That is probably because you are not American. It is fascinating what they think is normal and crazy in various situations, compared to us.

Entertainment and crazy laws aside!

The actions of the current federal government ignore reality. There are several hundreds of views on this topic in a matter of weeks.

It is hard to understand why a true liberal would support any action that has the effect to impose regulation of free trade. Ok, extend the GST collection, but also make laws to fine multinationals for not selling to Australians and make it an offence to price discriminate based on where you live.

Perhaps as the mighty “Trump” keeps reminding us - the world is full of ‘fake news.

Can we now add ‘fake liberalism’ to the same pedestal?

Put aside Taxation of commerce and freedom of consumers to have fair access to purchase goods internationally.

It is fake argument that buying in Australia keeps your money in Australia. The only money that stays in Australia is that paid in marketing and retail and transport costs. Buying the same item from overseas bypasses most of these costs all of which are non productive activities. True, Mr Harvey and others do get a slightly better deal for volume.

You could suggest that the money you save by purchasing more directly is money you could use to pay down your mortgage or invest in Oz? No doubt this is what Mr Harvey does with his earnings. No luxury lifestyle and no over seas holidays for any one who has invested in retail. It all goes back to Oz.

Being profitable in retail in Australia depends on your sales volumes and margins. The less competition there is the better it is for the retailer. Australia tried this. Think of the Menzies era to find liberal branded examples of high import duties and heavily regulated markets. Well petrol for the mower was cheap enough. If only we could have afforded a car.

In March of last year, Fairfax economics editor Ross Gittins commented:

“Australia’s problem isn’t fake news, it’s fake government.”

The truth of that is daily more evident.

One of the discussions has been about the impost and appropriateness of government demanding a business be their tax collector. Another was about the technology probably being in place. A decision by the US Supreme Court will be germane to how Amazon and other online merchants are forced to enter the ‘new world order’ of tax collecting. Previously they only had to collect tax for US states where they had bricks and mortar presence, now it will be akin to collecting GST. Each state and jurisdictions within most states have their own complex sales taxes that make our GST look trivial to implement.

One thing that Wayne Swan said when he was the Federal Treasurer that I actually agree with was “It wouldn’t be Xmas if Gerry Harvey wasn’t whingeing”.

That’s fine!! He should then shut up when I choose to do my shopping online and get a much better price than his franchises offered me. In time most people will go to Amazon or other online businesses and he will suffer as the companies he cannibalized some years ago.

This is just so wrong! From the Auspost Shopmate pages:

GST will be payable on:

- The value of the item(s) you are shipping into Australia via ShopMate including any shipping fees or local taxes paid to the USA retailer, and

- The value of the ShopMate shipping and service fee (including Extra Cover if applicable)

Australia is lodging taxes on delivery services that are 100% conducted in a foreign jurisdiction, and is adding a tax upon a foreign tax. Very Special.

PS - based on the shipping rates exclusive of GST Auspost could be using the US Postal Service individual rates! I did a test and what Amazon was able to send here for under $USD10 Auspost wants $AUD35 ex/GST. What a deal!

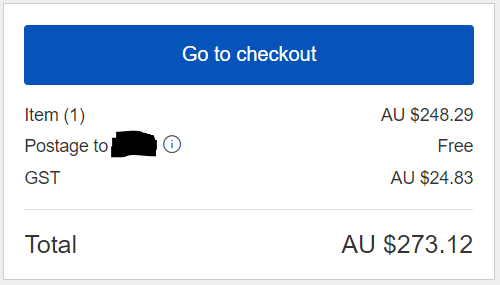

A friend purchased from Ebay this week and didnt see the tack on of

GST till the very end after paying - so he had to accept and couldnt

back out - but found out he was charged not 10% but F—n 15%

including on the bloody postage - Crap - so Ebay are making a

profit - Googled and found out they also own PayPal too - cripes.

They bought it from that Tesla dick in 2002 for 1.6 Billion.

I only purchased sub $100 bits and bobs anyway so they should

have made the limit say $250 - but what happens to a purchase

from a Chinese Ebay store that already supplies from an Aussie

Warehouse??? Are they not including GST in the price???

Perhaps they could apply for a refund on the 5% extra GST from EBay. The GST Act only allows for collection of 10% at this time. The Govt however are viewing tacking on another extra payment for all overseas items, around $7 I believe, to the 10% GST that is also to be collected.

