Some tips here on how to save in times of inflation, including from CHOICE’s @kcameron.

UK’s consumer organisation, Which?, is calling on businesses to take the following actions to help alleviate cost of living increases: Which? launches cost of living campaign - Which? News

From the article:

Which? is calling on supermarkets to:

- ensure their pricing is more transparent, making unit pricing much more prominent, legible and consistent – and displaying it for promotional offers – so that people can easily work out what is the best deal.

- ensure a range of budget lines for affordable essential items are available across their stores, and particularly in locations where people most need support.

- use their marketing budgets and promotions to tailor support to those who are struggling – including offers, vouchers and loyalty card benefits focused on the places and households where people are most in need.

Which? is calling on telecoms providers to:

- enable consumers to leave their contract without penalty when they increase prices mid-contract, regardless of whether or not these increases can be said to be ‘transparent’.

- ensure that social tariff customers do not incur additional charges when they are signing up, do not have to pay early termination charges (ETCs) to move to a social tariff if they are currently in contract, and are not subject to setup costs.

- increase awareness of the availability of social tariffs, what they offer, and how they differ to commercial tariffs.

Which? is calling on energy companies to:

- take action to make energy bills as clear and easy to understand as possible, empowering customers to know what they are paying and why.

- ensure customers on prepayment meters, who are more likely to be vulnerable and on lower incomes, are able to access government support, and prioritise them in their smart meter roll-outs where appropriate.

- make it as easy as possible for customers to get in touch to seek support when they need it.

What are your thoughts on these measures?

What are the essentials for most consumers?

How would they rank according to their place in the budget, potential for cost increases, and availability of better value lower cost options?

Should we focus on how to make the most of what is left over and spent on food after all other expenses are met? Agree that trying to get the best value from the Supermarket, Telcos and Energy companies is important when there is little left to meet those expenses.

However is the pain for many really due to the increased cost of keeping a roof over your head (rent or mortgage+rates+insurance+utilities+ …)?

It would seem reasonable to put the costs of transport, medical, schooling/education in the next few spots, order variable.

I’m suggesting Choice might also consider asking whether the banks given recent profits are justified in passing on full rate rises. There are also concerns with rental costs in a market place where landlords consider 12 months long term, and tenant insecurity is often exploited through poor or unregulated control over increases. Note governments have also increased various costs, including those of public transport, registration and ….

I think Australian businesses are more or less doing most on the list.

Some which could be universally adopted for any service provider is

This could apply to electricity, gas, insurances (such as those made monthly) as well as others if they are under a periodic contract for a special rate. Without penalty also needs to include return of ‘bond’ type payments which are used by some utilities and reimbursed after a set time.

More increases for East Coast gas,

in particular,

EnergyAustralia announced in January that its approximately 245,000 residential gas customers in Victoria on variable contracts would see their bills increase by an average of 26.7% – an average of $480 a year, including supply charges and GST.

And

AGL increased gas prices for its variable rate customers in Victoria, New South Wales, Queensland and South Australia.

In Victoria AGL’s average increase was 24%, equating to approximately $321 a year, excluding GST. NSW saw a 9% increase, or $78 a year. The corresponding increases in Queensland and SA were 5% or $40 and 6.2% or $56 a year respectively.

One of the problems with statistics such as CPI measures is they are averages. Not everyone fits the average. The rises impact us all in different ways. It may be mostly the cost of food, fuel and household energy for those who have a debt free home. Add in the mortgage shock of interest rises for some newer home owners.

For those renting - how bad can it get?

Averaging does not tell the whole story.

I am not sure where to post this.

There are many stories about grocery items shrinking in size and ballooning in price, but not so many stories about non grocery items.

Annually I buy, for the family, several large desktop calendars that double up as a protective layer on top of office desks. The pad contains 12 sheets, one per month with dates and spaces for comments/appointments.

Last year the home brand of Officeworks (J Burrows) sold for $5.98.

Today I bought some and they’re $7.88. A whopping 32% mark up.

Once again, proof that being a monopolist pays. And pays.

