We have been advised that there will be a 25% increase in electricity prices in Victoria and at the same time my energy supplier advises “The minimum feed-in tariff rate set by the Essential Services Commission is 4.9 cents per kilowatt hour from 1 July 2023.” This equates to a drop of more than 10%. How can this be? Prices go up but solar feed-in continues to go down.

From the beginning the FiT was envisaged to encourage us to install roof top solar as a form of subsidy. It was always pegged to go to zero and was never related to the cost of generated electricity from other sources except by random happenstance from time to time.

Imagine how well it was thought out when the retailers (another topic as is their profitability as seen by the ESC and others apparently justified big tariff increases) or grid operators will be getting free power and being able to resell it at 100% profit. One argument is that profit will be reinvested into modernising the grid. Maybe it will? Hopefully that discussion will cause a rethink some day but I do not hear more than murmurs at the moment.

The reason is complex and more than just energy cost. The AER determination can he found here:

Residential PV solar which exports is having an increasing cost on the network/consumers and FIT pricing would reflect these costs. There has been special levies or charges flagged to try to recoup some of these costs under a ‘user pays’ system, but is yet to be universally adopted.

Further to my earlier post, one can no longer compare FITs with energy prices for a default market offer (which some retail offers are based, but may be more than). It is now comparing apples with oranges.

Why, FIT is based on forecast prices over times when there is residential PV generation contributing to the energy market - this is principally in the middle of the day. Default market offer energy rates are based on longer periods - 24 hours.

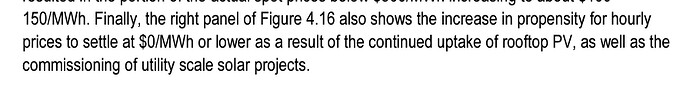

Why does this matter? Because during times of residential PV generation, there is a significant risk of over-generation where there is downward pressure on spot prices. So much so, on occasion pricing has been around zero or slightly negative in the past year. This impacts on FITs.

Default market offer energy considers energy rates not only when residential PV contributes to generation, but times when demand gets close to or exceeds supply/generation. The occurrence for such events have increased and prices can be many $1000s/MW. Default market offers sort of average the price over longer periods and is influenced by high prices.

This is why one can’t compare the two energy rates.

The last factor is the default market offer includes network costs, retail margins, green levies and the energy price. FITs are only the energy price.

Different retailers offer different FITs…but it is important not to make a decision purely on FIT rates. It is possible gains achieved by higher FITs are offset by higher charges elsewhere. Also, using as much residential PV generation so less is exported is the best way to improve financial return on installing a residential PV system. Not longer is exporting electricity the driver for designing/installing systems.

The AER does not set retail energy prices, but it provides a price comparison website, Energy Made Easy, to help customers find the best energy offers for their needs.

It pays to shop around, as little as the offers may be.

Currently AGL in QLD has been publicly advertising Solar FiT of 12c/kWh. Other retailers offer premiums for export based on instantaneous network demand and time of day. Free enterprise and competition principles.

Note the ‘Final Determination’ superseded the ‘Draft’ version during the week.

AER releases final determination for 2023–24 Default Market Offer | Australian Energy Regulator (AER).

There’s no complexity in what is happening here. Residential consumers represent a soft target for the large enterprises holding a significant portion of our national electricity assets. Those enterprises rely on Capital growth to maximise earnings, the underlying value of the asset and profits. Increased distributed generation (Rooftop solar PV) and independence (residential and community battery take up) by residential customers challenges the current business model and security of those with large investments.

Residential customers may only consume 25% (approx) of electricity generated, but we are the cream when it comes to adding value for the investors.

P.S.

I could not find an explanation of what is a fair feed in tariff in the AER determination. Although as the AER advises, it does not set retail prices. The existing grid has managed the current level of Solar PV penetration without significant augmentation. The future is a more complex discussion.

