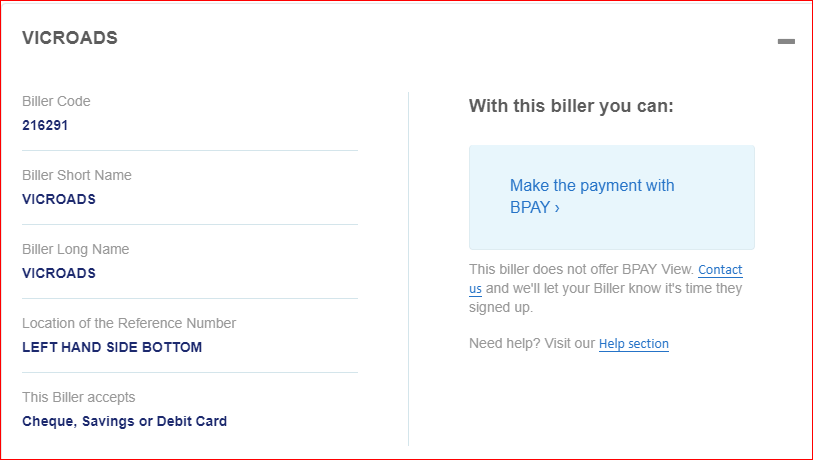

A couple more references re Credit Cards …

CommBank - How do I make a BPAY payment?

Credit Card payments using BPAY:

Payments made to BPAY billers who accept Credit Card payments will be treated as normal Credit Card purchases. Some billers however, do not accept payments made with a Credit Card via BPAY. To make the payment you will need to pay with another transaction account. If your other account has insufficient funds you may choose to make a cash advance transfer Credit Card to a non-credit account.

NAB example - BPAY® - fast, secure and trusted bill payments - NAB

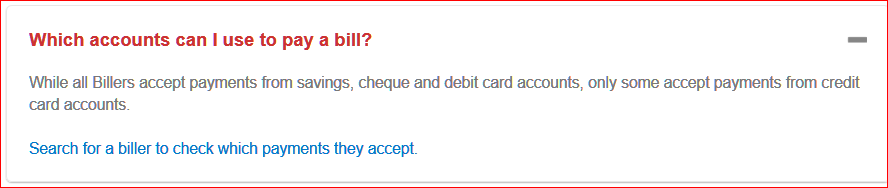

Which account can I pay bills from?

You are able to pay bills from any of your transaction or credit card accounts*.

*Selected billers do not accept credit card payments. If you select an account that a biller will not accept, NAB Internet Banking will reject the payment.

For periodic and future dated payments, NAB Internet Banking cannot verify whether the account is acceptable to the biller until the due date. You should therefore refer to your bill to confirm that the biller does accept payments from credit cards prior to creating the payment.

Westpac - BPAY - How to Register and Pay Bills | Westpac

If your bill displays the BPAY ® logo, you will be able to pay it directly from your cheque, savings or credit card 2.

[…]

2. Not all billers accept payments from a credit card.

ANZ - https://anz.com.au/internet-banking/help/pay-transfer/bpay/

Bill payments from your ANZ Credit Card can be processed as either a purchase or cash advance. This is dependent upon how the biller is set up with the BPAY® billing service. The biller has the option of accepting a credit card as a method of payment.

If the biller chooses to accept, the bill payment is processed as a purchase

If the biller does not accept credit card payments, ANZ may allow you to make the payment from your ANZ Credit Card (if sufficient funds are available)

If you choose to proceed with the credit card payment, it will be processed as a cash advance, a fee may be charged and interest will accrue accordingly.

ANZ is the only one of the big four that I noticed who obviously stated the possibility of the transaction being interpreted as a cash advance … the other three seem to indicate it will either be credit or you cant use a credit card … (CommBank do mention you can cash advance to another account then use the other account, but that’s a different kettle of fish).