I’ve emailed them now with the details.

Thanks for the replies everyone. I think I’ll have to pay the excess and try for reimbursement later. With the current timeline for repairs, and getting my car back it will be over two months since I made the claim.

Each day is an eye opener to how the (car) insurance industry works, with regards to sourcing parts and pricing them, everything is full retail (I’ve seen some of the invoices for work already done)! And the stories the assessor tells when asking about who will be doing the non panel work.

Years ago before insurance repairs were all ‘behind the curtains’ and we often got a glimpse of the costs, I bought a used car that had some recent repairs done from age and corrosion. In particular one door hinge stop rod (for lack of knowing the part name) had been recently replaced by the previous owner and still had the part sticker on it. After the fact of an insurance repair I noted the ‘low cost panel beater’ added that part to their own bill even when that door was not part of the repair. The insurance company’s interest? Too hard no worries, it was the low cost bid with a ‘missed’ extra thrown in to top off the bill. How common? No idea, but.

My father-in-law was involved in an accident where a driver cut a corner and ran into the front of him. Youi demanded $750 excess be paid to cover the other drivers claim which he paid (being elderly and old school did as requested). I became involved and using photographs, witness statements and a forensic investigator, found that the claimed damage on the other driver’s vehicle was from a much older accident, as indicated by the amount of rust. This eventually led to the driver being charged with a fraudulent claim. This resolved my father-in-law from any liability but Youi refused to refund his excess even though they did nothing. I cancelled all of his insurances as well as my house and contents and one vehicle and want nothing more to do with Youi. I wonder how many other companies do the same; charge an excess then when the driver is cleared, fail to return the money?

Pay the excess, change insurance companies after telling the internal dispute how disatisfied you are. Don’t waste money going to a lawyer. More money outlay for you. Not worth emotional and mental health for the sake of the time it will take to get restitution from thief who probably has none. My opinion is this as I have been down this road. What goes around comes around and lets hope the thief is properly punished. Current insurance company will lose a valuable customer.

I may do this yet, although I will be flagged as a high risk for any other insurer just because I made an “at fault claim”. So the premiums will be high for years to come. ![]()

Insurance companies are always hungry for business. Ring one or 2 and explain the situation and ask if your premium would be loaded if you changed to them. I have had at fault claims over the years(many years ago) and yet I still retain a lifetime no claim bonus.

If you really like your current insurer try asking for the ‘customer retention department’ by whatever name and make your case. Since it is about an excess they probably will not budge, but worth a shot. That ‘department’ often has more discretion as well as latitude to ‘help’ customers than the normal staff. Some companies disbanded those departments as more consumers became aware, so no magic.

Might not be as bad as you expect even if you get a $ hit. The NCB system as practised by all (?) our underwriters and their brands is simplistically as follows, assuming a new driver starts car insurance at year 1 with a ‘0 NCB’. Each subsequent claim free year the NCB increases until it hits their maximum, usually at 5 or 6 years. The unsaid component is the NCB is a discount off an opaque base amount that usually rises every year, and then the discount is applied.

In a simple case if you have a maximum ‘6 NCB’ and you have an at fault that is not ‘protected’ by your current policy, whether staying or leaving you should only be reduced to a 5, and back up to a 6 after a no claim year, sometimes 2, assuming no other issues. Those discounts will be applied to different base rates though, so get quotes based on cost not the NCB offered.

Last year we changed and went from an NCB of 6 to an offered 4 (one not at fault 3 years ago!?!), the new policy was equal or better and over $100 less per annum since we dodged the lazy tax. The biggest surprise is this years renewal is a 5 NCB (their top) and while the agreed value dropped so did the premium, for the first time in yonks.

Shop around and you could be pleasantly surprised.

In 2013 whilst driving from Cairns to Mudgee, we hit a kangaroo just south of Cleremont, and when I was reversing out of the car park at the Coles in Mudgee, I was ready to drive forward when a woman in a Prado didn’t bother to look and reversed into me.

Suncorp initially said that we had to pay the excess for both claims as the kangaroo was a single vehicle accident and that I was reversing in the Coles carpark.

I later spoke with a much more helpful person who agreed that I was no longer reversing in the car park and said that the excess would not apply.

He further agreed that it was not my fault that the kangaroo had run across the highway and then decided to see if it could run back, so he also waived that excess.

Well done Suncorp. We have always been happy with the outcomes of the vehicle and home & contents insurance we have had with them for decades.

But when one does have a problem, one needs to pursue it if you want a favourable outcome.

And you will possibly find that other insurers have the same approach in relation to theft excesses…maybe just their PDS is a little easier to read. Changing insurers may not have changed the outcome you are experiencing.

Our previous insurance broker said to us after a storm claim… that lifetime no claim bonuses which come with some insurance policies/companies don’t mean much as they increase your premiun after a claim as your risk profile changes, and then apply the ‘lifetime no claim discount’. I got the impression from them the premium increase was the same if one had the ‘lifetime no claim discount’ or not…making this marketing term a bit of a farce.

So my insurance renewed today with a 53% increase in my premium! All thanks to someone breaking into my house and stealing my car and it being “my fault”.

I did shop around online but as soon as you put in that you made a theft claim into the quote they all came back higher than I will currently be paying. So, the opposite of a win win situation.

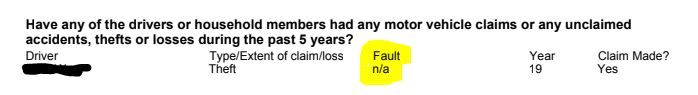

Although of note, my new policy lists the type of fault as being not applicable with regards to my past (still current, as I don’t have my car back yet) claim?