An alternative to consider for residential customers with a battery system or looking to add one is to join a VPP (Virtual Power Plant) scheme.

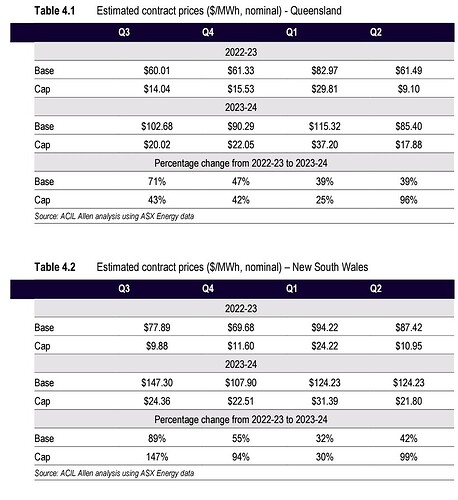

It sits outside the determination. The modelling of forecast market prices is. Here is an example:

What it does say is…

which supports the explanation in the earlier post that FIT is based on prices when residential PV exports to the grid. The report comment is pertinent to why FITs are significantly less than average quarterly energy prices and not the myth which is often used that it is retailers profiteering from FIT rates.

Another perspective on that is that just as the consumer is charged depending on Time-of-Use (ToU) - at least as a choice by the consumer - we may eventually have ToU FIT. Then a PV system at home could bias away from feeding to the grid at peak solar generation times (when supply may exceed demand and when supply may exceed capacity) and instead feed to the grid outside of peak solar generation time. This however may require either that the home PV system has a battery or that the consumer changes behaviour.

Appreciate the shared content from one of the supporting reports. Since it’s not a determination, what’s fair has not been decided. Although for customers in the ACT, Vic, Tas and Regiobal QLD (Ergon the distributor) there are seperate determinations by territory or state regulators.

WA and the NT also have independent approaches. WA being almost opposite in it’s thinking when compared to the NT.

Is it suggested Solar PV residences face near term outcomes of increasing costs to purchase power for lesser returns through FiT?

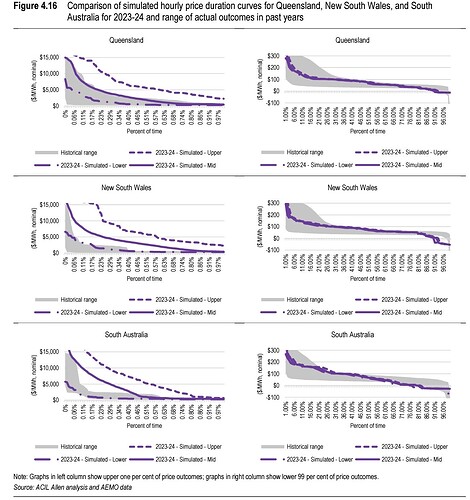

It’s a sobering thought when battery storage adds as little as 20c/kWh to the lifetime cost of a system. In comparison the Default Market Offer is indicative of costs for residential electricity supply in a range from 43-55 c/kWh? (Residential without controlled load.)

Note: As our household purchases/imports less than the amount of energy the AER uses in assessing the DMO the unit cost is actually greater. The daily fixed costs of connection and metering can make up 30-50% of a quarterly bill.

Already available, most commonly through VPP. AGL, Origin, PowerShop and others.

We are currently seeking to move to a plan based on ToU or better based on current residential use a Peak Demand based tariff. The first are very common. The second problematic depending on household, but likely very effective with a smaller home battery for increased self consumption. Consumers with excess home battery capacity, YMMV?

Note, moving all residential customers to Cost reflective tariffs, is included in the current NEM planning. Agreed to by all the NEM States and ACT through the responsible Ministers. It’s a strategy that supports increased distributed storage/generation with potential to reduce some of the future costs of grid capacity expansion.