A cost of living issue - your post has been moved to this existing topic. Not the only example of a substantial product cost increase over the past year.

Although wine is not a staple, a winery I supported for a few years raised their price for one variety by 40% in one go for the same bottle, same vintage. Their response was it was the first increase in 15 years. It was a good product at the old price but marginal at the new one. With the price up there are many equal and better bottles at their new price. I walked with my dollars.

While we all would unrealistically like cheaper groceries (even if they come at the expense of competition when the independents are no longer able to compete or our farmers, as supermarkets source more products offshore where they can be bought more cheaply), the increase in food prices are insignificant compared to impacts on the cost of living from other sources. The recent ACC analysis indicates there might be some ‘barking up the wrong tree’. But, there are no surprises why there isn’t an inquiry about these:

Another way of explaining the cost of living problem.

The issue here is that the “cost of living” is an essentially meaningless concept, rather like the sound of one hand clapping. The problem isn’t the cost of buying goods, but whether our income is sufficient to pay for those goods. For most of us, that means the real (inflation-adjusted) value of our wages, after paying tax and (for homebuyers) mortgage interest.

P.S.

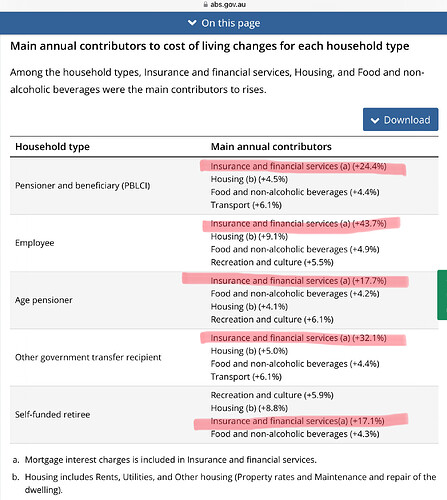

While groceries are more expensive, as a proportion of the pain over the 12 months to Sept 2023 it’s just one of several causes. My highlighting.

Of course we all need to eat.

‘Selected Living Cost Indexes, Australia, September 2023 | Australian Bureau of Statistics

The next update which will include data up to Dec 2023 is due first week of Feb 2024.

Do you know or think the ‘financial services’ in the table includes 1.35% surcharges for paying myriad bills? If so that by itself is a noticeable part of the quoted percentages.

There are various details found in the following.

‘Appendix 3 - Financial services in the consumer price index | Australian Bureau of Statistics

Perhaps the section on Direct Costs starting at paras 13 thru 18 provide the answer. Note:

16 The fee collection includes charges for ATM transactions, credit card annual fees, foreign currency conversion fees, account keeping fees, exception fees, loan servicing fees, package fees and others. Each month the price, terms and conditions for each banking product are observed. The sampled fees are grouped by type of product or service (e.g. credit cards, housing loans) and applied an appropriate weight to ensure representative derivation of price change for each product group.

Reality is how bills and daily payments are made will vary between households and individual preference. The headline ABS Statistics are what they are - a group average. They are all averages rather than percentiles which might offer a more realistic view of how it has changed at either end - the well off and not well off across the community.

There is a more complex discussion around Series Weighting by the ABS. It’s an imperfect system considering that weighting of the series changes retrospectively.

‘Selected Living Cost Indexes, Australia methodology, September 2023 | Australian Bureau of Statistics

P.S.

I think consumers focus on groceries/food because it is often the part of the household budget that comes near last after the must pay/haves are met - suggesting housing, transport, essential health care, some insurances, etc. The catch for those on lesser incomes or with essential needs greater than income is what one goes without until the next payday or Government payment falls due.

The increase in dollar costs for our household insurance, rates, energy and services have increased more than the dollar increases for the cost of food/groceries. For anyone paying off a home with a typical mortgage or renting no need for further comment. It’s why I chose the Selected Living Costs data series from the ABS to highlight one needs to ask questions beyond the ABS headline CPI figures.

One more way to look at the cost of living crisis.

average mortgage repayments are up more than $500 a week.