I doubt it! Ministers set the tone and it filters down to all staff. One just need look at the Ministers and the rest becomes obvious.

Adjusted this to where Amazon.com Inc is incorporated so they pay low State taxes there on their operations.

Lobbying can be much more than simple exchange of money for favours, it can be things like jobs after political retirement, it can be favourable treatment of certain politicians and or parties in media and other places. Give us this business and we will do such and such that will benefit a friend/associate.

I have adjusted that the revenue of $293 million was for the 3 arms to reflect it was only for Amazon Australia. The article as well as other reports on the Amazon business indicate it still has much more revenue raised but that is shifted to low tax centres to reduce profits (or it could even create losses). Again from the article Amazon (parent) had record profits (not revenue) of $11 Billion but paid $0 US Federal taxes. Of Course the EU is currently in battle over a number of issues with Amazon that could alter it’s practices there.

It isn’t provable about total revenues particularly as Amazon Australia isn’t listed on the ASX and so doesn’t have to provide as much information about it’s costs and revenues etc as it would otherwise have to.

https://www.cio.com.au/article/661116/why-world-cloud-leader-has-made-loss-australia/

http://www.annualreports.com/HostedData/AnnualReports/PDF/NASDAQ_AMZN_2018.pdf

Following your own link to: https://www.arnnet.com.au/article/659575/aws-australia-posts-15m-profit-loss/

Amazon Web Services (AWS) Australia … Total revenue for calendar 2018 was $306.2 million

which, ignoring the .2 million, is exactly what I said above Another multi-million dollar scam exposed - #78 by person . So 3 arms, all in Australia.

Ahh meant the 293 million was only attributable to Amazon Australia Commercial Services Ltd not AWS Australian arm or the Corporate Services Australian arms, that was my adjustment and on that revenue after costs were taken into account it suffered a loss of some small millions. In total as you said just over 1 billion revenue for the 3 arms but there is some debate as to whether that is even a true reflection as much of the revenue steam is “derived” from offshore sections of Amazon and so not reflected as Aust income/revenue. While legal as all the articles state, it isn’t what we might term fair to the Aust Tax system. Of course we can complain about how many of these businesses use the current legislation to avoid paying the taxes here (which I have complained to Federal members House of Rep & Senate about), but little seems to happen. Labor, GetUp! and others have also challenged the current systems but little if anything has changed recently. I think like NZ and some others are proposing, that a level of Tax on revenue streams may be a better answer. While the OECD comes up with or perhaps better said devise a way they think may work many are holding off implementing their own ways of tackling this.

A minimum rate of tax, based on revenue, is fundamentally flawed though if the company has legitimately reported a low profit, no profit or a loss - as can happen in the early years of a company or indeed as can happen during a bad period of years. Do you want to bankrupt every company that reported a loss in the shadows of the GFC, thereby exacerbating the GFC with bad government policy?

There is no substitute for a forensic examination of a company’s accounts in order to distinguish “legitimate” from “illegitimate”.

One approach to dealing with Amazon within the framework of existing Australian tax law would be to note that Luxembourg is already a “specified country”. I doubt that Amazon could claim with a straight face that its accounting aspects in respect of Luxembourg are proportionate to the actual amount of business that it conducts in Luxembourg - unless of course it relocates large server farms into that country.

Since the US government itself (IRS) has a problem with Amazon, it may not be too difficult to heavy Amazon into unwinding its Luxembourg accounting arrangements.

Nevertheless, based on the patchy information that the ABC has released, Amazon’s overall Australian result looked in my opinion “low but not taking-the-■■■■ low”. Perhaps Amazon is not stupid.

That would warrant closer examination - related party transactions always do - but Amazon is unlikely to be artificially bolstering its Australian revenue. You want expenditure in the high tax countries (Australia) and revenue in the low tax countries (Luxembourg).

We shouldn’t lose sight of the fact that if Amazon Australia sells to an Australian customer a cloud service and the underlying infrastructure for that cloud service is located outside of Australia then it is completely legitimate that some proportion of the expenditure is incurred outside of Australia, which has the effect of reducing the profit in Australia.

