Another article regarding ASIC being useless.

![]() Nah. Blazing torches and pitchforks! Can anyone deny they’ve earned it?

Nah. Blazing torches and pitchforks! Can anyone deny they’ve earned it?

Another interesting article regarding superannuation.

Risky solution?

Million dollar individual penalties and criminal conviction perhaps? Although these challenge the notion of whether taking advantage of a customer is fraud or just profitable business. “Unconscionable conduct” may not be criminal in our legal system.

While bonfires may bring pleasure to many, I remember the story of the Phoenix rising from the ashes. This is an attribute of many in business who have demonstrated disregard for principal in their dealings with both customers and suppliers alike!

An alternate solution may be to keep applying the pressure cooker that is the Hayne Royal Commisssion and make it never ending. A financial version of a CMC reporting every 6 months. Certainly the ACCC has demonstrated that it cannot perform the role effectively in it’s current business supportive role!

The way to prevent this is not to make corporate fines larger, that only alters the cost/benefit equation, instead make senior staff personally responsible at law. It doesn’t matter if the fraud was done by an underling, it doesn’t matter if the boss can plausibly say they didn’t know, it must be their personal responsibility to make sure they know, and to act and to report externally promptly.

I have seen too many senior people give lip service to control measures and to then give their subordinates the nod to proceed to the contrary anyway. They can get away with it whenever the CEO silently supports them, knowing that in the unlikely event that it blows up and they have to fall on their sword they will be protected, even rewarded, for being a good soldier.

Sounds like a good idea.

When our son was the operations manager at a very large WA goldmine, a couple of employees of a contractor were killed when a very large poly tailings pipe rolled into the trench that they were working in.

The site was under the control of the assets manager whilst the upgrade works were being carried out, but if it was not, he said he could have been held personally liable, even though he had been flown to another mine site in PNG at the time of the accident.

He is now the GM at another WA mine, and he takes his responsibilites very seriously.

Devil’s advocate question, what if the underling wanted to send the boss up the river for whatever reason?

Let a court decide who was responsible, one the other, or both.

Consider how that seemingly obvious approach could affect hiring. Personal loyalty would go right up there, above competence. It might be what you seek or an unintended consequence.

Therein lies the problem with the court system - too often (all the time?) they ‘decide’ rather than ‘determine’. Maybe that wasn’t what you intended to imply, but to me it seemed strangely felicitous none the less ![]()

You only have to read the news to see any number of cases where a crime has been committed and the possible perps all point at each other while saying “it wasn’t me”. The court has to decide (or even determine) whodunnit. Why is this type of crime any different?

It seems to me that white collar crime is no different to the more physical sort of theft in the problems with identifying the person(s) responsible, there will always be attempts to hide evidence, misdirect and shift blame. What is needed is to take away the shield of the corporation so that the legal system can get their hands on the problem and effectively do its job. I am not saying the system is 100% successful, nor will it be in future, but at the moment while the firm can pay a fine that is less than the sum stolen, including negotiating the amount, the rate of success is approaching zero.

The possibility of some gaol time, with its accompanying loss of face, will be far more effective in keeping the high flyers honest than a relatively small hit on the corporate bottom line. While it remains profitable the current strategy will still pay your bonus. Why would you change?

The CHOICE team has joined the #BankingRC in Sydney today. We’re live tweeting and @PatrickVeyret, @mcartwright and @XavierOHalloran will be joining us here on the Community as we demand a banking system that works for all Australians.

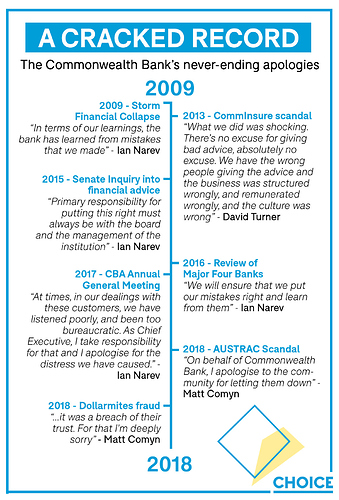

To get us started, here’s a handy list of the CBA’s never ending apologies for unacceptable behaviour.

Livingstone’s claim that she challenged CBA management is not in the minutes of the meeting… Not a great look for an org as big as CBA. #BankingRC

Strike 2: Also no evidence in the minutes of Livingstone challenging management over AUSTRAC #BankingRC

CBA told the regulator it wanted to be an industry leader… But as soon as it cost too much to do the right thing it hides behind the first mover disadvantage.

Livingston on variable remuneration - “we don’t regard it as a bonus”

CBA gets touchy when you call their Short Term Variable Remuneration a bonus. They’d much rather call it a STVR… Best to be opaque when you’re rewarding people for sales rather than good customer service.