Shonky company, recently transferred all our ‘inhouse’ salary packaging arrangements. Our paperwork consisted of a 2 page “Salary Packaging Confirmation Schedule”. This states our fortnightly fee amount. It was therefore a shock when I went to cease my salary packaging (due to maternity leave), only to find out they actually charge a yearly non rebateable fee and I owed them money for the remaining unused months.

They couldn’t even provide a PDS or any other kind of contract stating this. So so sneaky!!

Welcome to the Community @OzKy

I had a brief contract, with salary packaging with them in 2015, and there were no fees beyond the regular payroll deduction amounts. T&C change so first for clarity.

Your post is confusing because your use of ‘inhouse’ suggests you may be an employer who offers salary packaging, which could be an annual program contracted with Maxxia as your provider and that you have a contract, and that contract should have all information regarding fees, but then you state

that implies you are an employee who had packaged your salary and there should not have been any undisclosed fees.

Which is the case you have posted about, as an employer or as an employee?

Have you formally engaged in the processes available at

Hi Phil!

I am an employee whose employer has changed from an in-house salary packaging arrangement to outsourced to Maxxia about a year ago.

Hope that clarifies things!

As far as an I can recall at the time of transfer we weren’t told about the fees being annual or given terms and conditions by Maxxia, however hidden in our employer policy it states an annual fee. I attempted to clarify with them via email why I had an annual charge, where this was documented in my paperwork, and although they couldn’t provide evidence of disclosing this, they were insistent the remainder of the annual fee had to be paid and was not rebateable.

Being held over a barrel I have paid rather than have debt collectors chasing me. But it’s not a very transparent process!

Wouldn’t these fees be paid by your employer as part of their costs of running a business and not a fee the employee needs to pay? That seems an obscene outcome where the cost of salary payments are paid by the employee who does not have any say in how the Salary payments are processed (in house or third party). Fair Work Australia, the ACTU, the relevant Union for your occupation I think would be very interested in this.

Hi @OzKy, welcome to the community.

Did you resign or take maternity leave?

If you are on maternity leave and paid by the company/government through the company, you are considered a paid employee until such time the maternity leave runs out (payments cease). This can be many months or the whole time one is on maternity leave, depending on what arrangements you are on.

As an employee, either paid leave or unpaid leave, you are still and employee and bound to any employment agreements in place. The only time these agreements cease is when one resigns or has specific approval from the employer.

Have you checked Maxxia conditions in relation to paid leave? I suspect you would have been provided these when the change was made. …either individually or say in the tearoom for employees to read. Usually paid leave is dealt with the same way as on salary and at work. It is worth checking your employment agreement.

Well in fairness, our employer has always been very clear that salary packaging is an optional perk and not considered part of our salary. And very explicit that they will not pay any associated costs. So that bit was fine. And even when in house staff were responsible we still had to pay a fortnightly fee and had no choice of provider.

Maternity leave. As I’m not on paid leave for the upcoming year, I don’t need salary packaging access. Hence the request to suspend the fees.

Our employer policy on salary packaging is that it’s optional and costs incurred are employees responsibility.

Maxxia has been completely unforthcoming with any PDS, terms and conditions or other paperwork that proves they were upfront about the non refundable annual nature of the fees.

Looking at the Maxxia FAQs on their website, it appears that individual employers can have different contracts with them. If the employer has the arrangement with Maxxia, then it is unlikely that they will give you any agreement information unless you have authorisation from your employer.

Have you asked your employer for a copy of the Maxxia agreement, if it is a employment agreement?

The other form of agreement would be external of the employer…an employee deals directly with Maxxia. If this was the case, you would have signed an agreement with Maxxia when they took over management of the scheme …did you keep and have a copy?

I agree I think the agreement is with my employer, and therefore I was never personally given any detailed information on what happens if I want to cancel before the year is up. Which is shonky given that I am posting all the associated costs and bear any associated liabilities.

I haven’t had any dealings with Maxxia, but I have dealt with four other packaging companies in recent years. There will probably never be a fifth for me.

