As I understand it the purpose of the much publicised tax rebates is to stimulate the Australian economy. So how do I spend $1000 to have the maximum effect?

If I buy/upgrade goods for my house aren’t the majority of these made overseas? The same with clothes?

I could buy more food and support Australian farmers perhaps but I already have enough food and I understand a surprising amount already ends up in landfill.

Suggestions and an economics lesson please.

Just a quick response came to mind: buy Au food and donate to Foodbank ( or similar).

Would serve double purpose to help Au growers/ retailers, and help feed those who do not have enough for themselves.

Buy a bottle of aged Grange Hermitage, drink it and enjoy. Whenever you are feeling public spirited repeat the dose.

Don’t forget that it isn’t a lump sum but about $20 per week in the pay packet.

The effect will be both psychological and financial. Having a little more cash each week can take pressure off orher finances, and possibly making the money flow into the broader economy when spent (the financial effect).

Unlike the cash splash after the GFC which was a lump sum payment, it is unlikely that most consumers will use the extra $20 per week to buy expensive one off purchases. I expect the extra $20 per week will be used to cover existing expenses or to increase consumption of others (say going out for a meal, cup of coffee at the cafe etc). Some will save, most will possibly spend.

An excellent suggestion and if the entire nation does it we get stimulate the public and private health sectors as well.

It would seem logical that even buying goods has some positive impact. Possibly due to all the added costs along the way added to the value landed on the docks. Whether that feeds back into jobs and taxes, or simply makes Gerry Hervey wealthier is open to debate. The increased turnover may be easily accommodated within current staffing and store models diluting the potential benefits.

Perhaps the better bang for buck is spending on more service derived outcomes.

Eg why mow the lawn when you can pay a local contractor to do the job? Does the house need repainting, or that bedroom a fresh coat of paint? Having the plumber coming and fix the leaking down pipe.

There is also the option to take a local holiday which feeds into many different areas, and as @Gaby suggested the option of donating to charity directly or in some way. Of course the tax deduction accrued will reduce government revenue even further, so the benefit to government may not be so certain?

Alternately you could pay down the mortgage a little. Assuming there is discipline to not redraw it will hurt the banks reducing the interest they collect on the loan, lower profit expectations, and punish their shareholders through lower dividends. Less tax for government too, although the percentage is hardly relevant given how business and investments are taxed.

For many perhaps the reality comes down to more basic needs of whether the few dollars extra enables a better meal on the table.

At best the tax cuts while welcomed by many, to the economy appear no more than a bandaid on a festering sore.

The Governor of the Reserve Bank has had his say on the economy. The real solution lies elsewhere, with the Government, the need for significant and practical infrastructure spending, as well as steps to lift productivity.

P.S.

It does little for retirees paying no tax!

That’s the case for the future but I understood the cut was also to apply to the 2018/2019 tax year just ended and so a lump sum will be paid as people submit their tax returns. Have I got that wrong?

While off ropic…Yes, very true. And they must be feeling the impact of low interest rates…especially those who are self funded.

My understanding is it will appear in the next pay cycle for employees (this week or next). This is why the government/parliament wanted to legislate the cuts asap, so ‘benefits’ could be realised as early possible.

I don’t think they apply for the previous financial year, but will check.

OK lots of booze isn’t a good idea but your $1000 isn’t going to buy many bottles, possibly only four or even one depending on age. But there is an element of truth in the idea in that it is an Australian product that comes from an industry that is still fairly labour intensive and so the money goes back around the cycle through wages.

Look like they do…

In relation to. lump sum, it would only be the maximum amount if one usually gets a refund ($0+ refund). If one has a tax liability, the tax liability will be reduced by $1000 resulting in a refund less than $1000 or a reduced liability.

A big part of my donations goes to Christian overseas missions which are not tax deductible.

There’s always the option

of not claiming donations on our tax return, and therefore not being of any burden on other taxpayers.

You are correct. The value of your tax return will go up by the amount they calculate on your earnings…this is not necessarily $1,000. Not everyone will get the benefit as it will depend on if you pay tax and the amount of income you earn.

The Low and Middle Income Tax Offset (LMTO) is a new non refundable tax offset of up to $530 annually to Australian resident low and middle-income taxpayers. It will be available for the 2018-19, 2019-20, 2020-21 and 2021-22 income years (4 years of LMTO>>>my edit) and will be received as a lump sum on assessment after an individual lodges their tax return.

The LMITO provides a maximum of $530 to those earning between $48,000 and $90,000 and big earners (those earning above $126,000) get no benefit at all.

(From the ATO site)

Australian resident individuals (and certain trustees) whose income does not exceed $125,333 are entitled to the new low and middle income tax offset. Entitlement to the new offset is in addition to the existing low income tax offset, and is available on assessment after you lodge your income tax return.