Was this a short lived thing or a misunderstanding? I just did a test case:

So how does the ATO keep our offshore tax collectors honest? Not in conceivable a whole lot of moneys charged as GST will never be shown on any tax return with no jurisdiction for the ATO to audit anything offshore.

Me too (though the purchase was only $1.79). The GST was 10% (18¢).

My $1.79 purchase was available locally - for more than $6, plus delivery. Gerry Harvey won’t be happy until enough charges are added to make his business competitive. Then he’ll whine that it isn’t profitable enough.

Good question. In the case of an Australian-registered entity like eBay, the local arm does the collecting. That’s easy enough to police, but what about overseas suppliers with no local representation?

They are onshore…they have subsidiaries here…

Most major international companies (Google/Alphabet, Amazon, Apple etc) have registered businesses in Australia.

These business and structures have been subject to government inquires, as they have developed financial structures to minimise tax paid in Australia.

There is or was a simple system.

It was used back in the old days and today for any major import that customs clears directly.

The purchaser pays the import duty directly. We might as well have the purchaser pay the gst directly to the governement before it is handed over or released.

This will avoid the over seas supplier mysteriously offsetting and loosing the gst they collect from us. It negates the cost of expensive gst compliance work by the ATO on foreign entities or those bits not evident in Australia.

Yes, it might mean that Australia Post needs to collect the extra payment, like they did for decades on customs declarations. At east it will keep the local PO going. There is also no reason why the delivery van can’t do this too!

Assuming the delivery to your property is via an all Australian business. The seller could by agreement with the ATO remit the gst to the delivery agent. No remittance, no delivery. The gst then goes directly to the ATO. Hence you pay the gst to the supplier, they pay the Australian delivery agent an extra amount on top of the delivery cost equal to the gst and you do not even need to be home for delivery.

If you pay via PayPal Australia inc, even they could do the gst collection on the transaction and issue a clearance it has been collected.

I prefer any option that avoids overseas currency transactions on the gst, so payment at delivery keeps it free of all those rorts with exchange rates!

Yes, GH might still complain. In this instance about overseas vendors understating the invoice costs and lying about how cheap the goods really are. Of course he might be right in that they really are that cheap.

Rather than distract us with how low retail margins are, where retailers measure profit relative to turn over. It would be better to also understand actual profit relative to unencumbered capital investment or simply % markup relative to cost at the manufacturers gate FOB. This is close to how the pyramid of negatively geared share ownership or rental property investment is marketed.

I wonder if that is how the house of cards is stacked for GH?

Ali Express has started to add 10% GST to the pricing at the checkout.

I wonder how the ATO is going to audit takings vs any payments made to them?

Still sooooooo much cheaper than GH!

I was only charged 10% gst, however I reported them to the ACCC due to drip pricing.

Do not hold your breath. International online merchants are caught up in the tax collection business, but also in incompatible laws. In Australia for example prices must be inclusive of GST (unless otherwise stated) but in the US it is illegal to include the taxes in the price shown (except for petrol and maybe a few other special cases where government would be embarrassed if people knew the tax amount) with the tax only being shown during checkout. eg. In Australia we pay the price shown, in the US the price is almost always more than that posted and ‘dripping’ the tax at the end is the required methodology.

The online merchants are truly hung out to dry by the various government edicts and conflicting requirements.

Exactly how Gerry & friends like it.

Correct obbigttam that’s exactly what i’m getting at if your going to spend the same amount of money when you have looked around and done your homework.Look after the local retail staff and people’s jobs instead of purchasing overseas.Surely supporting the local workforce is better than sending all the money overseas.Maybe people didn’t understand what i was getting at and thanks for pointing that out.Buy local

If it was close to the same amount most would shop here but the difference can be significant. I buy various IT bits and pieces and most overseas retailers beat Australian Stores by many dollars. Some leads cost me $1 for a pack of five no postage from China, same leads here in single packs cost me $10 plus $5 postage.

AV software can be 1/2 the price it sells for here, even if I pay GST on the Oversea’s purchase. There are just lots of examples where the Australian price is no reflection of the overseas market. If a business buys in bulk eg HN then why is that same product bought from an overseas (OS) retailer much much cheaper even after the postage and insurance are paid on top of their mark up. Some companies raise the price simply because we are in Australia and they can mark up here more than they do in their other international operations because we have become so used to being geo ripped off.