating this plan every 60 seconds at the moment using Model Predictive Control method:

EMHASS is an add-on to Home Assistant which is an open source home automation system. It does all sorts of things in my home like manage the seucrity cameras, door locks, automatic gates, switch lights on and many other things.

The way EMHASS works is it takes a feed of data every x seconds via Home Assistant. This data is

- The current and next 24 hour forecast of the solar energy my PV system will produce (I get this from solcast.com)

- The current and next 24 hour forecast of the Feed-in and supply tariffs provided by amber electric through another add-on in Home Assistant. These tariffs follow the NEM but are not the same thing

- The household energy consumption from the past two days as collected by Home Assistant

- and some details about deferrable loads that you want the system to manage.

I currently manage two deferrable loads with it, the pool pump at 1300 static Watts and charging the car at a variable load up to 7360 Watts.

The system then provides instructions back to Home Assistnat on when to charge and discharge the home battery and at what rate (which is a sonnen 10 kWh, 9 usable), when to charge the car and at what rate and when to turn the pool pump on. If I had an electric hot water system I’d be manage that in the same way (but it’s still gas) and any other loads you can defer.

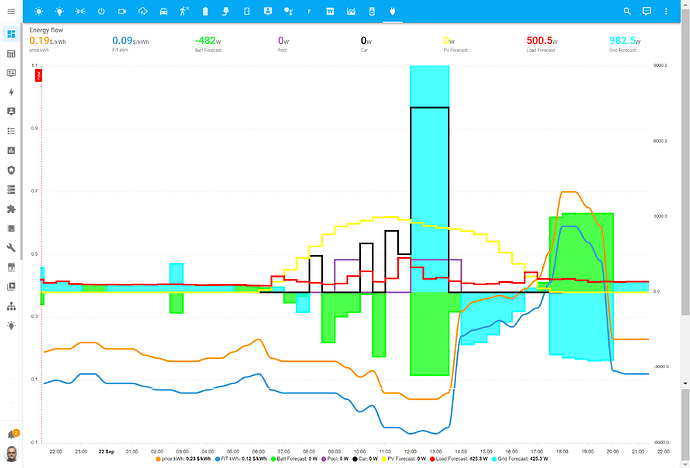

The result is something like this:

This is a typical graph from Home Assistant showing a 24 hour plan. You can see the two tariffs drifting up and down in parallel and the planned charging and loading to take place throught the day. This has been leading to a negative cost for electricity most of the time and when there is a spike the system takes advantage of it.

My battery is only capable of 3300 Watts output so I don’t make as much money as some people with larger batteries like a Tesla battery which is capable of something like 5kW.

I use node-red to manage the output from EMHASS. This is the node-red flow:

It triggers the EMHASS calculation every x seconds, controls the battery state and and interfaces with deferrable loads.

documented here

Noted the electricity supply contracts offered by the retailer Amber Electric rely on rates for supply and export that change dynamically. It’s an alternative to a standard Time of Use contract.

Choice offered the following, brief as it is.

Solar Quotes appraisal I linked previously offers a more comprehensive review.

Yes, the rates change every 30 minutes. Amber makes this wholesale market available to regular customers. However, its up to the customers to implement an arbitrage system to make the most of it or you can use the amber smartshift system to automatically manage your battery (if they support the brand of battery you have). This smartshift system doesn’t support sonnen hence my use of EMHASS. However, EMHASS squeezes quite a bit more out of the market by also managing deferrable loads of your choice and a more exacting calculation using this MPC method.

Useful information to hear there is a one stop option. It’s likely some of the aspects of the solution you have in place could be technically challenging for consumers.

Recognise that is the language Amber use in their self promotion. Of course Amber Electric is a retailer. What they are doing differently is adjusting their retail rates every 30 minutes in response to the changes in the wholesale pricing of electricity. In theory it’s close to a real time “Cost reflective tariff”.

I’ve not found a detailed explanation of how they cost the network charges, metering charges etc. As a retailer an assumption is Amber Electric is still bound to pay the local Network Distributor their share? Typically 40-50% of any residential bill costs.

Amber customers appear to be carrying the uncertainty of future changes in the wholesale pricing as their risk. For customers on a market offer or other retailers ToU plans the tariffs are set considering forecasts and regulated pricing. It varies by plan and retailer - the risk is largely carried by the retailer. Customers tariffs hence costs are more predictable.

Interesting choices knowing there are a number of tools one can use with a battery to change when one purchases electricity, even on the more mundane ToU tariff plans. Of course none of us know for certain the future.

Yes too complex for most and amber can’t offer a detailed service like this because most home networks are not datacentre quality (not that mine is). Also, smart switches are required (electrician) and access to Tesla car for charging control involves personal authentication. However, I’ve documented my config for those that have similar equipment and already HA users. See here

But they do offer the smartshift service which is probably 80% of what I’ve done (wild guess because I’ve never used smartshift). But do check that they support your battery before you move over.