If your income:

* does not exceed $37,000 you are entitled to $200

* exceeds $37,000 but does not exceed $48,000, you are entitled to $200 plus 3% of the amount of the income that exceeds $37,000

* exceeds $48,000 but not $90,000, you are entitled to $530

* exceeds $90,000 you are entitled to $530 less 1.5% of the amount of the income that exceeds $90,000.

After 2022 there will be no more LMTO and a new Low Income Tax Offset will replace it worth up to a maximum of $645 compared to the current max of $445.

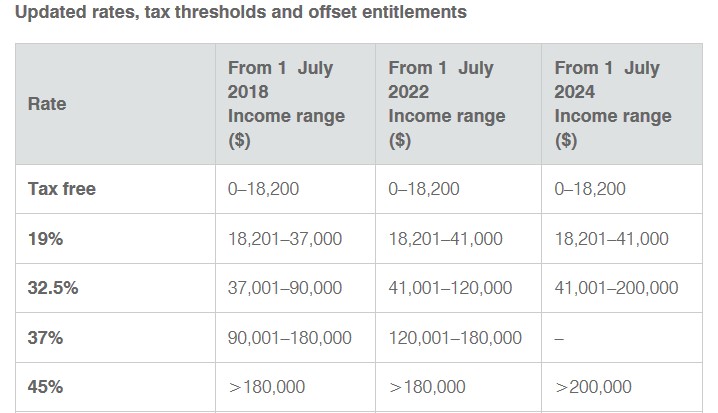

Later stages of the plan will see the ceiling on the 32.5 percent tax rate raised from $90,000 to $120,000, and then the 37 percent tax rate abolished entirely.

Again from the ATO site is the changes in the PAYG tax rates that I think @phb refers to when they posted “My understanding is it will appear in the next pay cycle for employees (this week or next)”

Because it’s tax relief, the people on Government assistance whether it’s a form of pension, the dole, or New Start, have been totally left out. In fact the Labor Party voted agains an increase in New Start!

Tax cuts to the top end of town were tried, and failed economically in parts of the US,in the Virgin Islands, and other parts of the world. There was NO trickle down. The rich elite got richer and more elite. Everyone else, from the middle class down, paid the price because there was insufficient Government money to pay for Health, Education, Infrastructure, or anything else Governments are responsible for. It resulted in a downward movement of a significant section of the middle class into the lower class.

So what happened with Government spending? There were three outcomes:

A) With no change, health, education etc fall into disarray, or

B) they were privatised and then the growing lower middle and lower classes have to pay more just to get basic services they should be entitled to. And the upper class get richer, and richer. The rest get poorer, and poorer. Or

C) The Government re-introduce higher taxation to eventually reverse the decline. (This was what they did in I think two Republican states of the US.)

So it’s great that you want to help stimulate the economy @andrew.p, but overseas experience shows that you will need the money you save from the tax cuts in the not too distant future. If you wish to be a philanthropist, donate this money to charities who help feed and house the poorest in our society (becasuse the Government doesn’t).

Yes a loss of at least $158 BILLION from the Tax receipts of the Govt means they have to cut $158 Billion at least from services they provide. Whether this entails Health, Education, Welfare or any other number of services is the great unknown until they introduce either a new budget to explain where or they simply don’t spend what they previously provisioned for. Simply put the Govt will let $158 Billion be cut from their spending and that’s not really good for the services they fund for the Australian population.

I was under the impression that is was a tax offset known as the LIMTO or low and middle income tax offset. So your tax will be offset or reduced by up to $1080 depending on your income. So if you only earn under $37000 you will get $255 back between $48000 and $90000 the full $1080 and in between those earning $37000 and $48000 it is pro rata’d, so $255 plus 7.5% of what you earn over $37000 and up to $48000.

The other proviso is that it reduces your tax, so if somehow you end up not paying any tax then you will not get the money.

This is in addition to the LITO, low income tax offset which is up to $445, so those who earn under $37000 get the full LITO and then for every dollar you earn above that you lose 1.5% and when you get to $66667 it has reduced to nil.

So in addition to your normal tax refund people will get the LIMTO and LITO and that will give them a lump sum of up to $1080.

Better save the money, sooner or later they have to rise tax to pay for the debt’s!!

Other option is to reduce government services or public service size (which can also be in addition to increasing tax revenue to double the net benefit).

As with any downsizing dogma, when one is running lean and mean and you reduce it further, what happens to those needing the service when there is no one left to provide it to even a basic level?

Government services? Have they not been all but abrogated into user pays already, so taxes pay pollie pay and pollie perks and pollie porking projects, and little else? (Plz accept the literary license and sarcasm, directed at the ideology you reference, not yourself)

I believe that the important thing here is spending the money and not saving the money. By spending the money you are supporting local businesses and therefore you help the economy. People have debt and for many people paying down debt will be a priority, unfortunately this does not stimulate the economy.