There may well be privacy reasons for the Australian government to ‘discourage’ Australian business customers from doing this but the Australian government is weak on privacy - while at the same time passing laws that provide a certain level of encouragement to locate infrastructure outside of Australia.

And another case of the disgusting behaviour of this ship of fools.

And some puerile drivel from the head honcho.

Statement from Department of Human Services General Manger Hank Jongen:

· We don’t ever want people to feel they’re in a situation of helplessness.

· We help people facing difficult situations every day and we do our best to consider any special circumstances.

· Support and help is always available from us and a wide range of government and community services.

· I strongly encourage anyone who’s experiencing mental distress, or their concerned families or friends, to call 132 850 to speak to one of our social workers, or make an appointment to see one at a service centre.

![]()

This is correct…and the ATO seem to be good at this for Australian businesses (of all sizes) and expect that they same would apply to foreign owned and run entities.

An organisations like AusTrac should also be able to see how much of the revenue is exported…which may indicate shifting of profits overseas especially for those business in the digital space.

and on the scale of money that is meaningful to the likes of us, there is a fair bit of money at stake (tens of millions), so if the ATO needs to employ more forensic accountants then that ought not be a problem for the government to authorise.

They can’t examine what Amazon are not required to provide. Private Companies do not have the same disclosure requirements that a Publicly listed Company does. You would be acting akin to trying to extract blood from a stone by wringing it with your bare hands.

Internalised transactions of parent and child companies, that are only often paper accounting figures do not attract the same AusTrac examination. Then if the parent is foreign based but runs most of it’s transaction through Luxenbourg or Netherlands or any other the the Tax havens this makes it very hard for Australian authorities to make any headway.

Examples re Ireland (not the UK one this time  ):

):

Private company requirements and perhaps more importantly exemptions for reporting:

https://www.charteredaccountantsanz.com/-/media/3524fddc04874276828fa53e3ba090ae.ashx

Under Australian Accounting Standards Board Standards aCompany (Private, Not for Profits and similar) is able to use “Tier 2 requirements [that] comprise the recognition, measurement and presentation requirements of Tier 1 but substantially reduced disclosure requirements in comparison with Tier 1”. In 2017 a DE (Draft Exposure) was released that sought to make more Teir 2 entities use a more rigorous in some areas RDR (Reporting Disclosure Requirement) but from the DE I quote "Consultation indicates that for entities that prepare GPFS and are eligible to use the Tier 2 disclosures:

(a) …//… (cut to reduce unneeded reading)

(b) the level of option among other types of companies, including large proprietary companies is very low with the likely reason being that the general level of disclosure under Tier 2 is still viewed as burdensome. In relation to this, a recent analysis of the financial reporting practices by a sample of large proprietary companies in Australia lodging annual financial statements with ASIC(7) identifies that:

(i) less than 10 percent of the total sample use Tier 2 disclosures; and

(ii) of those large proprietary companies sampled that prepare GPFS [General Purpose Financial Statements], around 20 percent use Tier 2 disclosures" (highlighting my own)

(7) Potter, B., Tanewski, G., and Wright, S., 2016, Financial Reporting by Private Companies in Australia: Current Practice and Opportunities for Research, paper presented at the AASB Research Forum, November 24, Sydney. The sample was a random sample of 394 large proprietary companies (with a 95 per cent confidence level).

If a Foreign Parent Company has an Australian Subsidiary they can use CAAP (commercially accepted accounting principles) to prepare the GPFS instead of the Australian Accounting Standards. Then this adds further smoke to the mirror:

"If none of the listed CAAP is applicable in your circumstances, then you can determine whether the accounting standards you apply are CAAP by following the guidance in What is CAAP (where Australian Accounting Standards don’t apply).

If you and/or your parent (whether immediate, intermediary or ultimate parent) use different accounting standards when preparing financial statements you may consider that more than one CAAP applies in your circumstances. In such instances a consistent CAAP must be used in subsequent years for preparing your GPFS excepting where that CAAP no longer applies."

So basically the Accounting Standard required can be one the Parent Company decides is the best fit for their circumstances.

