A neighbour’s tree fell across our property and damaged our tennis court. Our insurance company is refusing to cover the damage to the tennis court on the basis that they allegedly exclude artificial grass. The exclusion paragraph also lists lawn and compacted soil (“loose or compacted soil, sand, lawn, artificial grass, gravel (including on roads, driveways and tracks), pebbles, rocks or granular rubber”) so that excludes almost all residential tennis courts in our area, which would be inconsistent with their claim that they do cover tennis courts. Indeed their parent company, with the same exclusion paragraph, actively advertises on their website that they cover tennis courts. We believe that the exclusion is meant to apply to landscaping, and not a tennis court, but they disagree.

We’ve spoken to a lawyer, who feels we have a strong case, but have advised that their costs will be $3,500 to $7000 for representation for an internal dispute, and for the AFCA process it would be even more.

What have been people’s experiences of disputing insurance claims internally and through AFCA? Is it advisable to have legal representation for these processes? We have been with this insurance company as long as we can remember, and it is disappointing to have to spend money to fight for what we paid good money to insure.

Is there a reason to believe or expect one needs a lawyer to raise a complaint with the AFCA?

Independently of the lawyer have you referred to the AFCA web resources?

Assuming you have the AFCA provides a contact phone number (1800) and online chat option.

Refer to the content at - https://www.afca.org.au/make-a-complaint/insurance

Also to note re outcomes:

https://www.afca.org.au/what-to-expect/outcomes-afca-provides

Why not take it up with the neighbor to pay for the damage? Their tree that caused the damage. Want to spend some lawyer money, then go after them.

Unless the neighbours were negligent is some way (e.g. they were felling the trees causing it to go next door, had an arborist advise the tree was dangerous and they did nothing etc), a tree falling would be classed as an ‘Act of God’. Act of God means an act of nature that couldn’t have been predicted, prevented, and which no human is to blame. In an Act of God the tree falling isn’t the neighbours responsibility nor are they liable for the damage.

This assumption would only be valid if every tennis court had artificial grass surface and there were no alternatives. As there are a number alternatives, unfortunately this can’t be assumed to be the case.

Merely posing the question. Talk to the party responsible for the tree that decided to fall down and cause damage. It may be an ‘act of god’, but maybe demonstrated not.

It may be that the tree owner feels some responsibility for the damage caused by their tree to a neighbor.

Presumably this tree damaged the fence too, did the insurer cover that?

For whatever aspect is not covered what is the estimated cost of repair?

Most cases in AFCA do not need legal representation. An internal review by the insurer and your input to that matter may benefit from legal advice. There are Consumer Legal Advice centres that offer free advice and can help represent you. What AFCA will likely say is that as the items are excluded in the PDS, then the insurer is covered(we had a case where this was the explanation). I can’t say in your case this will be the outcome. In our case we used the services of a Community Legal service and finally got an outcome that settled our dispute (it was Superannuation but AFCA are the mediators in these as well).

A case in your State/Territory Civil and Administrative Tribunal may be a necessary step to get your case resolved.

Our insurer has advised similar to @phb comments. As an “act of god” event my insurer will cover any damage on our side of the fence and 50% of the fence repair costs. The neighbours insurer is responsible for the other side. As a good neighbour I always offer to help out. I’ve gone further for those neighbours who are not able, with their permission to work on their side. With 1.3km of fence line and many many trees - fence damage and tree clean up is just like mowing the lawn. Routine.

It’s unfortunate an exclusion re artificial turf has been extended to included the engineered surfaces chosen for a tennis court. If it had been rebound ace no problem and at greater expense? One would expect if the court surface, which can be any variation of less to more expensive options, would be a specified schedule item in a policy if the choice of surface made any difference to the insurance cover?

That is what we have been told. The tree had dropped a large branch 2 weeks earlier and taken out the power lines on the street, causing a loss of power. Perhaps an arborist should have been called at that stage, but it wasn’t. Unfortunately it would be up to a court to decide if that amounted to negligence, which would be a costly exercise.

Around where we live in Sydney, most residential courts are SFAG or grass. I’d say at least 3/4, maybe more. I don’t think it is reasonable to advertise that you cover damage to tennis courts on your website, and then hide in the fine print that you don’t cover most tennis courts. If it was a small percentage, then it might be reasonable, or if you had a disclaimer or note on the website. I don’t believe the intention of the clause was to refer to tennis courts, but rather to landscaping. It is merely convenient for them to deny the claim. If they are saying they don’t cover the majority of residential courts, then is it not false advertising to claim on your website that you do cover tennis courts? Or do they only need to show they cover a single tennis court to advertise they cover tennis courts?

They just need to demonstrate they insure tennis courts. They can have exclusions, such in your case where they cover tennis courts, but not the artificial turf surface within a tennis court.

