Naturally, we think & it was in the past, best to pay with cash. However, l think you’ll find the reason their charging this, surcharge, is due to you receiving a piece of paper, obviously your, now due bill with Telstra.

As, the world as a whole, (businesses) are/have been enticing everyone to be more environmentally friendly & not receive paper billing accounts & opt, to receiving them on-line, via Telstra App, for example.

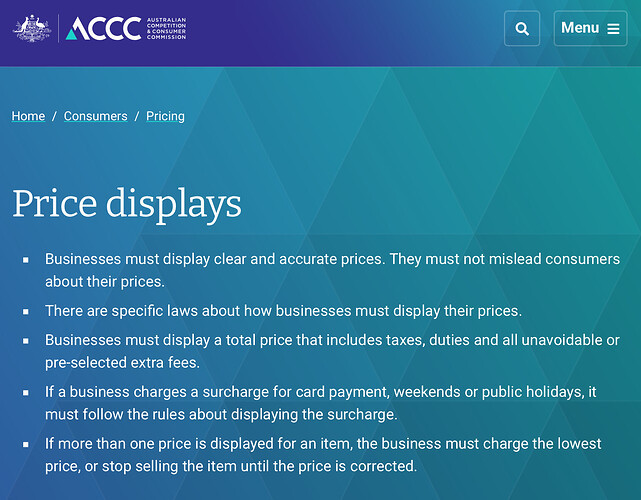

Paying via eftpos systems incurs fees, due to the Retailer/Vendor, purchasing the required digital payment machines, we utilise, within shops, when using our eftpos cards or credit cards. I think lt would be fair to say, the majority of businesses charge for this convenience, to the younger generation(s), as we head to, not a quite cashless society, but close.

It is difficult to not only change the natural, learnt, encouraged & rewarded behaviour of paying cash in our country that has been occurring, since it’s inception of trading of goods. I am 53yo & it took me over a decade to TRUST, NOT ONLY IN MY ABILITY OF HOW TO EVEN E-MAIL, LET ALONE PUT MY CARD NUMBERS INTO ELECTRONIC DEVICE.

I agree with you, that, these businesses etc don’t consider nor appreciate, the position, the elders in our community, especially, face, when it comes to the knowing how to utilise, ? do they even have a digital device? I feel, businesses, like Telstra etc who have an App on the phone & ANY customer is still paying their account in store with a paper invoice, should ask if said person has a device & if so & SUCH COMPANIES, SHOULD TAKE NOTE, AS GREAT CUSTOMER SERVICE, but also, stops person incurring surcharge, thus, better for environment.

Offer to assist these Customers & show them how to download the Telstra App, Set up an Account, guide them through it, hence, Customer, can now pay their bill on-line (end to end encryption) but advice & already shown App, so can decide on own VPN & pay their account with no extra surcharge. Showing this kindness & patience, should just BE, but it’s not, l’m sorry & this is what l would encourage you to do, to avoid this charge. Ask Telstra Customer Service Staff to show you. Then you may also be encouraged to, (not go crazy & be able to be like a Millennial) but confident to seek out a service within your community, cheaper to Seniors, as for Seniors, over 50/55/60 yo to learn as much or as little as they want, to utilise Computer/Digital systems as part of their lives. PLEASE NOTE: THEIR ARE INDIVIDUALS WHO ARE COMPUTER/DIGITALLY LITERATE THAT CARE & UNDERSTAND THE DIFFICULTIES FACED BY SENIORS IN ANY & ALL COMMUNITIES