Here’s parts three and four of our series into ethical super:

Really good reads and interesting how some funds sidestep the questions of why they invest in ways that are/appear “unethical”.

I initially started my super with Christian Super, but later down the line I decided to review it and moved to Australian Ethical for that exact reason. Their ethics policy really didn’t line up with what I considered ‘ethical’

I’m currently satisfied with Australian Ethical as they’re good at communicating changes when companies they’re invested in are called into question. Whilst I loathe the big banks I also understand the idea that some investments may need to be in that industry.

At the end of the day I’m able to make these decisions because both of those funds have detailed ethics policies easily available. For me this is the most important aspect of ethical investment

@XavierOHalloran from Super Consumers will be speaking at this special event discussing how your super can impact on ethical issues such as environmental destruction and what you can do to align your retirement nest egg to your values for those interested.

Doing a periodic review of our super funds I noticed the Perpetual Ethical SRI Fund. Its 10 year return is respectable, less so in recent times. But I digress and am not getting into industry vs retail, noting our retail mix has done quite well in spite of ‘high fees’.

The fund is stated to: … invest in quality companies that have satisfied our range of ethical and socially responsible investment criteria.Perpetual is also a signatory to the United Nations-supported Principles for Responsible Investing (PRI), and in relation to this fund, use research from external specialists to analyse socially responsible practices of companies listed on the Australian and overseas exchanges.

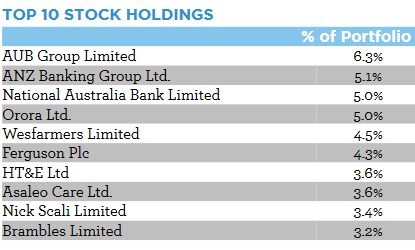

The fund’s top 10 investments include some notable companies, especially 2 of our big 4 banks and Nick Scali. Ethical?

It appears ethical may be a technical investment term in context, perhaps related to how an ‘ethical’ company operates on its supply side, or ticks some environmental boxes, while loosely or unrelated to how it interacts with its customers.

There can often be confusion between ‘Ethical Investments’ and ‘Lack of undeniably unethical investments.’ Some investors and consumers just want their stock out of businesses like weapons and fossil fuels. Where others would consider ethical to actually mean an investment in businesses actively seeking to be ethical and progressive.

As it stands super fund members are still in the dark, with no obligation for funds to disclose which of these they are or what they invest in, unlike what is typical for investor funds like that one.

This is an interesting development…

Usually ASIC doesn’t undertake investigations for the sake of it, but usually in response to information provided to them or they have identified through other investigations. It might be a ‘watch this space’ to see if the claims being made by (some) ethical super funds are correct or misleading (greenwashing).

When I first started a super fund I followed my parents and set it up with Christian Super. Later on when I went back to check it, I decided to look into which funds most aligned to my ethics. Much to my surprise, Christian Super had little to no environmental investment policies. I didn’t think investing in multi-national corporations involved in global environmental destruction was very Christian personally. To their credit, they have since significantly improved their exclusion policy.

I am currently with Australian Ethical

Ethical investing apparently has multiple criteria as well as multiple meanings to multiple funds and investors.