Most insurance companies have exclusions and inclusions. A good example is car insurance companies which insure cars, but not underage drivers who drive the car, if it is driven illegally, if it isn’t roadworthy or some modifications to vehicles. Another example is an insurer might insure fences…but have inclusions for fences made of specific materials (asbestos is an example). One can’t assume everything is covered all the time.

It is important when taking out insurance to understand inclusions and exclusions. Insurance companies will point to these in assessing a claim, and saying one assumed something else won’t be a successful argument.

I read the PDS and I honestly didn’t think that paragraph was referring to tennis courts.

So do you think it should perhaps be mentioned on this web page then, or is this ok?

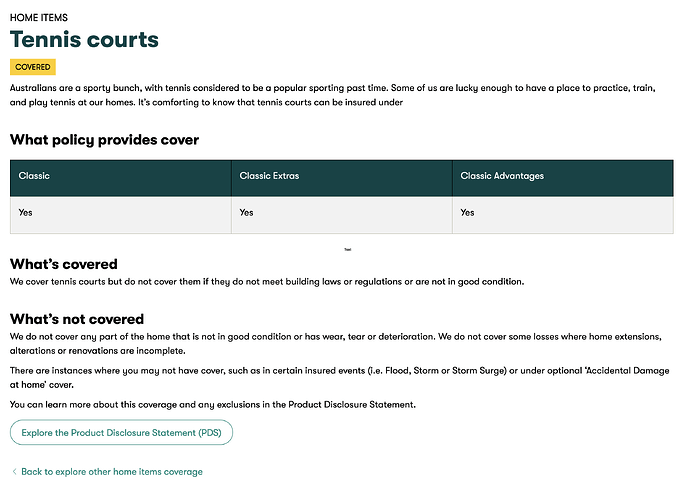

The website states there are exclusions for tennis court cover… the second part titled ‘What’s not covered’. They are clear there are exclusions for the tennis court cover, and as you found out, it doesn’t cover artificial grass. The Suncorp PDS provides general statement about what is not included in home coverage, that being artificial grass.

The insurer also invites a potential policy holder to read the PDS to ‘learn more about coverage and any exclusions’. The website and the PDS doesn’t work in your favour for arguing that artificial grass within a tennis court is (should be) covered.

If one expects artificial grass to be specifically presented on the webpage, this would mean the whole of the PDS needs to be displayed as text. Indirectly it is, as the PDS is linked and Suncorp invites the reading of it to ascertain more about coverage and any exclusions.

Even though most residential tennis courts are sand filled artificial grass?

Clearly we have very different expectations of how information should be displayed to customers.

It doesn’t matter. Artificial grass is a clear exclusion. Likewise if it was made from ‘loose or compacted soil, sand, lawn, artificial grass, gravel, pebbles, rocks or granular rubber’ which others could also be made from.

Suncorp have been very clear that artificial grass among other things are exclusions in their home insurance cover.

The PDS has exclusions for Tennis Court coverings for Flood and Storm damage to the court covering. However in the Impacts section no exclusion appears for the Court covering. In their policy they are quite specific that they cover tennis courts, further down they note that “loose or compacted soil, sand, lawn, artificial grass, gravel (including on roads, driveways and tracks), pebbles, rocks or granular rubber” are not covered. This exclusion seems at odds with the tennis court coverage and in particular that these items are only specifically mentioned as not covered in the event of flood or storm but not for impact. This may mean the exclusions in the not covered section is only meant to absolve cover of lawns etc surrounding the home.

As I am no legal expert it is only my opinion. The professional legal opinion you have received is that the tennis court cover should be covered, as such you should have a case to put to AFCA, and one that you may need to argue further in a Civil and Administrative Tribunal (CAT) if not successful at AFCA. As a decision at AFCA is not binding on you outside of Superannuation rulings, this is still the case as far as I know; then you do have the option to approach a CAT for their determination. I personally think AFCA will rule in favour of the insurers, and I think you will finally need a legal interpretation by a CAT or a Court that the exclusion does not apply to Tennis Courts coverings.

This may mean you want to use a legal professional to assist you in your situation, particularly if you are unsure what information and Case Law you need to present that supports your case. As I previously posted there are competent Community Consumer Legal Advice centres that can assist and you may find that they will be sufficient for your needs. If you decide to pay a solicitor, you may be able to seek costs if you are successful in your case if it goes to a CAT or Magistrates Court, I don’t think you can recover those costs as part of an AFCA determination (but you can ask AFCA about that before submitting your case for their review).

First though you should ask for an internal review of the claim. They will need to provide you with a written decision explaining the outcome, this may guide you and/or your legal representative about how to further argue your case, if needed, at AFCA or CAT.

Page 20 states that a tennis court is covered as the home.

Page 21 provides information on exclusions for the home. An exclusion is artificial grass at the home. Artificial grass anywhere at the home isn’t covered.

The PDS also has additional specific requirements for tennis courts which are read in conjunction with pages 20 and 21.

