I don’t see why they would feign knowledge of the loan, is that what you meant?

Possibly not. But then what simple words would suffice?

As to what records of the loans existed in their systems. In one instance the bank was unable to locate the deed, or record of it being released or converted to electronic registration. Fortunately from a copy of the original loan agreement from the 1950’s the paper title deed was located and a long chain of updating is now in progress. It is all reliant on copies of correspondence and records held by the owner of the property, and a record buried deep in the paper archives of a state public trustee. It is in reality more complex than this brief explanation. Not the CBA in this example.

For the second instance the customer had correspondence relating to final payment of the loan more than 10 years earlier, including an authority to release the deed and payment to the bank for that service. None of that record was accessible to the bank staff through their records. The bank knew it had the deed but had no evidence the loan had been repaid or release agreed. The property was listed as still mortgaged affecting the owners access to credit and ability to obtain a loan from another institution. The bank requested the customer provide evidence the loan had been fully paid along with other documentary evidence before it would proceed to release the mortgage. Relates to the CBA in this example.

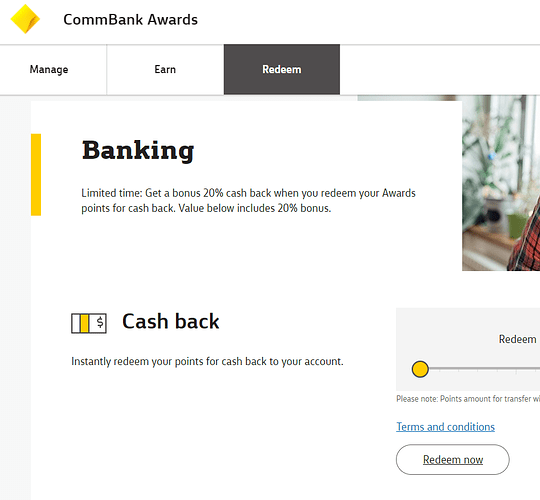

Promo from CBA …

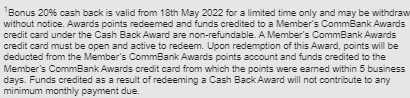

… conditions, of course, (1) at the bottom:

… may be withdrawn without notice … rather ambiguous. Funds will be credited against the card from which they were earned within 5 business days …

… but wait - “instantly”

Instantly redeemed, but 5 days to appear … but no - when one redeems said points, the resulting message indicates it is up to 10 days before the cash will appear.

Amusing at best …