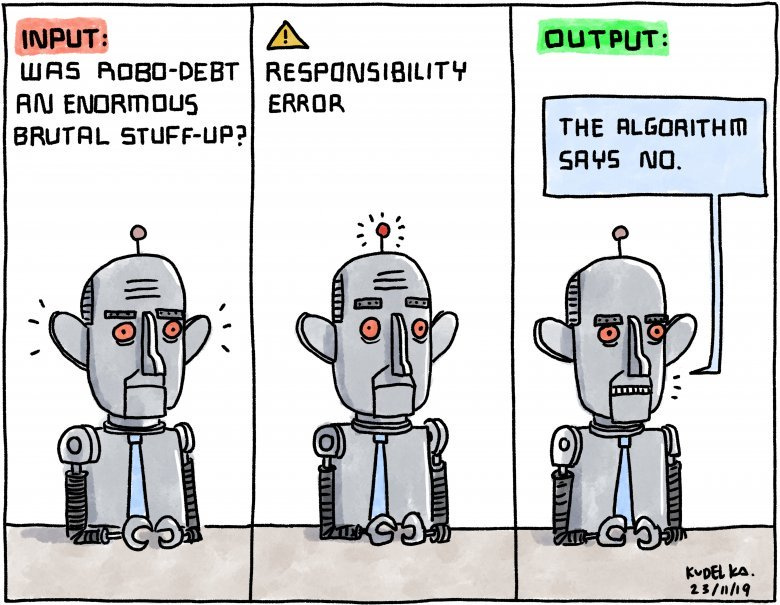

An article regarding the robodebt class action.

Hopefully they will take Centrelink to the cleaners.

When they win a large payout it will be us paying. What are the odds the voters will reward the ministers responsible, and the government responsible, by turfing them out for essentially abusing people and needlessly wasting our taxes?

It depends.

In one strategy for implementation of this approach companies trading in Australia could be split into two groups.

For those that are Australian companies owned and trading within Australia the current system applies.

For companies that are foreign or are the subsidiary of a foreign company the taxation is applied to the Australian revenue stream.

It’s however also difficult with exported and imported commodities and products to expose OS man in the middle transactions that seperate manufacturer from importer, or final customer from the Australian exporter. It may be useful to expand the taxation of revenue to all importers and exporters to be sure. Or at least at the discretion of the ATO to companies that are substantially foreign in their relationships. The Panama papers showed just how extensive and evasive these types of arrangements can be.

The ATO may certainly known more than we do, however the burden of proof in an Australian Court and legal costs may limit exactly which cases the ATO can hope to be successful with.

Did you check first whether you Federal Member was named in the Panama Papers, or has received political donations or any other form of assistance - whether direct or indirect - from a person or entity that was named?

That can’t happen, it’s against the Parliamentary Code of Conduct! (/s)

It is interesting to note that the government found implementation of a GST on all goods shipped to Australia to be quite a simple thing to implement - but has consistently struggled with tax avoidance at the large end of town.

This is a government that is all about shrinking the public service - including the ATO. Resources have been removed from parts that are responsible for the kinds of analysis that are necessary to stop large scale tax cheats (and probably redirected to RoboDebts).

I see that this comment is sarcasm but it isn’t clear to me why anyone would think that a code of conduct that applies to MPs would apply once a person ceases to be an MP. If a random employer tried to impose such a condition, it would likely be illegal unless compensation is offered (and compensation for former MPs was removed in 2004) and as far as I know this has not been legislated specifically for MPs to get around that.

I’m sure MPs just forgot to pass the needed legislation and they will get around to it in 2020. /s ![]()

Did they find it so? I haven’t imported anything under $1000 since that came in. (I have recently imported something over $1000 but that price point has always been subject to GST, since its introduction, and is also subject to the burdensome overhead of additional fees and charges.)

I think pretty much everything I have bought overseas lately has been inclusive of GST. Certainly Ebay, Etsy and Amazon apply it. Perhaps I should check AliExpress.

Yes on everything I buy it has been imposed, if not through my payment method it has been imposed at the Border by I am assuming Customs as that is the bill I get (I think they work it out on the Custom’s declaration). Only time I seem to miss is when it is a true gift from friends and family.

That can be where it is a problem - if you have the fees and charges for Customs on a relatively low value item. Are you experiencing that?

Indeed on from memory a $7 one and a $40 one, most suppliers it hasn’t been an issue.