On page 41 for flood events, any damage caused by a flood on a tennis court surface, no matter its composition, is excluded from coverage.

On page 42 the same applies for storms and on page 43, storm surge damage is also excluded. On page 77, accidental damage is also excluded.

There isn’t any inconsistency. In summary, the PDS states a tennis court is part of the home and any artificial grass at the home is excluded for any claimable events. It goes further by providing additional exclusions for any tennis court surface, stating that they are also not covered for flood, storm, storm surge or accidental damage.

If one had a tennis court surface other than those which are excluded, it would be covered by tree damage. The same surface would not be covered for damage caused by specific events of flood, storm, storm surge or accidental damage.

A lawyer will happily take on the dispute as it isn’t their money they are spending. I would only be pursuing legal advice if it is free or on a ‘no win, no fee basis’. In such case, one would not lose more money in addition to having to pay for a new tennis court surface.

None of us are lawyers.

As previously noted

There could be useful feedback, assuming the OP chooses to explore all the alternatives (minimal cost initially) and feels free to share the experiences with the community.

One could suggest a tennis court surface is one of any type of constructed engineered surface. Can the artificial mat material be any type and brand of product such as Bunnings or the local discount store sell? Or is it a purpose made matting specific to tennis court applications? Similar discussion can be had around the stabilising fill, underlying surface preparation (stabilisation) and materials selected. To the lay person and marketing it may be expedient to refer to it as artificial turf. A replacement for traditional grass courts. Of course even the traditional grass tennis court can not be delivered simply by running a Victa over the front lawn. Hence some expertise from the professional tennis court designers might be required for a more reliable assessment.

A question remains whether in assessing the value of a tennis court for the insured sum, an insurer takes into account the value of the surface separately from the remainder of the value of the court. If there is no question by the insurer as to the type of court surface one could ask why a more expensive surface could be covered but not an engineered grass alternative? Fairness may prevail in favour of the insured, subject to due legal process.

Your argument does not make sense. If the insurer covered some damage as the poster said, then surely its not an act of god.

So the neighbours insurer could not claim an act of god as thats inconsistent with the first insurer.

I dont understand why insurer (of the tennis court property) does not cover the damage , whether its in the pds or not, and then recovers the costs from the neighbour. Thats what they do for car insurance.

Insurance policies cover events classed as ‘act of god’ on the insured property only. It doesn’t cover ‘act of god’ events on neighbouring properties, so claim against neighbours insurance won’t be successful.

The insurance only excludes artificial grass. If the tennis court fence, net, umpire stand and lighting were damaged, these would be covered by the policy (unless they are nominated as exclusions like artificial grass). The issue is whether artificial grass surfaces are covered or not.

Good day Sydsim,

I have no opinion on the insurance matter per se, but reflecting on my interactions over the years, I am firmly in @phb’s camp. His views (which I am sure are shared in part or full by others) ring very true in as I say, my experience.

As to the AFCA process, been there, done that.

- Last year I applied to AFCA complaining against a bank and assume the process apes that of a complaint against an insurer. Specifically my grievances were about the bank:

(a) Not paying me the correct interest rate;

(b) Misleading me in their communications;

(c) Rolling over a term deposit w/out my approval and demanding I pay a break fee if I want

access to my funds before the term the bank unilaterally arranged expires.

-

The application (online) process is simple. Have all the evidence you wish to rely on scanned beforehand so you can attach it to the emailed application. Ideally include a table listing what each attachment is and number the pages.

-

Send the application via email (or the AFCA website).

-

You’ll soon receive an email confirmation of your application.

-

Soon after, maybe 2 weeks, you’ll be called not emailed by AFCA indicating a case manager will be assigned to you;

-

Weeks later (if my case is any guide) you will be contacted by AFCA by phone with the case manager introducing himself or herself. The case manager will tell you what if anything your application lacks eg the insurance policy PDS or what you want done if you are vague in your application.

-

After you send AFCA any more material (be aware of AFCA’s deadline for such material) in response to (6), AFCA will reach out to the insurer and discuss your complaint;

-

No less than 2 weeks later will be the deadline for the insurer to get back to AFCA with their response to your claim. Their response may be called their their “offer”;

-

AFCA will inform you of the insurer’s reply, which often has a “first and final offer” qualification mentioned in the correspondence;

-

If you’re not happy with the offer tell AFCA and the complaint goes up a rung on the complaints ladder at AFCA.

UPDATE

- As to using a lawyer for the application, again I find myself in the @phb camp. Forget it, unless the fee is so low cost xmas has come early for you. Legal representation is not usual when applying to AFCA. I recall a work colleague who some time ago complained to AFCA told me that she was told by AFCA that it is preferred if a complainant speaks to AFCA staff before hiring anyone to represent them so they are aware of the what costs can be sought if one prevails. At times lawyers do not make this abundantly clear to clients.