If that’s how it appears it’s OK. I’ve a Seniors Card ![]() .

.

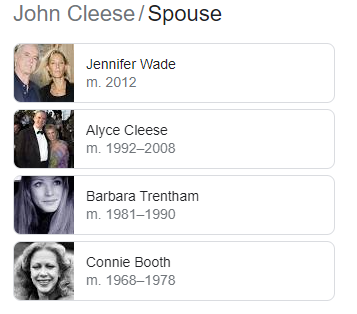

Being superseded is not a unique experience. Peter Sellers also managed regular updates.

Of some relevance: Australians are hoarding more banknotes but how far away is a cashless society in a digital world? - ABC News

The following (also in that article) gets a run every now and then:

According to data from the Reserve Bank of Australia (RBA), there are more than 2 billion banknotes on issue, worth more than $100 billion – that’s about $4,000 per person in Australia.

On average, there are 18 $100 notes, and 38 $50 notes on issue for every person in Australia.

I would like to know where my $3700 is. ![]()

I think the analysis might be slightly bogus because presumably at any one time some businesses must be holding cash too. So just dividing the value of banknotes on issue by the number of people is faulty.

I don’t know how banks themselves figure in this e.g. in the ATMs and within the bank itself.

Of course simply dividing something by something else to get an average is at best misleading and at worst meaningless.

I cringe every time some source quotes our Commonwealth debt, which currently stands at around a trillion dollars, as something like $40,000 that every man woman and child in Australia each owes.

I’d be looking in the kids piggy banks. Imagine finding all those thousands in loose change in slippery and sticky new $50 and $100 notes. ![]()

Ah yes, both 4 wives. But the picture was of Sellers.

It’s of little consequence. It might as well have been Rod Stewart!

@draughtrider quoted line referenced the credit card manual copying machine per the prior post. And yes, the pic and line that followed reminded me of John Cleese and his antics behind the counter - on screen with first spouse, and how things that used to be are no longer valued. 3 times at least for Sellers and Cleese.

Expect cash to be no different. It will come to pass that one way or another legal tender will become something other than expensive to produce, maintain and account for.

P.S.

Also a current concern when ending a long term relationship, but looking into the crystal ball …… ![]()

One problem that I have had with “the cashless society” is that it is very convenient to buy the item in the first place but not so convenient if the item has to be returned, specifically when the transaction was done in store (may have been EFTPOS, may have been credit card) and it happens to be more convenient to get someone else to return the item.

A couple of times, I’ve had the store wanting the original purchaser, wielding and operating the original card (and of course the someone else won’t have the needed PIN). This is never a problem if you paid cash …

Australia has the NPP (New Payments Platform), PayID and the RBA (Reserve Bank of Australia). It’s a work in progress, although Australians make extensive use of paying by card.

India appears to be light years ahead with its universal solution for customers and vendors.

Meanwhile back at the RBA, business as usual.

‘https://www.rba.gov.au/speeches/2022/pdf/sp-so-2022-05-03.pdf

Has Australia missed the boat, and how close or far away are consumers from a low cost universal cashless payment solution?

For consumers is PayID as effective and low cost to use as the Indian UPI?

Incidentally UPI is able to be used outside India including the EU.

P.S.

More of us now use a smart device to make payments. Typically with the overhead of a branded merchant system our retailers/sellers remain wedded to. The Indian UPI solution appears to have cut the middle man out. My bank - your bank.

Off topic: For a country that has struggled to introduce a simple easy to use and transparently understandable payment system for public transport we are getting closer every few years but the goal remains elusive across states that each either has it perfect or is progressing in parallel in isolation. Maybe on the 18th iteration? Hope springs from the Vic Linkt toll accounts now being valid across NSW and Qld.

On topic: So far our payments system has stumbled forward focusing on a single issue (ease) in blissful ignorance of other associated issues (security and fraud). It boggles the mind wondering what ‘we’ will come up with next.

I can imagine concerns that without a middleman (is the UPI the middleman?) a certain gorilla of international finance could have a conniption about money laundering and financial fraud. If it does not there is more behind the scenes than just an app.

The NPCI which belongs to the Govt of India is the provider of the UPI service, which may answer that. Whether it satisfies others? There is a significant volume of online content, much aimed at encouraging the benefits to consumers and sellers/retailers. It’s there for those more interested.

India has stepped significantly towards delivering a single national solution. Whether the thought spurs some Aussie consumers to consider more closely what is happening at home?

Our institutions, whether it’s the lack of a single payment option for public transport across borders (@PhilT ), or the RBA’s past advice on the economy/interest rates see only one side of the coin. The consumer side is rarely flipped over until consumers ask for more (transparency and or better service).

Aside:

If India can aspire to cashless, there will be no need to look for FEX in many destinations. UPI transactions in 2021 were equivalent to 31% of India’s GDP.

Can someone explain this to me regarding a ‘cashless’ society: In Sydney, there are countless black spots where you are unable to get a connection on your mobile phone. Also, the ‘system’ goes down in some areas, frequently.