Yes, its not NEM, its a price that follows the NEM and adds in the operating costs of supply and a $15 per month charge for amber. But it works.

They have a gaurantee price. For me this is currently 46.47 c/kWh and about to drop to 38.71 c/kWh in October (varies with the seasons typically cheaper in spring, and more expensive in winter). This price is basically the cap on the maximum average usage rate over a quarter year. This is approximately 12% above the Government reference price.

So amber customers are protected from negative events like the disasters seen in Texas in 2021 and at the same time able to take advantage of positive events which seem to happen about twice a month in the form of spikes in FiT (e.g. $17/kWh for a couple of hours in the evening).

You’ll see me running around the house turing electrical appliances off in these spikes and rubbing my hands together but also wishing I had two or three tesla batteries to take advantage. Some people make considerable profits at these times that cover their electricity costs for months. I might make $10 or $20 on the day as I can only feed in 3300W for about two and ahalf hours.

A natural choice for a HA user with a battery controlable through http requests.

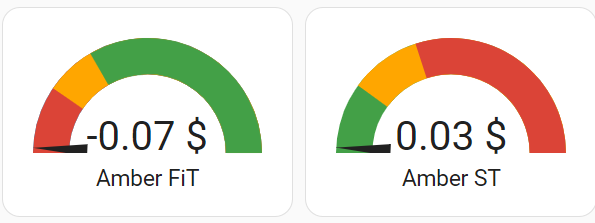

Oh, I do like this though:

I charge the car every day at this time of year at 3 c/kWh. That means it costs me around $2.25 to totally fill my car (to use old parlance). That’s 600km city driving for $2.25.

Of cause I earn that back by selling the energy in the home battery at 50c/kWh (or whatever) in the evenings so its not really costing me anyting to charge my car.

In summer I’ll probably get paid to run my car when the supply tariff goes negative. But I have to be carefull not to incure costs by exporting energy when the grid is negative. Need to investigate export curtailment if it gets too much. That’s where I shutdown my solar cells via the inverter when it costs money to export energy to the grid.

I think that’s easy to do with the Fronius inverter using MODBUS TCP. Just haven’t gotten around to it.

My car is a Tesla model Y performance with a 75kWh battery (my second Tesla, I sold the model 3 I bought in 2019). So 3c * 75 = $2.25 to charge 100%.

I just couldn’t entertain owning an ICE car these days.

The minute you can, get out and get yourself an EV. You’ll never look back.

Eyes wide open, do Amber Electric’s variable rate offers better suit some customers depending on home set up and use?

The flip side - recognising Amber hedged its maximum cost per unit of electricity. At a margin above the standing offer for each distribution area!

Noted Amber Electric retail supply in New South Wales, Victoria, south-east Queensland, South Australia and the ACT. Customers include a mix without solar PV or battery, with solar PV, and with a home battery. There are variable cost of electricity options for all.

Surely the government could do something about the various formats of electricity bills. They need to be all in the same format so that we can compare them.

@gordon It depends very much on where you are as to what you’re offered. Here in Southeast Queensland there doesn’t appear to be anyone offering ToU tariffs. The moment they shop around for a competitive price anyone with a smart meter is pretty much pushed onto demand tariffs, and we’re likely to see more of that as more smart meters get rolled out. If you phone an energy retailer or try to get an online quote the first thing that happens is that you have to quote your NMI - or your address which is linked to the NMI. That then determines what tariff options get presented to you.

@mark_m I too am anti the demand tariffs, my major gripe being that the average person doesn’t understand them whereas ToU is much easier to comprehend. For better or worse, the argument that’s used to support them is that even if you have a high demand for only a single day in the entire month they still have to build enough capacity to cope with it, even if you don’t use much on the other 29 days.

Amber is like the stock market. you can do really well, or you can lose out badly. The only different is that you get a 24-hour crystal ball to help make decisions.

It’s not the really high prices that kill but an inability to take advantage of them.

Everybody on amber is looking forward to the really high prices as they are a two-edged sward.

This is because high supply tariffs are accompanied by high feed-in tariffs. So, it you are prepared with your fully charged battery, you can sell electricity at very high prices when everybody else is having to buy.

That what you do every night at 7pm. Charge your battery for free with the sun or if no sun then with cheap midday supply tariff and then sell at 7pm when everybody is making dinner at high feed-in tariff.

-Tomorrows plan-

Here the system is planning to charge the battery between 9am and 2pm tomorrow. It will be a cloudy day in Sydney according to solcast (my solar forecaster) so I’ll be using more grid than solar as can be seen from the midday price of about 10 cents (haven’t included solar prediction in the chart). If it will be sunny the price will be more like 2 cents.

So, the price between 9 and 2 is predicted to be between 6 and 15 c/kWh to buy. Then at 2pm the price will suddenly change to 41 c/kWh to buy and 32c to sell or feed-in.

So, I’ll sell at 32c and make a small profit.

What we sometimes get is a much bigger jump to 20 $/kWh which is a windfall.

But if you can just make a few $ each day with the small regular changes then you come out at the end of the year with a few hundred in profit.

