Terms and agreements, contracts and product disclosure statements they are everywhere numerous pages of legalese that even if most of us had time to read we would not understand.

For me it is a worry i am constantly signing or agreeing to things that no one could expect a normal person to understand is there something choice could do about this.

Reply Star for later · 6 0

I agree! At CHOICE, we’ve found that consumers are increasingly being confronted with overly long and complex contracts, often during time-limited checkout processes (like for booking airfares), which we believe is unfair.

We’re calling for policy reform to fix this. For instance, we just made a submission to a review of the Australian Consumer Law, recommending that standard form contracts as a whole should be able to be deemed legally unfair - currently only individual terms can be ‘unfair’ under the law, which doesn’t fix the problems with long or complex contracts.

We think that consumers should be able to seek redress for any harm suffered as a consequence of being bound by an unfair contract.

You can read our full submission by clicking the link in this article - https://www.choice.com.au/shopping/consumer-rights-and-advice/your-rights/articles/consumer-law-review-2016

Thanks!

Sarah Agar

Policy & Campaigns Adviser

There was a great Dilbert cartoon about software EULAs.

This recent study raises similar concerns to previous research from CHOICE, which found around 80% of consumers do not understand lengthy contracts like those found with insurance products or mobile phone plans.

Leave a comment below with your thoughts on lengthy contract documents, or read these tips to avoid unfair contract terms.

Another update from CHOICE on lengthy T&Cs, plus how long does it take to read all of Amazon Kindle’s terms and conditions? We hired someone to find out:

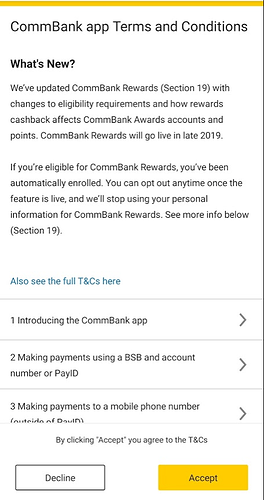

My phone updated the CBA banking app the other day … apparently … When I needed to check something in a hurry I was presented with the new T&C’s page:

Interestingly I’ve been automatically enrolled and cannot opt-out until it goes live - the concerning bits in section 19D - yes I was reading this while pushed for time …

d. You acknowledge and accept that we will use your personal information and will securely disclose your personal information to Mastercard on an anonymous basis, only for the purpose of providing CommBank Rewards to you in accordance with our Privacy Policy. Details of the overseas locations in which we process personal information are contained in our Privacy Policy as well as information in relation to how we collect, use, hold and disclose your personal information. Retailers will not receive any of your information and will not contact you directly. From time to time, we may send you notifications about the CommBank Rewards including Reward Offers and Cashbacks, subject to terms outlined in section 11. You can opt-out of program notifications via CommBank Rewards settings in the CommBank app. If you would prefer us to stop using your personal information for the purpose of providing you with CommBank Rewards, you can do so via CommBank Rewards settings in the CommBank app. This will un-enrol you from CommBank Rewards and we will no longer use or disclose your personal information for this purpose.

Later I went back and pasted the T&C’s into Word, just for fun - roughly 26 pages in 12 point Arial, for a total of 11492 words - not so bad to read on a laptop, if you have time, but imagine being at the checkout of a supermarket … not so convenient.

Out of interest how does everyone’s bank communicate changes in interest rates, if at all?

I checked my savings account today and noticed the interest paid was lower in line with interest rate cuts. I wound up moving it to a term deposit since it appears rates will be low for some time.

The process would have been easier if I’d been told the change though. Should this be a requirement?

My banks send me letters, emails and advise me when I log onto their online banking portals. I normally get 3 advices each time there is a change with one of them.

For savings, our bank notifies of when a fixed term deposit will expire…but doesn’t provide changes in interest rates which occur from time to time. I do see them advertised in national broadsheet newspapers though.

ING and Rabo both send emails, usually the day before the change takes effect.

Some online variable rate accounts pay better interest than their term deposits. The remaining downside for interest rate reductions is limited, but yes there is a real risk of another 0.25% drop since the government seems to have abrogated its role in managing a robust economy in the name of balanced budgets and toe cutting. OTOH if the TD rate is already 0.25% less than the online variable rate it seems a decent punt to go online variable with a good account.