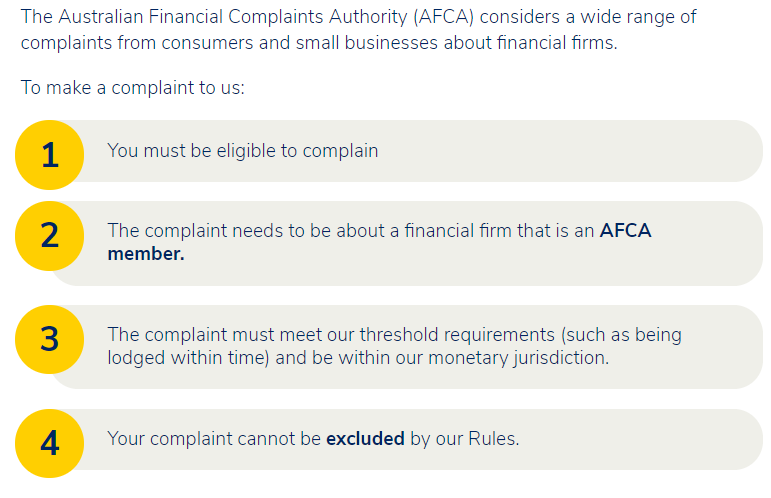

In my opinion only, companies involved in salary packaging seem to be the gold standard of zero value cream scrapers - they exist because companies simply want to ‘provide a benefit to employees’ without any significant effort on their part while at the same time divorcing themselves from the legalities/etc - the companies they outsource this to seem thin on financial process and accountability (except where the process makes using them more difficult to deal with, especially posterior covering documentation), ambiguous on governance and legal framework and thick on fees. I made three different formal complaints with full supporting documentation that were each dismissed by FOS and later AFCA, in each case indicating that the companies weren’t providing a financial service relevant to their (FOS/AFCA) charter (noting the terms of reference changed between them, and became even more confusing) - they got that right

In my humble opinion AFCA is a four letter acronym you can use in place of “useless like teats on a bull” or similar descriptions of failures, hmmmm actually teats on a bull are probably more useful. AFCA may do some good but often it is easier to find/list/enumerate the failures.

I’ve made a couple other complaints to them - also well documented - it seems they have conditions worded more slippery than insurance terms …

To begin with, in the big print:

The fine print goes on and on and on … legislation defines who actually is considered to provide a financial service, which has many and various twists and turns and does not include everyone who can get their hands on your money to provide what to a layperson is clearly a financial service. Then AFCA decides how it fits their rules, then they decide somewhat arbitrarily whether they will handle it or whether it is best dealt with in court - the latter they will provide precisely no reasonable or practical assistance with.

Are they merely an apologist front for the big end of town mandated by the government to protect big business? that might be a cynical view, but also optimistic …

I’ve not been able to find any useful stats on how many complaints they avoid, hedge or sidestep … but thats probably enough of a digression ![]()

Yeah it seems to be a large unregulated hole in the financial services industry. Possibly the shonky should go to the whole salary packaging sector

It would be interesting to put down some questions to ask.

For me, they would be:

- how often can I make a claim for an item (for me this was remote fuel and remote housing - mortgage interest in one case and rental in a previous - electricity (before I had solar) and gas)

- what are the fees for each claim

- do the fees apply to each claim or each item on each claim

- what substantiation is required for each claim - receipts, statements, etc

- does each claim need to be approved by the HR department on each occasion

- is the claim available online or do documents need to be physically signed and scanned on each occasion

- what accountability/reporting is there on monies deducted from salary (not just from payslip/employer, but from salary sacrifice company on monies received)

- are items deducted on a needs/justified basis or is the process ‘predicted’ and some attempt made later to ‘square up’ the deductions vs the actual justified salary sacrificed amounts

- what statements are provided on an ongoing/live basis

- what statements are provided annually - summary/etc

- what protection(s) does the salary sacrifice company put in place to safeguard against exceeding any limits that might apply (legislatively) and/or avoiding any unexpected (from a laypersons perspective) tax implications

- what cut-off times are there for claims in payroll cycles

- what is the delay from sacrifice deduction to payment

My experience is that salary sacrifice is ‘sold’ to the victim(ahem) customer by someone with a similar skillset and ethical foundation as what one might stereotype as an insurance or used car salesperson, and that the product is similar to the paint/fabric protection one is encouraged to purchase at time of sale. I imagine that it might work well for some people, but anecdotally it seems people experience (at least some) surprise and disappointment when they come to terms with the reality of their decision.