With the increase cost of living, home and/or contents insurance hasn’t been spared from price increases. Some of these price increases are due to higher costs of providing insurance (wages, interest rates, reinsurance costs) whilst other increases are due to a larger number of claimable events being received by insurers.

There are many reports in the media that some premiums have jumped, and what may be seen by some as unreasonable amounts. One such recent report is that a home and contents policy policy renewal premium increased around 400% on the previous year.

Insurance is about spreading the risk. If one has home and/or contents insurance, they hope that they never face a situation where they need to use it. The premiums paid spread the risk to each individual, allowing those who do need to have a claim, to be able to claim against the cover they have. Those who don’t make claims, are supporting other consumers who need to make a claim to taken the burden off them when a claim is made (hence risk spreading).

Notwithstanding this, if one lives in a higher risk area (cyclone region, bushfire area etc), premiums also increase to reflect the risk (or higher probability) of claims being made. This is done to reduce the burden on those who live in areas where they don’t face the same risks.

Many consumers will be finding that their home and/or contents insurance has increased substantially, even though they live in the same house and haven’t done anything to cause an increase in their premiums.

Let us know how much your home and/or contents insurance premium has increase from the last two bills you have received. It will be the premium paid in 2022 compared to 2023, or 2023 compared to 2024.

Let us know how much your insurance premium has increased with the last two policy renewals. My premium has

- has reduced (reduced more than 10% on the previous year)

- is about the same (within 10% of previous year)

- increased by 10-20%

- increased by 20-30%

- increased by 30-40%

- increased by 40-50%

- increased by 50-75%

- increased by 75-100% (almost doubled)

- increased by 100-200% (almost tripled)

- increased greater than 200% (tripled or more)

- or I don’t have home and/or contents insurance

- or I cancelled my home and/or contents insurance due to the cost

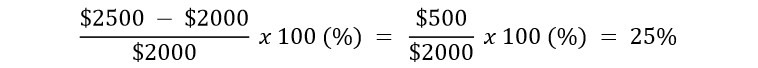

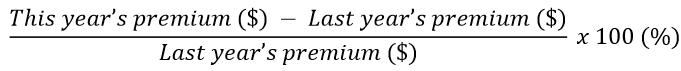

Now the maths. To assist you in working out the percentage change between the two bills, use the following equation:

For example, if this years premium is $2500, and last years premium was $2000, the equation would be:

For a 25% increase, select the increased by 20-30% above.

Note: A negative percentage means your premium has decreased.

Below you are more than welcome to provide information if you know why there has been a change to your home and contents premium . Did if there has been anything you have done to try and reduce the premium (increasing excess, shopping around etc)? If you tried to reduce your premium, did it work?