CHOICE is looking into the new breed of investment apps targeting younger people and adopting the same marketing tactics as gambling apps. Of the approximately 1.67 million retail trading accounts that were active in 2020, about 700,000 placed their first trade that year. About half of those first-time investors were aged between 25 and 39, while 18% were under 25 years old. Have you or anyone one you know used an investment app for the first time over the past 18 months or so?

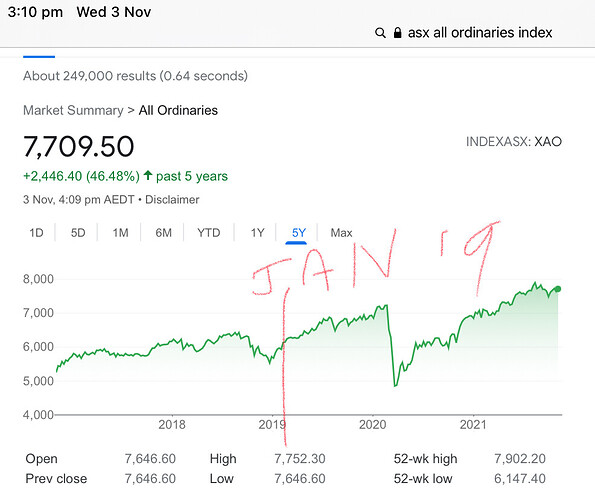

Yes, I am 24 years old and I wanted to get into investing Jan 2019.

Heard about the app Raiz and part of my research was the choice article you guys did. Put about half my savings $5k that month into their moderately aggressive portfolio. Since then i have invested about another $6k personally received $630 of dividends and almost $3k in market returns. That is a +22% change in value since the beginning and +15% in the last year. I still keep about 50% of my saving there.

I am very happy with this but have just changed my portfolio to their ethical portfolio (which actually has slightly better projected returns). I am also about to receive a lump sum of inheritance which I will be investing 70% of into this account. (I am also considering finding another similar app and investing half of that 70% there for diversity). I also like how there isnt much of a penalty if any for taking money out it just takes like a week.

I also use their Super Annulation since June 2020 putting in a lump sum of $386 and $70 further in contributions. $15 worth of reinvested dividends and a -72% of market returns. I am disabled and unable to work so the fees are eating it slowly. Not sure what im going to so here.

Haven’t linked my card so im not doing round ups, and im not using their rewards program as most sites they have money back codes for have better straight discount codes found with a quick google.

I also let my self play with some high risk such like memestokcs and crypto. I see it as straight gambling and only invest money i am very happy to loose. Purchased 2x Game Stop stock (GME) at the Hight of that hysteria for $59AUD each using SelfWealth. Together they are worth $565 today. I don’t plan to sell any time soon because of the principle of the thing. Self wealth as a website is super confusing 100% not beginner friendly, i had a real hard time using it.

I also use Coin Spot for Crypto. Got in Early on the Doge hype put in about $130 in and my wallet is worth $530 now. All up I have invested $220ish in various coins and my wallet is worth $800 right now. but the crypto market is VERY volatile so tomorrow that number could and has been very different. My highest amount being almost double at $1400. Coin spot is ok, simple design but can be a little confusing, and your purchase history is not very clear.

TL;DR 100% recommend raiz to anyone a any age if they arnt investing at least somewhere other than their bank. If you want to pick your stocks or crypto coins there are probably better options than selfwealth and coinspot.

Previously I compared the performance of equity based investments (disposable savings) against relevant market indices such as the All Ordinaries etc. It can also be useful to compare the returns of other competitors products over the same time period?

EG

Hopefully anyone who invested in Dec 2018 or Jan 2019 would today be looking at some great returns. Anyone who made the plunge in Jan 2020 would have had severe investors remorse for sometime. Their gains might only now be looking a little positive.

It seems I got lucky, I hope that trend continues! I’m still learning but Raiz has been a great tool to dip my toes in.

I considered trying Raiz but at the time I was expecting to be wanting a house deposit in about 12 months. Like all investments, Raiz suggests investing for several years to guarantee a return. So at the end of the day I settled for my money attracting virtually no interest in a bank account, just for security.