My guess is that the Plus account operation is costed on the basis of online only and the three documents they accept for ID can be verified that way. If so, that leads to the question of why the State issued POI card cannot be verified that way.

It is not as if each state could not integrate such confirmations within their DL systems. My take is that it is a lack of political interest and it likely would require all states and territories to get on board - since each already has it perfect and might not budge it may be harder than it would appear for ‘getting it done’ and then businesses getting on board.

If not by the ‘stroke of a pen’ the first part could be done by the stroke of 8 pens with the institutions requiring 100 point checks to timely follow?

Isn’t this something CHOICE could push for?

The misunderstandings around and different approaches to state/territory ID documents is obviously an impediment, and sometimes a serious one, for many consumers. Moreover, this mess is entirely unnecessary, because there are no genuine technical impediments. All it’d take to fix is some goodwill (and banks fixing their own documentation) …

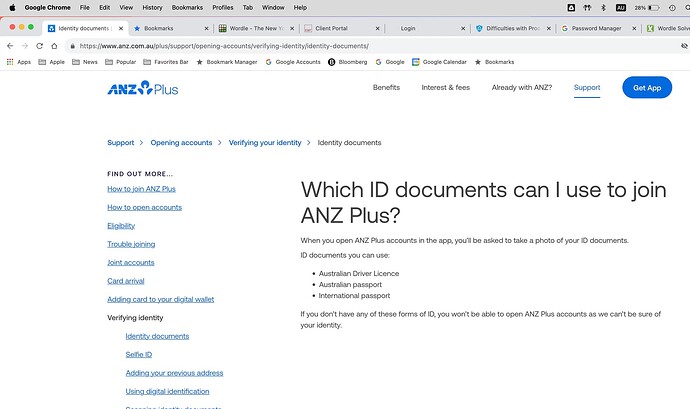

The reason is obvious. The ANZ Plus account is set up online without face to face verification. They will be using the government’s IDMatch for such purposes. Proof of Identity aren’t a verification document in IDMatch, therefore can’t be used for online verification. The only documents which can be used are those supported by IDMatch.

If one applies for a branch based account, face to face verification is required and proof of identity documents can be used for such purposes.

A bit ironic that

It seems the ANZ is a good example of intransigent policies and procedures that seem to stick it to a segment of the community just because they can, not because they have to?

Because @Gaz was trying to verify an online only account in a ANZ branch. This isn’t possible and outlined on the ANZ bank website.

The ANZ Plus account in online only and can only be applied for online. There is no branch support for the account.

If one had read the information and restrictions on the account, the wasted trip to an ANZ branch could have been avoided.

All I can suggest and outlined above, is that @Gaz contacts one of ANZ Coaches to see if there is any way to set up the ANZ Plus account in ANZ Digital Bank without doing the online verification process. If this can’t be done, unfortunately there is little that can be done other than exploring accounts other than those which require online verification. To assist @Gaz in the search for an alternative account, here is some which may need to be avoided/or checked prior to proceeding as they are also likely to pose the same problem of not having a driver’s licence for online verification purposes:

An interesting idea. A learner’s permit is good for 10 years in Vic, the test can be done online, and for a small fee can be issued once proof of identity is shown at a Vicroads office. Treated the same as a driver’s licence.

One snag though. If you have a medical condition that would preclude you from getting or keeping a driver’s licence, you won’t get a learner’s permit either.

Yes, I posted my friend’s experience before the OP added/revealed that due to a medical condition it’s not possible for them to obtain any driving permits.

What do you think of opening an account which has simpler ID requirements (proof of age card accepted, for example) and then making a transfer (maybe with just part of the sum initially) to the one @Gaz is interested in? It’s been my experience that transfers by the same client from an account with the same bank are done without problems?

ANZ Plus seems to be a separate banking system to ANZ retail. In a way similar to NAB and its online only Ubank.

The hurdle is getting an account opened in the online-only system. I don’t think having an account with ANZ retail with branch presence would help with establishing an account with ANZ plus.

Interesting info on the new anz plus app.

It says it can be opened in minutes by scanning passport or driver licence documents and doing a selfie!

And an info in another website says a transfer of money can be made from an anz savings account by using ‘pay anyone’ after the plus app has been organised.

Looks like the ANZ might be one of the first organisations to use the IDMatch ‘selfie’ verification for online verification processes using IDMatch. The IDMatch website indicates that the function for ‘drivers licences will be available for verification shortly’, and possibly should be updated.

Taking a selfie and using biometric data for verifying IDMatch reference documents provides a higher level of security than documents alone. Selfie verification has been available for passport, citizenship certificates and visas for some time. I didn’t know that photos are attached to citizenship certificates which is something I have learnt today.