So, what happens in an area where this is rife, regarding wave/pay, or via your mobile device?

Regards

Ray

Sundowner

The same as would happen with a really decent solar storm, i.e, no service, no business.

There are many other places around the country where connectivity is limited or nil. It’s a useful question to ask, considering it’s not a situation unique to Sydney or Australia. Although we tend to look inwards more than to the rest of the world for solutions?

In 2021 the ACS suggested we’d be 98% cashless by 2024.

As Australia’s major processor of retail payments, eftpos has doubled down on its market dominance with recently-announced plans to develop a nationwide payment network based on QR codes, with pilot testing due by mid-year and full rollout by 2022.

‘Australia to be 98pc cashless by 2024 | Information Age | ACS

It’s an interesting contrast between the promise to Australia by eftpos, and the government led UPI solution using QR codes. All up and running in 2016 in India. UPI also has a recent update (progressive implementation) UPI Lite that does not require connectivity all the time for low value transactions. It’s not that novel considering our early CC schemes relied on imprinted paper slips with real time authorisations limited to certain high value transactions. We transact cashless at present relying only on the merchant being connected - at a cost through their merchant provider.

This topic is long and somewhat boring but covers the wonders of our world, noting the India UPI system is new information to ‘Australia’ (thanks @mark_m), taking since 2016 to get here. Even when there are demonstrable solutions to this and that they seem eternally elusive in practice. Our apparent response is Osko and the ‘brilliant’ PayID that is becoming fraudsters fav all while our banks tout how easy it is in lieu of using BSB+accounts.

Universal if you

- have a mobile phone

- have a compatible mobile phone

- have a compatible mobile phone and are prepared to run blackbox code on it 1

So it wouldn’t be for everyone.

1 although the Wikipedia article suggests that the client-side code is open source.

It is not without precedent that jumping into a new way of doing things late can actually be an advantage i.e. first mover disadvantage.

Unfortunately that Wikipedia article is relatively silent about security, fraud and privacy. That’s not to say that the developers haven’t thought about those things.

Maybe Albo can have a chat about this whole topic with the Indian PM if things start to drag at the cricket.

If it’s still just bank to bank (with no middleman i.e. your bank account to the merchant’s bank account, with each of your communicating with your bank) then the government still gets full opportunity for surveillance (AML/CTF) - and the banks still get full opportunity for surveillance capitalism (i.e. selling your privacy).

UPI supports offline transactions for small amounts.

The holy grail is a stored-value card where the value exists exclusively on the card and value can be transferred with integrity to another similar card nearby, for the purposes of payment. But governments would hate that. That would be cashless and yet not require a mobile network or any other kind of internet connection at the time of the transaction.

Cashless Society: Thank you. Yes, we’ve got a long way to go before even getting any way clear of the starting grid on this.

Ray

Sundowner

In 2018, PhilIT started a post under the “Future Vision” category called “Apparitions of a Cashless Society and an Online connected Life” (Apparitions of a Cashless Society and an Online connected Life). Well, this is not longer a future vision as the big banks, especially ANZ announcing that it’s “scrapping some of its services, with certain branches no longer carrying physical cash”.

There are so many things wrong with this and we should all be worried… especially if you don’t live in the city.

Despite the fact that all of your transactions will be tracked (and if you think there is nothing wrong with that, wait until your insurance company starts questioning your lifestyle purchases), we’re quickly turning into a country where a flash of a plastic card, watch or phone (which you or the seller pay more for) is accepted over, and increasingly instead of, Australia Legal Tender (cash).

“But it’s more convenient” they say… for whom? The banks make extra money if you don’t transact with cash and that makes them happy. They’ll tell you how it’s “safer” and will “stop cash crimes” but haven’t explained how they will protect your data… think Optus, Medibank Private and now Latitude Financial.

On top of all that, last year we had some “once in a lifetime” weather events, which are expected to be repeated or worse, and during these events the telecoms services went down for extended periods of time (this is another discussion all together). But when the telecoms and power go down, cash is king! I live in the Northern Rivers region of NSW and I watched this play out… everyone struggling to find cash to buy the basics as they couldn’t get to their funds any other way. In a cashless society… how many would have starved or put in serious harm due to this?

Going cashless takes away more of our independence. We become another number in the banks profit machine and become more reliant on their commercial systems. They don’t want you to use Australian cash when it costs them too much out of their profits. They want to own the ecosystem in which you trade. All that metadata is worth a huge amount to them… even if they don’t resell it… check out your banks privacy policy to see how many others they share info with.

And to top it off… I found out about this from non Australian media… go figure.

Anyway, I hope this gets a discussion going on this as we are on the cusp of losing our personal financial freedom of choosing to pay by Australian Legal Tender.

That has already been decided despite what is often repeated.

P.S.

There’s no government agreed solution to how communities can function without being digitally connected. One only needs to look to which street of their electorates our representatives choose to live on and where they locate their offices. Connectivity is everything.