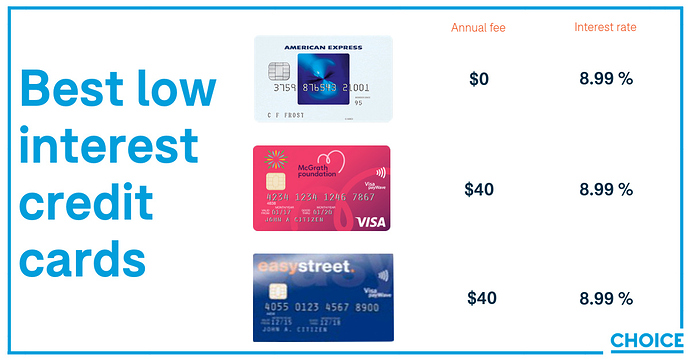

The best credit card is no credit card, but with the average credit card debt sitting at $3273 in June, there’s a good number of Australians that could save by switching to a lower rate. Here’s the three lowest rate cards, find out more in our latest comparison:

I wonder how accurate these stats are? are these figures (aggregated) reportable by the banks?

What is the stat actually measuring?

It would be useful to report how many credit card accounts as a percentage of the total are not paid off in full by the due date each month, and the average balance owing that is then subject to interest?

That might even reveal how much the banks are taking in from credit card debt in real money. And how many of us are at risk. An increasing trend in $ and or percentage would not be good.

Unfortunately it is an increasing number, and overall Aussies carry a lot of credit card debt. The numbers come from the RBA, so hopefully it’s pretty accurate. The same data indicates most people carry debt on cards with higher interest rates, so we could save a lot by switching.

Anecdotally, I’ve also heard that credit cards packaged with other products like home loans are a barrier to making changes, for some people at least.

American Express - great $0 fee & 9% interest - but I see the notices at shops & fuel bowsers - indicating a charge of 2% or 2.5% for their use. Not so great.

In addition to the higher fees it is not welcomed at nearly as many businesses as Visa and MC.

Perhaps Choice should have a qualifier that while the Amex card itself is good, using it is not so good ![]()

True, not much use if you find yourself in a situation where you can’t use the card, and a premium card surcharge seems particularly common for Amex. Of course, it could be good motivation to find another avenue for everyday transactions

I feel that we as Australians overuse our Credit Cards. How many of us have 2-3 cards in our wallet. Some are attached to our debit cards and many times we move payments around. If you get payed monthly and don’t use your card properly by the time you get paid again half of it goes to pay off the card.

I have a no annual fee credit card, I have used the same one for years and when it is time to renew the card they inform us that we have to pay an annual fee we just tell them to cancel the card. So far we have not had to pay a fee.

A good reason to have 2-3 cards from different issuers apart from economic considerations is the high reliability of our banks’ systems. (/sarcasm)

If one bank’s systems are down another is probably up and running unless the merchant uses the one that is down for his card processing. Merchants might get compensation but not we customers. The NBN admonishes us to all have fully charged mobiles at all times, and apparently the banks may be OK to admonish us to always carry sufficient cash for our needs at all times ![]()

Multiple cards (credit as well as debit matter), including no cost low fee ones seem just part of the mix unless you are a cash only customer and not worried about carrying a few $100 all the time.

Our low-interest credit cards article is updated, including some info on cards with 0% balance transfers.

I have two credit cards in my wallet. In the last 10 years, I have twice had to have a card replaced due to fraudulent transactions. The thought of being on a trip outside of Australia, and having a card rendered unusable, is the main reason I carry more than one.

Watch out for the fees on these no-interest credit cards:

CBA charging $12 a month for a card with a $1,000 limit.

Some $144 per annum or upwards of 14.4% per annum.

What a disgraceful rip-off.

Let’s go into the maths of things. What if you spent $100 on each of these payment methods and repaid the minimum each month. How much would you end up paying provided you pay on time?

NAB ‘Straight Up’ $1000 ($35/month, $10 fee): $140

CBA Neo $1000 ($25/month, $12 fee): $196

Afterpay ($25/fortnight): $100

Zip Pay up to $1000 ($40/month, $6 fee): $118

Example credit card ($40/month, $5 fee plus 10%/month interest): approx $140

As we can see in my example, these new “low cost” options can actually be more expensive than a low fee credit card paid off quickly. Especially since many credit cards also offer interest free periods if you plan purchases carefully. And compared to new fintechs they’re even more.

I don’t like fintechs and criticise them frequently here, but of course the banks do it even worse.