CHOICE is closely monitoring how effectively superannuation funds are communicating recently legislated changes to insurance cover.

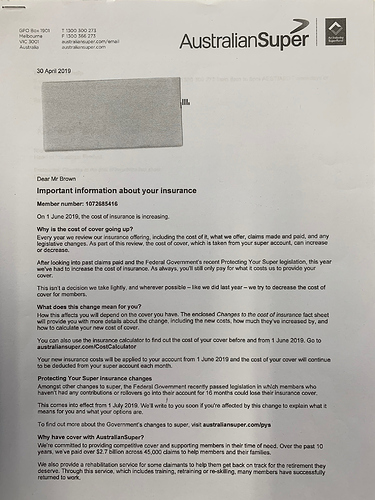

If you (or someone in your family) gets a letter from a super fund about insurance over the next few weeks, could you black out any personal information and send it to super@choice.com.au? You can put a Post-it note over the name and address and take a photo on your phone (as below), or to scan and send us a PDF.

Not everyone will get a letter. Superannuation funds have until 1 December to write or email members who have a superannuation balance under $6000 to advise them that they may no longer have (death and disability) insurance cover after 1 April 2020, and to consider opting-in to retain cover. This will almost exclusively impact young people, recent migrants, and people with multiple or part-time jobs.

We are very grateful for any assistance - thank you!

BACKGROUND

There have been two major legislated changes this year to default insurance arrangements in superannuation.

After the first change (April), super funds made a poor attempt at communicating, prompting ASIC to issue a cautionary press release (linked here)

We wrote an open letter to all super funds after the second change (September), which wasn’t exactly received warmly: (https://thenewdaily.com.au/money/superannuation/2019/09/20/super-trustees-choice-letter/)

But a few weeks later (October), ASIC also wrote to super funds reiterating many of our concerns (linked here)

Super funds have until 1 December to notify any members with balances under $6000, who will have four months to decide whether to “opt in” to maintain insurance cover.

WHAT YOU CAN DO

-

Please blot out any personal details and send any upcoming communications to super@choice.com.au

-

If you have any old letters (or emails) in your superannuation filing cabinet (from April through June this year), we’d be very grateful to see those too.