I thought house ( building) insurance

should be calculated on costs of rebuilding at the time you take up or renew your insurance, and not on what

the market price of your house was when bought or would be if re-sold?

In some places with very high house/land value that would mean insuring for millions a simple dwelling

in a sought after position, but not reflect

the real cost of rebuilding on that same land?

What has only been touched on is an increase in amount insured by the removal of rubble etc. Also you need to be comfortable that if building is condemned that the insurance company will accept that. Also is there an average clause in policy.

Welcome @KandW. It is certainly an interesting topic.

It is usual for professional QS or Insurance assessments to include site clearing, demolition and other costs.

Eg

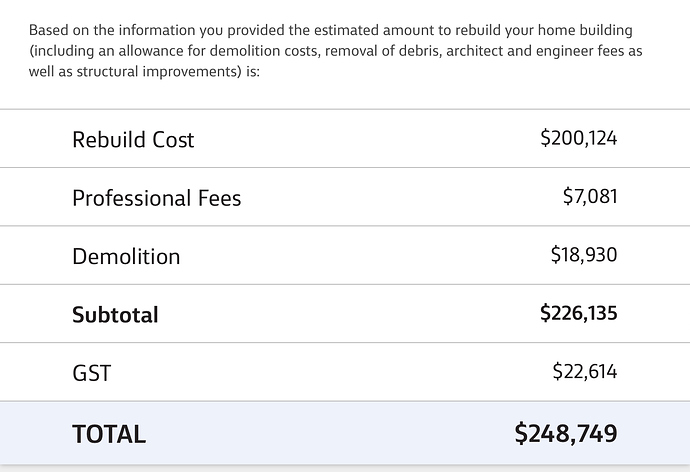

One sample for a modest two bedroom 50’s house, on a simple site not subject to fire or cyclone.

The total insurance required is greater than the rebuild costs, detailed as follows.

The rebuild cost needs to include all builders costs such as plans, certifiers, building approval, etc such as a turn key project home builder would include. Some might add an allowance for garden and vegetation or outdoor items.

Don’t these only affect properties which have been subject to under insurance?

It would be interesting to know if insurers can apply these where demand has caused unexpected short term a spike in market costs.

P.s.

I’m aware of some who are happy to insure for much higher values than reasonable. The expectation is there will be a windfall on loss with the insurer paying out the maximum.

Perhaps not?

Interesting stuff. Based on the Cordell calculator, I have more than sufficient insurance, and I know that the current market value is well above that. So I should be OK.

A followup article on underinsurance.

I used this calculator and it came up with a figure of a whopping $970,000. I asked 2 builders to give me an estimate on removing my current house then rebuilding it. They came back with $550,000 - this included fencing, driveway and clothesline. I forgot to mention that the Cordell quote does not include removal of old building rubble, plan submission to council, council fees, etc, etc.

Welcome to the Choice community.

I suggest a starting point of something like: https://www.bmtqs.com.au/construction-cost-table

If that is much closer to the higher figure than the lower figure then I would guess that the builders didn’t put much effort into the estimate because, after all, it’s a hypothetical and there’s nothing in it for them.

Maybe you could tell us which of the categories of house you judge your house to fit in. Honestly $970,000 could be cheap if you live in a ‘palace’ or a ridiculous overestimate if you live in a very modest dwelling. Without any information to go on, noone can say.

One has to also remember that unless only your property is damaged by an event (say a house fire compared to widespread storm damage p), rebuilding costs increase substantially when there is a large demand for tradie skills.

Cordell will assume higher cost environment when rebuilding. Some insurers also have a buffer to also cover this as well.

Speaking to our broker, the Cordell they use does include any ancillary costs which could be incurred as part of a full rebuild…such as waste removal, approvals, certification etc.

I also understand that Cordell also assumes the building will be returned to the same as before a rebuild event…to the same quality etc. Often builders will quote based on a cheaper replacement similar to that which existed.

In some cases, a cheaper replacement may be okay, but in other cases, it may not be such as a property which has heritage listing where it must be returned to predamage condition.

Cordell isn’t perfect, but is is a recognised estimator for building work… The only real way to get a true estimate is to commission a quantity surveyor, experienced in your housing type. A builder will only give a rule of thumb type estimate unless the builder has plans and full building specifications.

One caution regarding per-square-metre calculators, they don’t really encompass your ceiling height - whereas a good online calculator will ask you that.

Thanks for clearing up the issue of ancillary costs phb. I still can’t believe that my 241 sq metre house could cost over $900,000 to rebuild.

For an average modern style home it seems a little silly. Demolition, site clearing, building design, services management, approvals etc are reasonably in the $50k-$100k range. I’ve access to a professionally prepared estimate for a larger dwelling as a point of reference.

Is the property in some way very different to a typical urban house? EG older character property, bespoke Grand Designs style statement, heritage listed, or very old (100yrs+), plus site conditions such as hillside/fire/cyclone etc.

@person has pointed the way.

I’m familiar with three properties and how they have been valued. Two built in suburbia in the 1980’s and 2,000’s. Cordells works for both. The third dates from somewhere 150 years back. Cordells has no real idea other than chucking up a big number with too many zeroes.

In that instance some of the building materials used are likely to be very difficult to source and the methods of construction (EG joinery) no longer used. Likely not to standard either. Some of the character of the property comes from it’s age and details over time. Simply impossible to replace. At best you might replace it with a similar style using modern fire rated materials and construction at a fraction of the estimate. What value to you insure the property for? You can’t negotiate that over a phone. For the insurer a major repair might go a long way towards the cost of a replacement with new.

We playing the Grand Designs drinking game? ![]()

Another article warning regarding underinsurance.

As always, “it’s complicated”.

- Underinsurance is certainly a consideration. On a larger property, the cost for fencing can easily mount up. So you need to calculate well and include it in the insured value. But let’s assume that you aren’t underinsured.

- The next thing is the Terms and Conditions. What do they actually say? If the Ts and Cs limit your coverage then you should know that i.e. read the Ts and Cs.

- Another factor is … 10 km of fencing suggests a good-sized property. It may be a commercial farming or other agricultural enterprise, in which case you may be expected to have business cover for the asset.

- Typically, for boundary fences with a neighbour, you are only responsible for half the cost and you can only claim half the cost. This is as distinct from internal fences and from boundary fences that adjoin crown land (e.g. road frontage, water course, state forest, …).