CHOICE is looking into the issue of banks applying very high exchange rate margins when it comes to foreign transactions - both in the case of checks from foreign banks being deposited in AU banks and overseas money transfers to AU banks. Have you or someone you know been ripped-off by your bank on exchange rates?

It has been years since I learned the hard way and have never dealt with an Australian bank forex again. This earlier topic has a number of cases.

including

and while this example is not unique to Australia it a scam by another name - it is common in some countries and rare to non-existent in others.

I routinely follow the xrates to manage multi-national personal finances and taxes and our banks have one of two operating principles for incomings. One option is to offer very poor exchange rates compared to those available elsewhere (at least on the US side). Some banks only accept transfers already denominated in $AUD (some warn there could be substantial costs if they need to exchange an incoming transfer in $[foreign currency] through a 3rd party, and others state they will refuse the transfer if in a foreign currency).

Transferring out is another issue, already the subject of Choice articles.

In 2017 I was the beneficiary of a will of a lady who died in the UK. The distributed amount was £224.71 which according to the bank was $AU365.62 (it just happened to be a bad time for converting £ to $, the quoted rate was the market rate) . I wanted to redirect the money to a relative in the UK but the legal system is rigid and the money had to be paid to me. There seemed to be only two options the solicitors would use and the cheapest method was to send a cheque. The amount deposited to my account was $313.08, after deducting $52.54 in fees. This is my only O/S transaction apart from PayPal, and I thought it was a ripoff.

From friends I understand that St George no longer accepts for deposit into Australian accounts cheques drawn on foreign banks.

Also that many consumers think highly of the few Australian banks that offer debit cards with so called no foreign transaction fees on transactions performed overseas or performed in Australia say on foreign websites.

Supporters of such cards may not know that often the exchange rates offered on so called foreign transaction fees free banks are worse than the rates offered by credit cards issued by Australian banks.

While not all banks operate the same, most foreign transactions on Australian debit and credit cards are cleared by Visa or MC International and provide the same xrates of the day (as determined by Visa or MC International) to the customer without an additional bank markup. ie There is no worse xrate just because the card is ‘fee free’. The difference is that pesky 3% add-on ‘the others’ demand.

The numbers on cards denote the category, class, and benefits associated with it, as well as the issuer and account. Using ING as an example, if one does not ‘play ING’s game’ of deposits and debits/charges in the previous month, they levy the fees; if one plays the game they levy and then rebate the fees so it is visible how it works. The xrate is the same either way and the processing is fully internal to ING’s systems.

An extract shows the Visa processed xrate was 5.866 rounded. The mid-point interbank xrate of the day from PoundsterlingLive history was 5.876 (rounded).

It gets complex but this SG site seems pretty comprehensive re xrates

https://www.thinmargin.com/blogs/visa-vs-mastercard-who-gives-better-exchange-rates

a related dormant topic is

It’s not just Forex. The rate/fee charged when buying anything online that’s in a foreign currency is also excessive.

I have a couple of times transferred Australia to Vietnam. When you transfer you get a much better rate in Vietnam so I transfer in $AUD. The exchange rates of Australian banks are terrible.

Incoming $USD converted to $AUD by a major US financial institution (convenience, not the cheapest) today, $AUD1 = $USD0.69683. A round $AUD50,000 would cost $USD 34,841.50. $USD50,000 would deposit $AUD71,753.51.

Incoming $USD converted to $AUD by Westpac, $AUD1 = $USD0.7175. $AUD50,000 would cost $USD 35,883.61. $USD50,000 would deposit $AUD69.686.41.

The higher the amount the better the xrates.

FWIW $AUD50,000 going outbound to the US converted by Westpac would only deposit $USD33,303.34.

Go to Transferwise or now known as Wise, better than most Banks and efficient.

Have used them and recommended.

Absolutely Andy. As the world opens up again, this has become an issue. When VISA/MasterCard can provide near spot price currency exchange rates and the entire transaction process is automated, how can a bank justify a 3% - 5% fee?

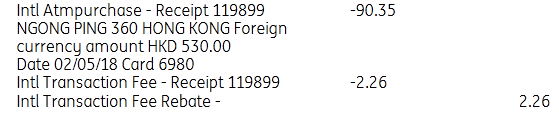

A slightly related topic of ‘International Transaction Fee’ that some credit card companies charge is another dubious fee. Again, it pays to shop around for a card provider that does not charge that fee.

Keep up the great work Choice!!

I see someone else HAS mentioned wise.com - it used to cost me $20 to send $100 from NZ to Australia. Now costs a few dollars to send $500.

Best find in a long time when it happened!

Still going strong . . .

Give it a go - you won’t regret it : )

The exchange rate used by wise.com is found here - in my experience they are very close if not the same. https://www.xe.com/

Plus a very low amount of money going to wise.com for the service they provide

They are very clever how they do it - no money crosses any borders

The money I sent from NZ to Australia works like this

The NZ dollars are sent to their own NZ account.

The Australian dollars are then send to the recipient from their Australian account

Pretty darn clever, or not?

Thank you wise guyz : )

Cheers

L

Who is to say the big banks and credit card services do not do likewise?

Especially where they have significant customer assets in each of the countries currencies being exchanged. I’m thinking of the ANZ and the last time I used my Aussie ANZ card to make an ATM withdrawal in ‘kiwis’ in Auckland!

At the end of the day or at some time the banks etc may need to make a balancing international transfer due to differences in relative demand. A single one off transfer, or possibly several as they chase the exchange rate? Hardly a high overhead micro transfer carried out separately on every consumer purchase.

Do consumers really get a fair deal, and is there full transparency of the costs/profits to the institutions?

The ACCC agrees that the big banks are likely the most expensive option. There are other options as Choice and the Community have and the ACCC point out.

The ACCC material is a must read. Full of information and explains the manner in which For Exch companies and the banks operate. It recommends trying to do a deal with the bank when transferring $

AU. ANZ and CBA refused to negotiate. ANZ has its own foreign exhange dealers and does not use anybody else (as far as I am able to tell) but the CBA (which is used by some smaller banks) uses Torfx.

When transferring $12million dollars, therefore, the people concerned used Torfx thereby saving much money. The persons receiving the funds in the UK and Ireland wanted to use Torfx and the Australians know what to do next time. If one were an ANZ or a CBA shareholder they may wonder what on Earth their bank is doing not negotiating with such people. It is bizarre behaviour and they have paid no attention to the ACCC advice.

Welcome to the Community @rr1

Refusing to negotiate is often a tactic to maintain the ‘valuable product or service’s value’. Once negotiated and it gets out everyone will expect similar benefits whether for $12 million or $12. It is not really bizarre, it is marketing psychology.

All customers are not good customers and 20% of the customers make up 80% of the profits, or so it goes. A business can lose lots of the 80% of customers who deliver only 20% of the profits without any perceptible difference to its P/L. That being written many of our businesses of all sorts still think they live and operate in the pre-internet days where the customers were ‘blind, deaf, and dumb’ to their tactics.

You ask if the big boys do the same as wise.com?

I bet manydo and somehow some manage to fleece customers extra fees for intermediary banks who

it is claimed are used to process the transaction.

transferred 50k to NZ from OZ today. Commbank rate was 1.06 approx, OFX was 1.11. That equated to a $1900 difference in my nz account. THIS IS A MAJOR SCAM BEING USED AGAINST UNKNOWING CUSTOMERS . use OFX for foreign exchange