While not all banks operate the same, most foreign transactions on Australian debit and credit cards are cleared by Visa or MC International and provide the same xrates of the day (as determined by Visa or MC International) to the customer without an additional bank markup. ie There is no worse xrate just because the card is ‘fee free’. The difference is that pesky 3% add-on ‘the others’ demand.

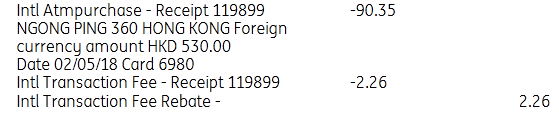

The numbers on cards denote the category, class, and benefits associated with it, as well as the issuer and account. Using ING as an example, if one does not ‘play ING’s game’ of deposits and debits/charges in the previous month, they levy the fees; if one plays the game they levy and then rebate the fees so it is visible how it works. The xrate is the same either way and the processing is fully internal to ING’s systems.

An extract shows the Visa processed xrate was 5.866 rounded. The mid-point interbank xrate of the day from PoundsterlingLive history was 5.876 (rounded).

It gets complex but this SG site seems pretty comprehensive re xrates

https://www.thinmargin.com/blogs/visa-vs-mastercard-who-gives-better-exchange-rates

a related dormant topic is