Can I have some advice please?

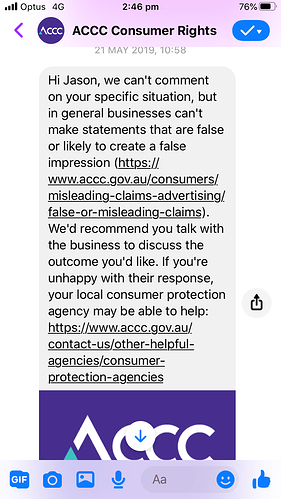

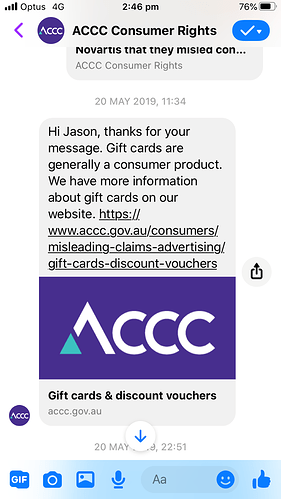

I’ll copy the contents of the self-explanatory email I sent to the card issuers “Rewards Come True” (as advised by the customer service person at the phone number I called yesterday), and I’ll also copy the reply I received today.

Hello,

I am writing to request your consideration to reactivate or replace an expired gift Visa Card.

I am a full-time carer for my aged, invalid mother. In the process of moving her into my home, in July 2021 we purchased and installed a Panasonic air conditioner, which had a ‘cash back’ promotion at the time.

In the following weeks, the card was received and somehow misplaced during the move.

My mother’s health has substantially declined since then, and her care takes up considerably more time than when she initially moved in with me.

I have spent many moments over the months searching for this gift card, but combined with moving my mother’s belongings, this has become quite difficult.

I was so excited yesterday, then, when I finally found the gift card. This excitement quickly turned to disappointment when I saw the card had already expired in December 2022.

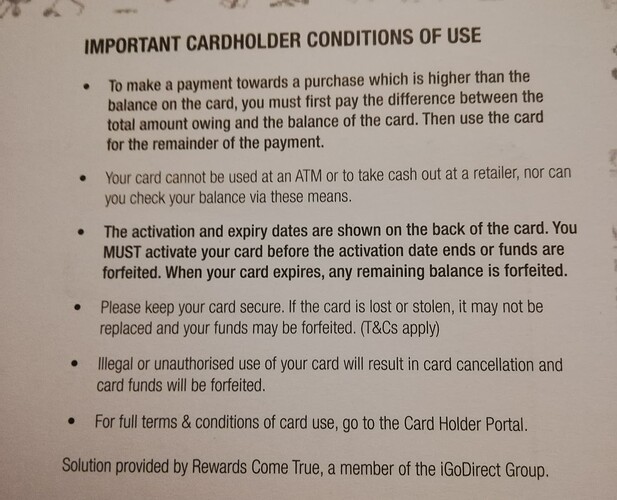

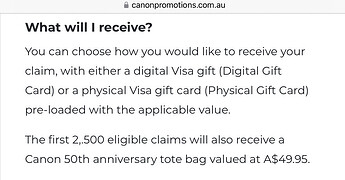

This confused me, as I believed that requirements had changed, allowing gift cards to be valid for much longer. i had not even realised that there was a specific “Activation” date for the card either.

The card is for $75, which is a substantial sum for us. We are both pensioners - my mother receives the Age Pension and I receive Carer’s Pension.

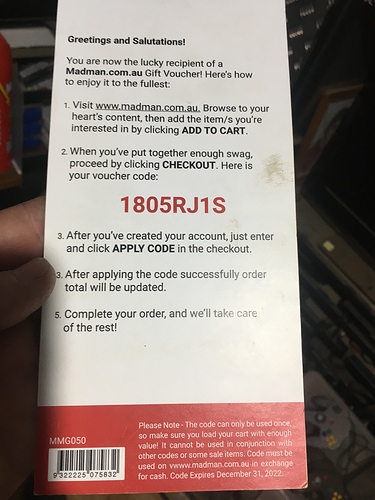

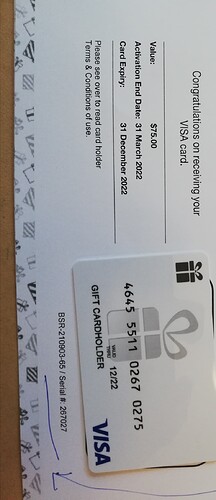

A photo of the card is attached, showing Serial #267027 on the packaging.

Is there any way that you would please consider reactivating or reissuing this gift card?

It would mean so much to us.

Thank you.

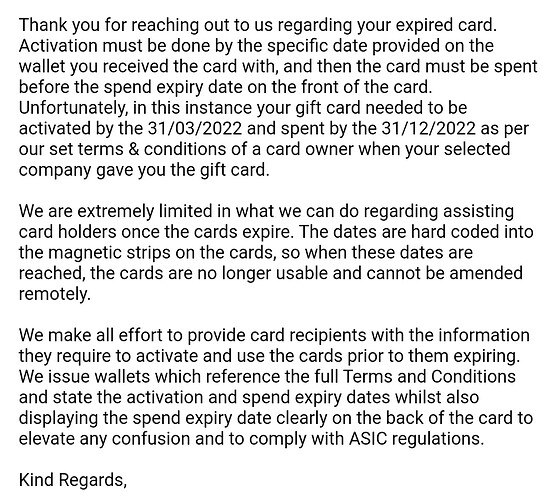

Note he doesn’t address the reissuing of the card at all.

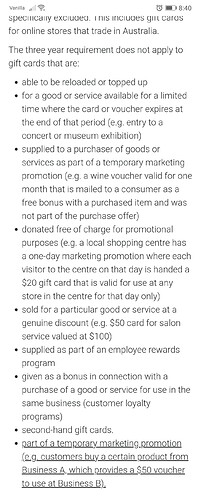

I then had a look at the ACL blurb regarding gift cards, as I feel this card does not belong in one of the categories that the 3 year expiry doesn’t apply to.

The air-con was installed in July 2021, and the gift card received a number of weeks after this date. Even using the July date, that is still only 8 months till the end of the activation date, after which time funds are forfeited anyway.

This is the details from the gift card, showing Activation and Expiry dates-both grossly under a 3 year term. By having an activation date so short dated, it completely undermines ANY expiration date, regardless of whether it is 2 or 3 years…

Thanks all.