Whilst many may have concerns about biometric verification, these needs to be weighed against the risk of not doing such. If one has provided a photograph to government (states or commonwealth) for some purpose, they will already have one’s biometric data to allow them to compare with the ‘selfies’.

ANZ should have given its digital-only offspring an entirely different name, so their original ANZ customers wouldn’t fall into the trap of thinking that there’s a close relationship between them.

In reality, they appear to have nothing in common apart from the misleadingly similar names.

At least NAB has given its digital-only business a different name.

Also interesting if one can access the AFR. Some of the wise are already asking about its place in the future of banking with the ANZ.

ANZ’s new digital bank, known as ANZ Plus, began offering home loans last week to a very limited number of customers, but CEO Shayne Elliott says in a few years the platform could be the dominant distribution channel for its mortgages and allow them to be originated at a much lower cost.

Noted the banking can only be accessed from an App on a smart device (Android or IOS), assumed to be mobile data connected for best service. There is no alternative to provide a web client or browser access. Also provides direct uncomplicated access to competitive interest rates for “any amount up to $250k”.

More reasons to challenge the status quo and ensure consumers get a fair go. Note some of the Alternatives such as NAB’s U-Bank provide web access independent of the App.

From Identityguard.com

Which is safer banking app or online banking?

Why does this distinction matter? Because banks have more control over the security of your account when you use their app than they do when you use a website. For example, scammers can create phishing sites that look like your bank’s login page or intercept your Wi-Fi network as you enter your credentials

On the flip side, providing alternatives can encourage competition and reduced costs to consumers. This appears what ANZ is attempting, by being an early adopter. This can be a positive. Sometimes changes fom the ‘business as usual’ can be difficult to accept.

We know what ‘business as usual’ can result in frm the Banking Royal Commission.

… as will everyone who has ever photographed you, including every 2 bit surveillance camera (looking at you Bunnings), and every social media platform, and every club that requires drivers licence on entry or photographs you for club membership, …

The only saving grace is that better selfie verification also has “liveness detection” i.e. you provide a live video stream, they verify liveness, and they then compare some part of that video with the existing photograph.

Of course that places a barrier to legitimate customers if they don’t have suitable equipment (need e.g. smartphone or e.g. webcam).

Competition only fairly exists in an unrestricted free market. Not being able to access a product - it’s no longer a free market for those excluded. There’s something about consumers fighting for fair that is oft repeated by a number of well recognised consumer leaning organisations.

We both know that irrespective of any debate on why it is, consumers are being excluded from the ANZ offering. As far as I can determine the same consumers may also be excluded from some of the competitors close alternatives. The ANZ has an option to mitigate being a lightning rod by taking the consumers side and proactively assisting to deliver a solution.

I’m afraid not, Gaby. It is a requirement for the account I wanted to open (ANZ Plus) that you MUST have either a passport or a driver’s licence. The only way I could get it is to obtain a passport I don’t need. It seems weird to not allow a Proof of Identity card as proof of owns identity.

Unrestricted free markets only exist in theory. Markets are restricted in many different ways, including availability of supply, regulations, etc etc. Restrictions are minor through to extreme, and will always exist.

Competition can exist in such markets - as they are real markets like those which exist in Australia. Where restrictions are extreme, such as in a monopoly, government usually steps in.

Almost every business excludes some customers. It could through payment methods, age restrictions, dietary requirements, technology awareness, pricing and the list goes on and is very long.

ANZ has decided to use the current best practice online ID verification process established by the Commonwealth Government. It would have done this knowing that its online only offering can’t be used by every consumer. They would know limitations of the verification process, non-internet users, possibly non-mobile users etc won’t be consumers of the product. This is a business decision but ANZ shouldn’t be required to ensure they include every possible customer - this is an unreasonable expectation. If it was the expectation, businesses would jot he able to exist or offer any services.

If this was a standard to be adopted, it would apply to all businesses and is unachievable. If it was mandated through law, many, if not all, businesses couldn’t comply.

I very much agree with you and totally sympathise! The anz plus app is a digital way of banking which looks like it’s the way of the future for most banking. I’ve learned from the anz websites that as it doesn’t use the internet it is harder to scam/phish/ intercept and therefore safer, but it does exclude anyone under age or not travelling or driving anymore. I can understand the passport being asked because it’s been an Epassport in Aus for some time and uses biometrics to identify, in fact to open the anz plus app account scanning of the document and a selfie is asked.

Thanks for posting @Gaz it has been a wake up call for me to not let my passport or driver licence expire even if I don’t intend to use it in the future.

If you’ll allow me, could I suggest that you also keep an up to date passport even if it’s not needed for travelling, just to avoid all of the hassle. And I hope you understand that I say this in a spirit of goodwill towards you ![]()

![]()