That’s good to know - but I haven’t seen one. Can you link to any such plan from any of AGL, Origin or PowerShop? (I recently had to change provider yet again but didn’t notice any such plans as I was trawling though options.)

Heresy? If our present disparate grids were nationally connected the east would power the west for brekkie and the west the east for dinner, simplistically adding about 3~6 hours per day where solar input is available to meet demand, notwithstanding the remaining few hours per sunny day where it would still exceed demand. With the vagaries of weather ‘applied’ it could further smooth the equation.

While ‘dark periods’ can already be partly addressed by the VPPs many consumers are not ready to ‘give it up’ to them because it remains a ‘promise’ regarding the economic reward and the impact on one’s investment in batteries. Simply Energy has had a few VPP campaigns (my solar company hosts their talks) in Vic essentially subsidising Tesla Powerwalls, but running the numbers as best one is able makes the economics fuzzy when all costs and pricing is considered. Consumer reports after enough years to require their batteries be replaced will be the tipping point for more (or less) interest under anything resembling current promotional programs.

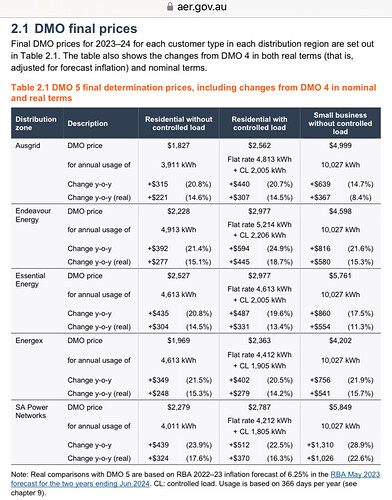

It Is part of the determination, the AER states:

We have also published our cost assessment model and ACIL Allen’s technical paper for the final determination alongside our decision.

Retailers use forecast energy prices to determine fixed rate FITs. They take on the risk if their forecasts are higher than what is the energy prices at the time a residential PV customer exports… It is possible that in coming years for some customers, they could lose money from FITs >$0/kW, especially from the information in the determination. FITs may becoming more of a marketing tool to attract customers, rather than being a financial opportunity for them. But as indicated above, higher FITs might be hiding higher charges elsewhere.

With FIT ToU, the consumer takes on the risk and hopes the ToU prices are higher than a retailer fixed FIT. What one choses would depend if one is a risk taker or not.

Could you please provide authoritative references which indicate it is heresy? The authoritative source for electricity pricing in Australia has been provided above, that being the AER. While one may not agree with the AER and basis for their decision, their decision influences state regulators and retailers in relation to offers (pricing) they make to their customers.

I’m not taking one position or another on VPP. I linked to Solar Quotes in a prior post. They offer a comparison table and list choices, plus links to further specific details.

The relative merits will always be debatable.

The greater public community still has a diverse range of views. There are those who believe there should be only fossil fuels because they have always been the cheapest proven most reliable source of energy. And there are those who will spend extra to demonstrate a commitment to saving our future. Done quietly or with a fanfare of trumpets and calls to change irrespective of cost.

Knowing there are VPP options is relevant to those committed to Solar PV (needs a suitable battery system) and who may find these offers attractive. Motivations and personal goals vary. Free to choose or not.

OK, I think a misunderstanding.

What I am after is a plan that, in isolation, offers ToU FIT, not as part of a VPP.

The major objection that I would have to a VPP is the network security aspect of it. (That is already a consideration with random blackbox devices on your local network, like inverter and battery, but it doesn’t get any better if a third party is also involved.)

Also an option, although whether it is depends on where you live? I’d read previously how WA’s proposal was developed.

Or elsewhere

I found the ‘Energy Made Easy’ website of limited usefulness when seeking other than the most commonly used tariffs.

