I have had to make appointments for my most recent interactions with ANZ, as they limit what they will do without one. If your wife does make the trip, it might be wise book an appointment, rather than risked being told to come back in three days.

It’s symptomatic of the digital transformation.

There must be solutions that do not require one to go to the branch. ING for one has no branch network and yet offers banking services. HSBC for another provide limited branch numbers and will open an account without presenting in person.

Is the problem unique to ANZ or to Australia? We have a friend who was until recently a resident of a large SE Asian nation. Their chosen bank head quarters was in Singapore. There was a local branch in a town not too distant from their home OS. When visiting Australia and getting trapped due to Covid they relied on accessing their online account. One erroneous attempt too many and they were locked out of all of their accounts. The only solution - present in person at the Singapore head office or their local branch. No Australian branch or office. It was a long time later and the cost of an international gouge priced airfare to remedy.

I have a US account that I can set a magic password of sorts, but get it wrong and the only unlock is a trip to the closest office in Honolulu. It is not unique and I am not aware of an alternative unlock. My account is up front on the benefits and potential consequences. I chose not to set one.

The RBA has indicated that Australia may have reached ‘peak cash’ in circulation with potential for reduction in amount in circulation in future years.

Well that is one trend.

But I for one will be going back to paying by cash if another trend becomes more prevalent. That is businesses putting on surcharges for ALL card payments including normal Eftpos debit transactions.

So far, those businesses are rare in my experience, but they need to be shown the rules about surcharges.

Welcome to the future?

Assumes one is not keen on air travel.

Qantas offers several options to pay without a surcharge, cash not included.

Payment options that don’t incur the payment fee:

- POLi

- BPAY for bookings made at least 7 days before departure;

- UATP cards issued by Qantas;

- Flight Credits.

For Points Plus Pay - Flights booking, a payment fee applies unless you pay using POLi or choose to redeem entirely in points.

.

Just to be different?

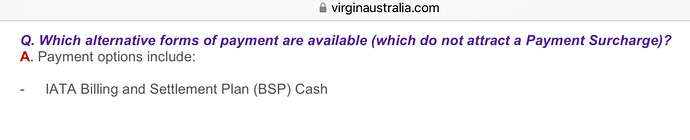

The new owners of Virgin have a different solution!

I think this is saying one needs to book through an IATA registered travel services provider?

POLi is also an option, mentioned on a different Virgin Aust web page. Sloppy IT or convenient, the web often provides more than one answer.

Other options - it may pay to shop around, assuming all fares offer the same dollar for dollar.

EG

Flight Centre according to their FAQs offer in store several options including BPAY, cheque or cash for fares up to $10,000.

For another topic. ![]()

The three noted above indicate a surcharge for all debit card transactions. Curiosity is the different surcharge percentage for each business.

How so? Different businesses and different processing services negotiate their own fees. Bigger is usually a lesser add-on amount and some processing services are more competitive than others.

Some business sign up for high transaction fee contracts because it is easy and others shop around like we do. But with surcharges being how they have become I doubt many businesses that add surcharges shop around these days rather than take ‘quick and easy’ for themselves. OTOH businesses that treat processing fees as a business expense and roll them into their pricing are most likely to shop around as well as negotiate for their best deal that provides our best deal in the total price.

In context of the 3 large businesses specifically referenced:

- Virgin Australia - debit cards all, surcharge: 0.54%

- Qantas - debit & prepaid Mastercard, surcharge 0.30%

- Qantas - debit & prepaid Visacard, surcharge 0.44%

- Flight Centre - Debit card surcharges of 0.39% for debit card Visa and 0.27% for debit card MasterCard.

Being who they are, one can assume they can all satisfy the RBA regulations?

I think this has been posted previously, but may be instructive for those who missed it. There are ‘merchant fees’ in addition, eg ‘Visa and Mastercard tend to charge merchants processing fees between 1.5 percent and 2.5 percent to accept their credit cards, whereas American Express charges 2.5 percent to 3.5 percent.’

Not one trend, but is likely to become more universal and the norm.

