I realise this answer will differ between states.

But do retailers buy at the wholesale spot price or is there a fixed price set by the distributor eg. Ausgrid? For residential connections?

A: It doesn’t. ![]()

It’s slightly more complex than just the states.

Some light reading which may or may not assist in better defining the question/s you might like answered.

As residential consumers we are several steps removed from the wholesale cost of electricity.

There are generators/suppliers (EG AGL, Snowy Hydro), distributors (EG Ausgrid), and retailers (EG AGL, Origin).

Re Ausgrid,

‘Network prices - Ausgrid

It may be pertinent to also ask ‘who the market works for’?

And as residential consumers we may also be producers receiving the Feed-In Tariff.

Retailers may be subject to variations in the price they pay for electricity to deliver it to you, the end domestic user.

But that is their issue to manage. If the spot price goes up hugely due to demand or supply issues, they can’t just pass the variations in price onto you as the market spot price varies, which can be in as little as 5 minute periods in the energy market.

Your tariffs for supply and usage are fixed for your billing period.

I wondered that myself just now, as I received a text from EA saying my winter quarter electricity cost last year was 93% more than that for Autumn. It was not. Because I use an app that records all my expenses as I pay them (not incidentals, just big stuff like G&S, mobile, internet etc) I can go back and look at the costs. IN fact it was 49%, NOT 93% more. The increase was expected. EA Has been trying to get me onto a plan which does not really seem to be cheaper than the one I am already on. So whats up with that, I wonder…

Have you queried their sums? What did they say?

Thanks this is exactly what I was looking for.

I believe this is a common misconception but wrong, retailers don’t pay the spot price as seen in the above link.

It depends on the type of arrangement in place, whether it is regulated or unregulated, and how the local market is set.

Generally, retailers buy a block of energy from the pool in advance, based in best offers from generators. The price they pay for the block may be regulated (such as tariffs set by state electricity regulators) through to negotiate prices for deregulated contracts. Deregulated contracts prices are based on a number of things such as profile of its customers, total amount required to meet forecast demand etc.

One has to also remember that about 50% of the unit retail rate is network charges (infrastructure to send power from the generator to one’s home. If the kW retailer price is $0.30, roughly $0.15 will be non-network charges. This is principally energy cost, environmental levies and retail margins. It is worth noting $0.15/kW corresponds to $150/MW. A doubling of the price the retailer pays would result in roughly 40% increase in retail rates, not doubling as network charges should be more or less fixed.

Hope this helps.

Naww, can’t be arsed. They are trying to get me onto a new plan, I’m not interested. I guess some people will freak at the thought of that kind of increase and won’t have their own stats. Maybe I should, just as an exercise.

Very much so. If one is so inclined, no doubt there is content to be found elsewhere for each state or territory.

For Queensland which had nearly 0.5 million rooftop solar PV systems in 2015, it took the QPC (Queensland Productivity Commission) just 311 pages to explain just how Feed-in Pricing worked or would work up until 2020.

For a current view the following is the latest QCA (Queensland Competition Authority) determination for solar feed-in tariffs 2021-22. A short 15 pages, and interesting comparison if one chooses to wade through the previously noted 311.

Every state and territory does things a little different. Even in Qld it depends whether one lives in the South East of the state or somewhere else. Remote areas not on the grid offer a third option, while those not connected - off the grid rural properties may be happy they do not have the worry.

Then there’s the fixed daily charge (supply charge) on top of the per kWh rate.

Is is possible that EA is correct. Reasons why their figures are different to yours might include.

- The crediting of a rebate or subsidy on your winter bill will not show on you payments app.

- The might not be a neat match between when you used the energy and when you paid for it i.e. some autumn usage may be billed and/or paid in winter.

Hmm, yes. Must check on that with the next bill and see how the % works out. I forgot I was getting a little subsidy.

In Qld, Pension & Seniors Concession Card holders get a rebate from the State Govt for Electricity and Gas supplies. These rebates are detailed on the quarterly bills, so a pensioner is able to see if the rebates have been applied or not. Mistakes happen at times and that is why here it is important to check to ensure proper rebating has occurred.

“ Queensland pensioners and seniors may be eligible for: the Electricity Rebate—$340.85 per year (GST inclusive) the Reticulated Natural Gas Rebate—$76.19 per year (GST inclusive) .”

I assume other States offer similar relief.

NSW does. Perhaps not exactly the same but similar.

The current issues with supply across the NEM prompted an unprecedented response.

One point to take away from the following is that the wholesale supply of electricity has a portion which is contracted on terms over time, and the ‘spot market’ a portion which is volatile, subject to competitive pricing and a choice by generators to sell or not to sell.

We hear as consumers about the volatile spot pricing, but no one is indicating what portion of the supply at any time is subject to that volatility? As a consequence is there a tendency to exaggerate the impact to serve both the news cycle and vested interests on the supply side?

Most regulated tariffs and domestic supply from the big retailers would be based on contracted rates. With big business, this can be from their own generators so that they have a known fixed revenue stream for their subsidiary activities.