While I could find details of our current electricity suppliers, SE QLD for ToU and Peak Demand plans on the EME website, it could not compare the costs for our usage. On phoning our supplier to request an update on plans and best options the everyday call centre staff could only follow their script. It can take a higher level of patience, before getting them to transfer you to a resolutions or more capable team member more familiar with the less common requests. Even then it might prove a challenge. Their on screen systems for one retailer could only estimate the best deal based on the AER assumed average consumption pattern.

Something that I can’t answer reliably as it’s a moving target that favours consumers taking the path of least resistance. Have I tested all the retail options. Not at this time. Using my own spreadsheet and data the cheapest plan is less than any the EME website suggests. There may be others.

@phb I get it, but it still seems unfair. Obviously dispatchable power is more valuable than intermittently-generated solar power. Obviously too, households need to pay something towards the supply and maintenance of the grid, and obvious as well is the need for retailers to make a profit. Nevertheless. a markup of around 700% is outrageous in anyone’s language.

You’re right in saying that there are times when the solar power being fed in is of zero use to the retailer because it’s surplus to needs, but that’s only for comparatively short periods and certainly not every day.

Surely, even during those periods the retailers are able to source all the power that they require for 4 cents/kWh and then sell it for >30 cents/kWh. They’re not exactly losing out.

As outlined above, the usage tariffs include network, environmental levies, retailer margins and the energy cost.

The FIT is energy cost only. In Australia consumers of electricity pay the environmental levy, network charges and retail margins, not the generators. This is standard across all generators whether they are large scale such as coal, gas, wind farms, hydro or solar farms…to small scale residential PV systems.

So it isn’t a markup of 700%. Without other charges, it is likely to be about 1/2 to 1/3 of that. The difference has been explained above and also below.

Yes zero/negative pool prices are for for comparatively short periods, until such time the market operator (AEMO) can adjust generation to better balance demand. In such cases, it usually means disconnecting/shutting down generators. It is worth noting that more recently installed domestic PV inverters have such functionality and proposals to allow disconnection of residential PV systems has been tabled so they can be managed no differently to other larger generators.

While zero/negative only occurs for comparably short periods, lower spot energy prices occur when residential PV solar can export. These being in the middle hours of the day (as an example, this link shows spot prices for an unexceptional day in NSW, where lowest spot prices are in the middle of the day - around $0.06/kW). This has been exacerbated by lack of storage connected to the grid (due to high costs) to allow excess generation to be used later. This means solar farm production generation along with other forms of generation (traditional and renewable) peak during middle of the day hours, each trying to make money by suppling to the network. Fluctuation nature of renewable generation causes excess generation and downward pressure on spot prices.

With peak demand shifting to late afternoon/evening, solar exports has limited ability to export when spot prices are higher. With greater shift to renewables, the peaks and troughs in spot prices will change to traditional generation profiles. Higher spot prices are likely in the evening through to morning when storage partly fills deficits. So, one should expect the FIT differential to get greater in the future.

Outside middle of the day hours, there is a greater risk of upward pressure on spot prices, as solar is removed as a generation sources. This accounts for most of the day (say 18 hours) compared to lesser time for downward price cycles (say 4-6 hours per day).

What you are suggesting as being unfair is asking for a FIT averaged across 24 hours when the FIT in reality only occurs for 4-6 hours. If the FIT is averaged over 24 hour spot prices, someone has to pay the extra premium which would be all consumers with higher import tariffs. This is where unfairness exists as all consumers will pay for those who have residential solar. Such has existed in the past when state governments gave high FITs to encourage solar uptake - with all consumers paying to subsidise those who installed residential PV systems.

In the last budget, the NT approach was to reinforce the Berrimah Line by slashing FiT to save $12 million, while in the same budget committing $27 million to upgrade boat ramps. Admittedly a very simplistic view, but given it’s the NT government that’s not surprising ![]() Let’s go fishing, it’s only a 16 hour drive … so much for promoting solar

Let’s go fishing, it’s only a 16 hour drive … so much for promoting solar ![]()

Done in close consultation with the Henley-on-Todd Regatta organisers I presume?