I’m hoping someone can advise if the credit charges associated with fuel cards falls under the same legalisation as credit cards. I have a Caltex fuel card and am charged 2.5% on each transaction. Is this right?

I’d have thought your leasing fees covered the card costs, and that costs wouldn’t be passed on to the vendor.

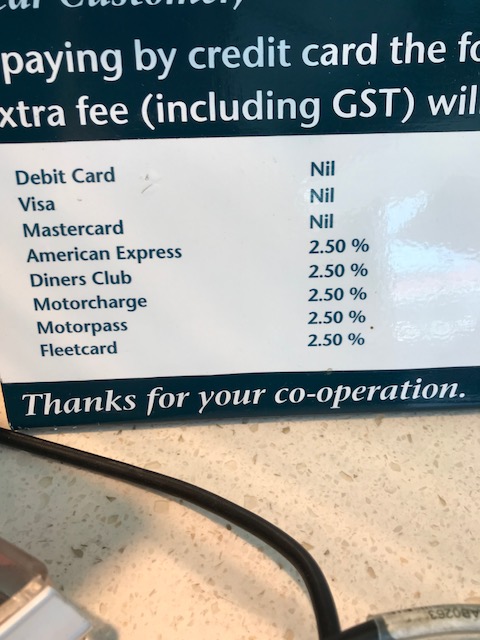

That aside, unless that or a similar notice is posted on the pump itself or somewhere outside where it could be reasonably said that a customer would see it before commencing the purchase, then the surcharge is Nil in all cases

On the ACCC site, there doesn’t seem to be anything about fuel cards being treated the same as credit cards: Excessive payment surcharge ban

So it would seem that as long as the retailers charge a ‘reasonable’ rate to recoup the cost of servicing the transaction, there is no issue. AmEx and Diners merchants charges are higher than the three cards listed at the top of the photo. Given that all the lower volume cards are charged at the same rate, it is probably not excessive.

So to my mind, whether a fuel card is treated the same as a credit card or not, it’s probably reasonable to charge the same as AmEx and Diners.

The advantages of a fuel card are the

- (occasssional) discounting associated with the card,

- tracking of all work related monthly fuel usage and associated and expenses in one place, and

- the advantage it provides for claiming GST and other business taxes.