I’m not a ‘fan’ of Direct Debit, even though, I do use it, and it can be convenient. To me, there’s always a risk, I’m writing an ‘open cheque’ to the company to take what THEY think is the right amount.

Plus, I’ve also been ‘caught’ when there’s been a problem with the debit, and then been charged a $35 dollar bank ‘dishonour’ fee… such a scam.

So, when I signed up for my Optus 5G internet service, my understanding, was that it was a flat $70 per month.

But when my first bills started coming in, I started noticing they were for $72.20 … which I thought was odd.

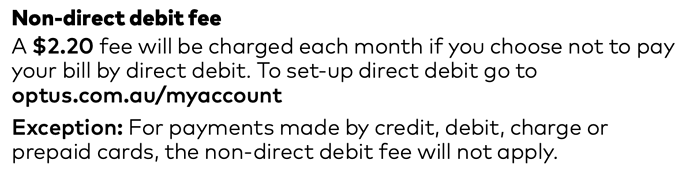

Upon investigating, I found out, ‘unless’ you sign-up for Direct Debit, you must pay a $2.20 processing fee.

How can this be? I have an ‘auto-payment’ set up on my Bpay to pay the bill ‘early’ every month.

After a long series of emails and chat portals to customer service based in the Philippines… I haggled them around to avoiding the toll… but, since bills are ‘automated’, I still get a bill for $72.20… and started getting OVERDUE - PAY NOW notices for the $2.20, then $4.40…

It’s been a right old pain in the butt… and it’s still not over.

On principle, I feel the ‘Direct Debit’ demand, is unreasonable. I didn’t know it was a condition of the deal, and I didn’t expect to pay it.

Sign up for Direct Debit or be ‘fined’ for not doing it.