Not that minimum payment worries me at all since I pay the full amount each month, and therefore pay no interest, but a more realistic minimum could be imposed.

Let’s say that the minimum is an amount that would pay off the outstanding within 12 months. So if the balance was $3000, the minimum to pay would be $250.

If that amount was paid, reducing the balance but then add in say $40 interest, and say new purchases of $500, then the next month the minimum would be $274.

If the balance keeps going up, so too does the minimum to pay each month.

If the minimum is not paid, then the card is suspended so no new purchases can increase the balance beyond what it will increase due to another month’s interest and non payment charge.

Might teach people some financial disipline and the real ramifications of using very expensive credit. I know some will think that idea sounds harsh.

And what the banks are offering with terms over 54 years and 3 months or the still incredibly excessive interest rates are not?

The current business practices reflect the values of those making the decisions at the banks, financial regulator, and somewhere else. They are well enough paid not to need to worry, although perhaps not all that well enough educated to understand the consequences beyond the profit lines.

Some will think that judgement is harsh.

When I bought my first home, interest rates were 16.25% for a mortgage and CC interest about the same.

When I bought my second home, the rates were 12.5%.

What are mortgage rates now? Around 3%.

And where are CC rates? way over 10%. If people cannot realize that they are being ripped off by CC interest when they can’t or won’t pay off their debt in full, then they need to be forced to realize it. Every month when the CC statement arrives.

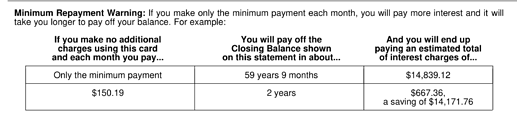

When I went to pay my CBA MasterCard balance on Monday, it displayed 3 options.

- Pay full amount…

- $70.00.

- Other.

Why is there not a fourth option listed, namely the amount shown to pay off the balance in 2 years instead of half a century?

Oh, that’s right. They would prefer to keep customers trapped in debt with 20%+ interest rates.

![]()