But you’re depending on all your equipment working every day without fail.

This is why people can make money even without solar cells. All they need is lots of battery capacity and a good arbitration system.

An alternate preference given the high upfront capital outlay is to assess the battery benefits/costs on self consumption only.

- avoiding the higher tariff costs at peak times in the evening to run the home,

- using solar or cheap off-peak power to supplement running the home and charging the battery when the rooftop solar cannot meet needs.

- assuming a notional benefit of greater reliability or independence from the grid.

Any opportunity to export a surplus may be a bonus? There is no assurance whether longer term the windfall opportunities and peak feed-in rates will be fewer and less or increase.

Progressively all smart meter connections are supposed to have moved to cost reflective “distributor” tariffs. Retailers depending on where one lives in Australia are continuing to offer flat tariffs to smart meter residential customers. Hence with a battery system one needs to do the homework and compare the estimated total annual bill for the best flat rate offers as well as any ToU or Demand options. The VPP or variable rate plans such as those offered by Amber Electric are the most difficult to assess.

Whether a flat tariff is the best for all customers, it’s set using an average? Hence a large percentage of customers on a flat rate are likely paying more for their electricity than a reasonable return to the industry requires, and a similar number less. IE one group of customers is subsidising the other.

An observation is prominent socially focussed groups regularly make submissions to the AER against cost reflective tariffs. It’s assumed those tariffs have the potential to disadvantage many of lesser means. One challenge is advantage may fall to those with greater capacity to invest in solar/batteries and who have been the larger consumers of electric power. If a large number of these customers substantially reduce their purchased electricity the cost burdens of the grid and new generation all fall to those who cannot offset their costs, renters being one large group.

O/T

How one accounts for the benefits of a system on a purely financial basis is an interesting aside. It may be better to say these are earnings. EBIT?

If we keep it very simple and ignore the installation and purchases costs of the system, depreciation and time cost of money. The usable life cycle cost of the battery is typically equated to an operating cost. If one has charged the battery from the network at an average of 10c/kWh and returned it to the system in the evening for a feed-in tariff at a generous 32c/kWh one earns 22c/kWh before allowing for any other costs.

SolarQuotes provides an estimate of the lifetime cost of energy for many different battery brands and models. These range from 19c/kWh assuming the battery is fully discharged on a daily basis to more than 50c/kWh. With the supposed cheapest to own batteries to be more realistic one needs to discount the 22c/kWh earned by 19c or more for the battery life cost plus a small amount for the losses in battery and power conversion inefficiency. If you only use part of the capacity of a battery each day the life cycle cost of the battery in c/kWh could be 2-3 times higher than the SolarQuotes guidance.

Yes, there are windfall earnings from time to time.

Eyes wide open, the stock market provides one analogy. Lotto entries another, although you only need to outlay as you go.

Hi Porcheen,

I’m amazed you were asked if you wanted to opt in! My retailer (which will very soon be my ‘ex’ retailer) just whacked me on it after they installed a star meter. No emails, no updates, zero, zilch comms. I discovered it after seeing trying to make sense of my last power bill with it’s blitz of different charging over 92 days. The bill was much higher and the excess pretty much reflected the inflated unannounced charge. I’ve been trying to get the tariff changed but my retailer has been incredibly tardy over it. I’ve discovered anther retailer who has in writing promised they wouldn’t pull the same stunt. I’m moving to them hols bolus tomorrow. Pretty cranky about it all. If you don’t want demand pricing be very careful if they con you into a smart meter. Thank you. (ps it was Energy Australia).

Welcome to the community @Joey77

What we should expect.

For customers in SA, NSW, QLD, Tas, ACT notice must be given by the retailer to the customer a minimum of 5 days before any change in tariffs or charges.

‘https://www.aemc.gov.au/sites/default/files/2018-09/Amending%20rule_0.pdf

How it is for Vic, WA, and NT?

In respect of being “whacked on it”, what were the changes. Was it a ToU (time of use) based tariff plan or Demand tariff or something else? It may assist others to relate if you could share which State or Territory and the Distributor for your location.

Hi Mod,

And thanks for the welcome.

Looking back over the agreements for the past year, I realise now that I didn’t scrutinise the detail closely enough.

Earlier in the year I switched to another plan with the same retailer in the chase for a better discount (especially with prices about to ratchet upwards). The catch, I can see now, is that the new deal was TOU plus demand. Groan.

For years I have had flat pricing which works for my household. Then the smart meter came (they pestered me about updating, and I finally relented). Well, pretty much after that I changed deals - and hey presto a new terribly long invoice with TOU and demand costs on top. I should have paid closer attention.

Having said that I can’t find any separate comms saying that demand pricing would be introduced to my tariff. A separate note would have raised my interest in contrast to a line slipped into the updated agreement - easy to miss for harried folk. I’m in the inner city of Sydney and the distributor is Ausgrid (and as mentioned the retailer is - soon to be ‘was’ - Energy Australia). Cheers j