Some retailers don’t have their own generators and/or decide to buy out of the spot market (this also applies for contestable market customers) and as a result they can end up paying significantly more that the retail contracts they have entered with the customers. This is why some of the smaller retailers have advised their customers to go elsewhere as they either

- supply the domestic contracted rate, operate at a loss and potentially go insolvent, or

- review domestic contract rates causing a significant increase in the domestic rates they provide to their customers (with pool pricing being at the $300MW ceiling, the domestic rate is likely to be in the order of $0.50-0.60/kW including network, environmental and retail margins).

There isn’t an exaggeration for those on contracted terms. If the spot price remains at the ceiling, then future contract terms will be based on the ceiling price. Contract terms or regulated prices are very much dependent on the annual average spot price for electricity. This is where the impact will be on consumers whose supply is currently on a contracted supply price from the generators.

Furthermore, if a retailer can’t supply all their customers from the contracted supply agreement with their own generators, they will be purchasing shortfalls from the pool. If the pool is high, then this will be passed back (average over) their customer base.

Edit: The other main impact is the flow through on consumer goods and services. Medium to large businesses may be subject to spot pool pricing. When the pricing increases substantially for a long period, businesses where electricity is a significant cost may not be able to absorb the price increase. This means that they may increase the price of products and services which will be passed onto the consumer.

That’s a big if. The reality is the generators will need to substantiate what their reasonable costs are retrospectively for the current period. Looking forward if the system is broken, should we expect the regulator and government to accept any more than true cost plus a fair margin?

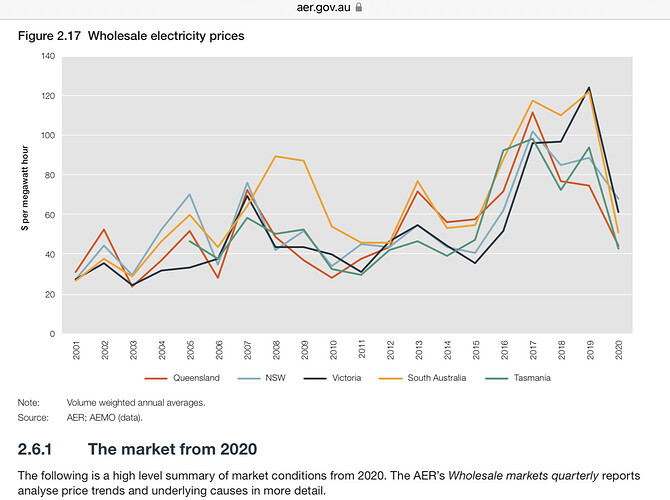

How the market works according to the Regulator. At least up until the start of 2021.

As you suggest higher electricity prices feed through in so many ways. It’s interesting to point out that wholesale prices for generation in 2020 were typically half what they had been in the preceding 4 years. If wholesale prices are expected to double or worse, how can the cost to consumers be any greater than what we were asked to pay 3-5 years ago? It’s not saying consumers will not be asked to pay more. It’s asking what will be a reasonable expectation of any future increase as measured at the household meter box and not at the point of generation 10%, 20% or something higher?

Given renewables have not increased in cost, Vic brown coal generation has not increased in cost, and not all black coal generation is facing increased cost of fuel. It would seem unreasonable to expect to pay all of these a windfall profit for no extra costs, because the smaller portion of the generators utilising gas or those with coal supply issues are paying a premium for their fuel.

Supply and demand. With some generators off line and others unwilling to generate because the $300MW cap was less than their costs, it caused a situation where demand exceed supply. This was also contributed by the highest winter demand in states like Qld due to cooler than expected weather conditions.

Possibly correct at this point in time.

It is worth noting the cost of renewables to support the network will increase over time. While they may be cheapest form of electricity now, being ‘cheap’ is their generation shortfalls are made up by fossil fuel generation. As more fossil fuel is replaced by renewables, the trigger prices renewables will enter the market will also increase (capacity will far exceed demand and with fixed costs, the cost base will be spread over less generation).

It will bit like the current gas situation where some gas generators didn’t want to generate at a loss at the $300MW cap. Likewise, at certain times when renewable generation is high, spot market price may be lower than the cost if generation. Renewable generators will enter ir leave the market based in price. To cover intermittency of renewable generation, capacity will be significantly greater than peak demand. When I worked in the industry, some if the planners were talking about 2-3 time or more peak demand. This is required to try an meet generation shortfalls…such as wind generators stationary in parts of the country due to weather conditions. There is a point where marginal increase in generation to improve reliability exceeds storage (storage for medium term supply is very expensive and will remain expensive for many forms of storage).

It is frustrating for those in the industry to have spin doctors and vested interest parties saying when Australia moves to full renewables, electricity will be cheaper. This is incorrect and assumes the status quo where reliability issues of renewables is supported by fossil fuels will be the same in the future. It won’t and prices will increase and the cheapness if renewables will disappear except possibly in the most reliable renewable generators - which are limited and have limited opportunities.