Many banks now offer flat surcharge rate (%) merchant fees for all cards present whether they are EFTPOS, MasterCard/Visa debit/credit card or some other credit cards. An example of one of the many banks now offering flat surcharge rates (%) is Westpac…

Our own bank is the same as well as others. Merchant fees based on different card types may soon be long gone.

From a recent trip to Melbourne CBD, we were surprised that every smaller retailer, hospitality and accommodation business had percentage surcharges on any card presented (inc. EFTPOS). Many were flat surcharge rates between 1.2% to around 2% for all cards presented, with a minority having slightly lower flat rates (%) or EFTPOS and debit cards.

We found the only organisations not to have surcharges were the big supermarkets/retailers and government run experiences which commanded an entry fee.

We were surprised as in our own town, a minority of retailers have surcharges. As flat surcharges in big city’s CBDs like Melbourne are now a norm, it will only be time before other areas catch up with this trend.

I suppose since card use dominates payments in Australia and merchant fees are moving towards a flat surcharge rate (%) across all cards, hopefully the ACCC might revisit their current advice about surcharges. The shift towards flat surcharge rates (%) tends to support including merchant fees in displayed prices (as part of cost of doing business) rather than adding it to displayed prices when payment is made.

It is possibly something Choice could raise with the ACCC.

An online experience with my last comment in this linked post being most germane.

‘Technology has taken another step to marginalise and even exclude those not ‘with it’.’

The cashless society around Eltham Vic 3095 has become almost universally a 1.1% surcharge society during the past months with the exception of national chain stores (eg Colesworths, Bunnings, etc).

While 1.1% might not seem much it adds up. We are using cash everywhere that surcharges.

Our Terry White Chemist is now surcharging for CC. Although the counter staff did not know how much? Neither notice, one next to the card terminal and another attached to it indicated the percentage. One notice included AMEX as an option, the other did not. The staff operator thought AMEX was not accepted.

Using a CC added 7cents to a standard PBS medication. Added to the bill by the operator making a selection on the register before tapping.

I would have thought that living out in the hippy community of Eltham you would be knitting beanies and scarves to exchange for veggies. ![]()

I take it you have not been out this way lately. You need to go to St Andrews area for that vibe now.

… which must surely be a nice incentive back in the other direction i.e. towards cash, not towards cashless.

NAB testing the water?

NAB has closed or announced the closure of 29 regional branches and 14 branches in metropolitan areas since 1 March,

NAB’s replies to a Senate Enquiry re branch visits:

‘NAB caught out in data lie over branch closures I Australian Rural & Regional News

A NAB spokesman revealed this week however, that the figures are only for over-the-counter transactions and business bag deposits, meaning customers coming into branches for general business are not captured in the foot traffic count.

General business is anything that does not involve a transaction, such as customers who have had to come into a branch to sort out IT issues, provide proof-of-identity documents, remove or add names to accounts, appointments for term deposit changes, to speak to staff about loans, meetings with managers or any other activity that is not a deposit or withdrawal.

The other big banks have also used the drop in over the counter transactions to justify closures. The phrase most customers now choose to, or similar is shared across all four big banks.

Whether customers are really making the choice they would prefer, or the bank has chosen in the best interests of the shareholder? Expect the banks AI Chatbot to have an answer. ![]()

I relate the choice of teller vs ATM to a grocery where there are 15 self-serve checkouts and purposefully a single staffed checkout often shared as the service desk with attendant interruptions by people buying tobacco, returns, scan errors, and so on, so the time for service can be highly variable. One can get in a short or no queue for self service or get into an indeterminate or often long one. Even so many resist the self service route; anecdotally when a second or third staffed checkout opens people usually gravitate to them. Locally I have not noticed an idle staffed checkout and a queue for the self service machines at the same shop.

I increasingly feel like we are in an experiment akin to Skinner’s rat box designed for the desired conclusion, eg our supposed preferences.

Yes, customers are caught in the vice between banks closing branches and ever-rising government requirements (that can only be met in person).

A problem of the banks own making.

I’ve used the same supporting documents since the 100 points system was introduced somewhere prior to 1990. It seems these days easier to have sufficient ID to hand at all times. In them olden days it meant having a paper birth certificate, originals of statutory issued bills (rate notices etc) and who recalls what else.